Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

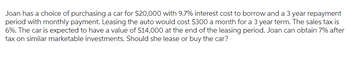

Transcribed Image Text:Joan has a choice of purchasing a car for $20,000 with 9.7% interest cost to borrow and a 3 year repayment

period with monthly payment. Leasing the auto would cost $300 a month for a 3 year term. The sales tax is

6%. The car is expected to have a value of $14,000 at the end of the leasing period. Joan can obtain 7% after

tax on similar marketable investments. Should she lease or buy the car?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Judy has $2,000 for a down payment on a vehicle, and she can afford monthly payments of $400. If lenders are currently offering 6% interest on 5-year loans, what is the maximum price Judy can pay for a vehicle? (Show all work.)arrow_forwardEaston has two options for buying a car. Option A is 1.5% APR financing over 36 months and Option B is 5.5% APR over 36 months with $1800cash back, which he would use as part of the down payment. The price of the car is $35,042 and Easton has saved $3500 for the down payment. Find the total amount Easton will spend on the car for each option if he plans to make monthly payments. Round your answers to the nearest cent, if necessary. Option A: $ Option B: $arrow_forwardChuck Wells is planning to buy a Winnebago motor home. The listed price is $175,000. Chuck can get a secured add-on interest loan from his bank at 7.35% for as long as 60 months if he pays 15% down. Chuck's goal is to keep his payments below $4,100 per month and amortize the loan in 42 months. (a) Find Chuck's monthly payment (in $) with these conditions. (Round your answer to the nearest cent.) $ Can he pay off the loan and keep his payments under $4,100? Yes, under these conditions, Chuck will meet his goal.No, the monthly payment is too high. (b) What are Chuck's options to get his payments closer to his goal? (Select all that apply.) try to negotiate a lower interest ratetry to negotiate a higher interest ratemake a lower down paymenttry to bargain for a higher sale pricemake a higher down paymenttry to bargain for a lower sale price (c) Chuck spoke with his bank's loan officer, who has agreed to finance the deal with a 6.85% loan if Chuck can pay 20% down. What…arrow_forward

- Jeff decides to lease a $35,000 vehicle for 4 years. It is estimated that the car will be sold at a price of $17,955. If the annual interest is 3%, what is the financing fee? $44.89 O $87.50 $66.19 O $151.30arrow_forwardMegan can purchase a new car for $30,000. Alternatively, in addition to a down payment of $2,000, Megan can make lease payments of $475 at the beginning of each month for three years to lease the car. The car has a residual value of $15,000. Assume that the cost of borrowing is 3.85% compounded monthly. Which option is economically better for Megan? In the lease option, what will be the buyback value of the vehicle at the end of two years?arrow_forwardChuck Wells is planning to buy a Winnebago motor home. The listed price is $155,000. Chuck can get a secured add-on interest loan from his bank at 7.35% for as long as 60 months if he pays 15% down. Chuck's goal is to keep his payments below $3,600 per month and amortize the loan in 42 months. (a) Find Chuck's monthly payment (in $) with these conditions. (Round your answer to the nearest cent.)arrow_forward

- Ms. Towne is buying a home for $250,000 and is putting down 20 percent cash on the purchase. She is financing the rest with a 30-year, fixed-rate mortgage with a rate of 5 percent but is considering an option that would allow her to make biweekly payments. How long would it take to pay off the loan if she chooses the biweekly payments option?arrow_forwardChuck Wells is planning to buy a Winnebago motor home. The listed price is $175,000. Chuck can get a secured add-on interest loan from his bank at 7.45% for as long as 60 months if he pays 15% down. Chuck's goal is to keep his payments below $4,100 per month and amortize the loan in 42 months. (a) Find Chuck's monthly payment (in $) with these conditions. (Round your answer to the nearest cent.) $ Can he pay off the loan and keep his payments under $4,100? Yes, under these conditions, Chuck will meet his goal.No, the monthly payment is too high. (b) What are Chuck's options to get his payments closer to his goal? (Select all that apply.) try to negotiate a higher interest ratetry to bargain for a lower sale pricetry to negotiate a lower interest ratemake a lower down paymenttry to bargain for a higher sale pricemake a higher down payment (c) Chuck spoke with his bank's loan officer, who has agreed to finance the deal with a 6.85% loan if Chuck can pay 20% down. What…arrow_forwardAddie wants to buy a car that is available at two dealerships. The price of the car is the same at both dealerships. Sams Motors would let her make quarterly payments of $7,500.00 for 6 years at a quarterly interest rate of 4.24 percent. Her first payment to Sams Motors would be due immediately. If Bolden Cars would let her make equal monthly payments of $3,500.00 at a monthly interest rate of 1.56 percent and if her first payment to Bolden Cars would be in 1 month, then how many monthly payments would Addie need to make to Bolden Cars? 17.90 (plus or minus 0.3 payments) O 47.21 (plus or minus 0.3 payments) 46.15 (plus or minus 0.3 payments) 17.58 (plus or minus 0.3 payments) 17.63 (plus or minus 0.3 payments)arrow_forward

- Maria can buy Car A, brand new, for $450/mo for a 4 year loan, or she can lease the same car for $395/mo for 3 years. Help Maria decide which option is best. 1. What will Maria's payments be in year 4 if she chooses each option? BUY LEASEarrow_forwardThe Potters want to buy a small cottage costing $119,000 with annual insurance and taxes of $760 and $2900, respectively. They have saved $11,000 for a down payment, and they can get a 6%, 10-year mortgage from a bank They are qualified for a home loan as long as the total monthly payment does not exceed $1000. Are they qualified? What is the total monthly payment?arrow_forwardAfter deciding to acquire a new car, you realize you can either lease the car or purchase it with a two-year loan. The car you want costs $34,000. The dealer has a leasing arrangement where you pay $97 today and $497 per month for the next two years. If you purchase the car, you will pay it off in monthly payments over the next two years at an APR of 6 percent. You believe that you will be able to sell the car for $22,000 in two years. What is the present value of purchasing the car? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Present value of lease $ What is the present value of leasing the car? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Present value of purchase $ What break-even resale price in two years would make you indifferent between buying and leasing? (Do not round intermediate calculations and round your answer to 2…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education