Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

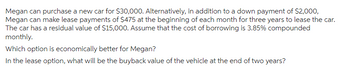

Transcribed Image Text:Megan can purchase a new car for $30,000. Alternatively, in addition to a down payment of $2,000,

Megan can make lease payments of $475 at the beginning of each month for three years to lease the car.

The car has a residual value of $15,000. Assume that the cost of borrowing is 3.85% compounded

monthly.

Which option is economically better for Megan?

In the lease option, what will be the buyback value of the vehicle at the end of two years?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Emma runs a small factory that needs a vacuum oven for brazing small fittings. She can purchase the model she needs for $180,000 up front, or she can lease it for five years for $4200 per month. She can borrow at 7% APR, compounded monthly. Assuming that the oven will be used for five years, should she purchase the oven or should she lease it? O A. Buy, since the present value (PV) of the lease is $32,108 more than the cost of the oven. O B. Lease, since the present value (PV) of the lease is $8642 less than the cost of the oven. O C. Lease, since the present value (PV) of the lease is $2212 less than the cost of the oven. O D. Lease, since the present value (PV) of the lease is $12,224 less than the cost of the oven.arrow_forwardJohn Lloyd and Izan want to buy a $138,000 home. They plan to pay 20% as a down payment, and take out a 30 year loan at 4.15% interest for the balance. a) How much is the loan amount going to be? b) What will the monthly payment be for John Lloyd and Izan? c) How much of the first payment is interest? d) What is the total of the payments? e) How much interest was paid?arrow_forwardAn apartment requires a 12-month lease. The terms of the lease require you to pay $1, 000 upfront when you move in (the first month's $500 rent, plus a $500 security deposit). You then must pay S 500 monthly per month, except at the end of the 12th month when you do not pay but receive your $500 security deposit back. What is the present value cost of this lease to you if your prevailing interest rate is the (absurdly large) 3.26% per month? (You can use a spreadsheet.)arrow_forward

- Kelly and Tim Jarowski plan to refinance their mortgage to obtain a lower interest rate. They will reduce their mortgage payments by $60 a month. Their closing costs for refinancing will be $1,760. How long will it take them to cover the cost of refinancing? (Round your answer to the nearest whole number.) Number of monthsarrow_forwardMarian Plunket owns her own business and is considering an investment. If she undertakes the investment, it will pay $4,680 at the end of each of the next 3 years. The opportunity requires an initial investment of $1,170 plus an additional investment at the end of the second year of $5,850. What is the NPV of this opportunity if the interest rate is 2.3% per year? Should Marian take it? What is the NPV of this opportunity if the interest rate is 2.3% per year? The NPV of this opportunity is $. (Round to the nearest cent.)arrow_forwardA family wants to buy an apartment in a building that is being built on Calzada de Tlalpan # 910, the apartment has a price of $3,400,000.00, the family can pay a 20% down payment and for the rest they agree to sign a 15-year mortgage with BANORTE with (equal) monthly payments, calculated at a rate of 10.75% per yeara) Calculate the value of the down paymentb) Calculate the value of each of the paymentsc) From the first payment, calculate how much money is used to pay interest? How much is spent paying for the house?d) Construct the amortization table for our problem (only 5 lines)e) After 98 payments, how much does the family still owe?f) After 119 payments, how much of the house has the family already paid for?arrow_forward

- marian plunket owners her own business and is considering an investment. If she undertakes the investment, it will pay $32,000 at the end of each of the next 3 years. The opportunity requires an initial investment of $8,000 plus an additional investment at the end of the second year of $40,000. What is the NPV of this opportunity if the interest rate is 8% per year? Should marian take it?arrow_forwardThe price of a small cabin is $65,000. The bank requires a 5% down payment. The buyer is offered two mortgage options: 20-year fixed at 8.5%or 30-year fixed at8.5%. Calculate the amount of interest paid for each option. How much does the buyer save in interest with the 20-year option? Find the monthly payment for the 20-year option.arrow_forwardMark found two feasible options for an apartment to rent for the next 2 years. Option A requires monthly rent of $1,300 to be paid at the beginning of each month. Option B allows for end-of-month rent payments of $1,300 (same amenities as in option A). Mark uses a fairly high annual discount rate of 24 % (sadly, he is also a high credit risk). Find the PV of the future rent payments for both options over the 2-year time period and explain which one Mark will prefer, if he bases his decision strictly on cash flow. (Round present value factor calculations to 5 decimal places, e.g. 1.25124 and final answers to 2 decimal places eg. 5,125.36.) Click here to view the factor table A Option A Present value $ S Option B Mark would choose , because he would effectively be paying in rent over this two-year period.arrow_forward

- Suppose you inherit $100,000 at age 25 and immediately invested in a growth fund who’s annual rate of return average is 13%. Five years later, you transfer all proceeds from the scrubs fun into a long-term IRA that pays an average annual rate of 8%. Immediately you start making additional contributions of $7000 per year to the same IRA. Assuming continuous interest, steady interest rates, and a perfect record of making annualcontributions, how much is this IRA worth when you reach the age of 65? The formula that will need to be used is A = P e^r*t + D/r (e^r*t - 1). Hint: use the continuous interest formula to find the accumulated amount for the first five years, which is then the annual investment, P, into the IRA. arrow_forwardMarian Plunket owns her own business and is considering an investment. If she undertakes the investment, it will pay $40,000 at the end of each of the next 3 years. The opportunity requires an initial investment of $ 10,000 plus an additional investment at the end of the second year of $50,000. What is the NPV of this opportunity if the interest rate is2% per year? Should Marian take it?arrow_forwardYou purchase a home costing $480,000 with a 20% down payment. After shopping around for a mortgage, you select a lender who offers you two options for 30-year mortgages with monthly payments: Option I: A rate of 2.75% (APR) and an upfront fee (due immediately) of $3,840 Option II: A rate of 2.65% (APR) and an upfront fee (due immediately) of $9,600. a. Compute the monthly loan payment for each option. b. Compute the outstanding loan balance after 10 years for each option. c. If you prefer a lower true interest rate, which one should you choose? d. If you anticipate staying in the house for 10 years, which option should you choose?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education