Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:olo

3.

Canvas

Accounts payable

$10,000,000

Accruals

$9,000,000

Current liabilities

$19,000,000

Long-term debt (40,000 bonds, $1,000 par value)

Total liabilities

$40,000,000

$59,000,000

Common stock (10,000,000 shares)

Retained earnings

$50,000,000

Total shareholders' equity

$80,000,000

Total liabilities and shareholders' equity

$139,000,000

The stock is currently selling for $15.25 per share, and its noncallable $1,000.00 par value, 20-year, 9.00% bonds with semiannual payments are selling

for $930.41. The beta is 1.22, the yield on a 6-month Treasury bill is 3.50%, and the yield on a 20-year Treasury bond is 5.50%. The required return on

the stock market is 11.50%, but the market has had an average annual return of 14.50% during the past 5 years. The firm's tax rate is 25%.

Refer to Exhibit 10.1. Based on the CAPM, what is the firm's cost of equity?

O 10.65%

O 11.01%

O 11.74%

O 12.10%

O 12.46%

« Previous

Next

Quiz saved at 10:56pm

Submit Quiz

000

DD

F8

%23

4

8

6

R

Transcribed Image Text:I

A,

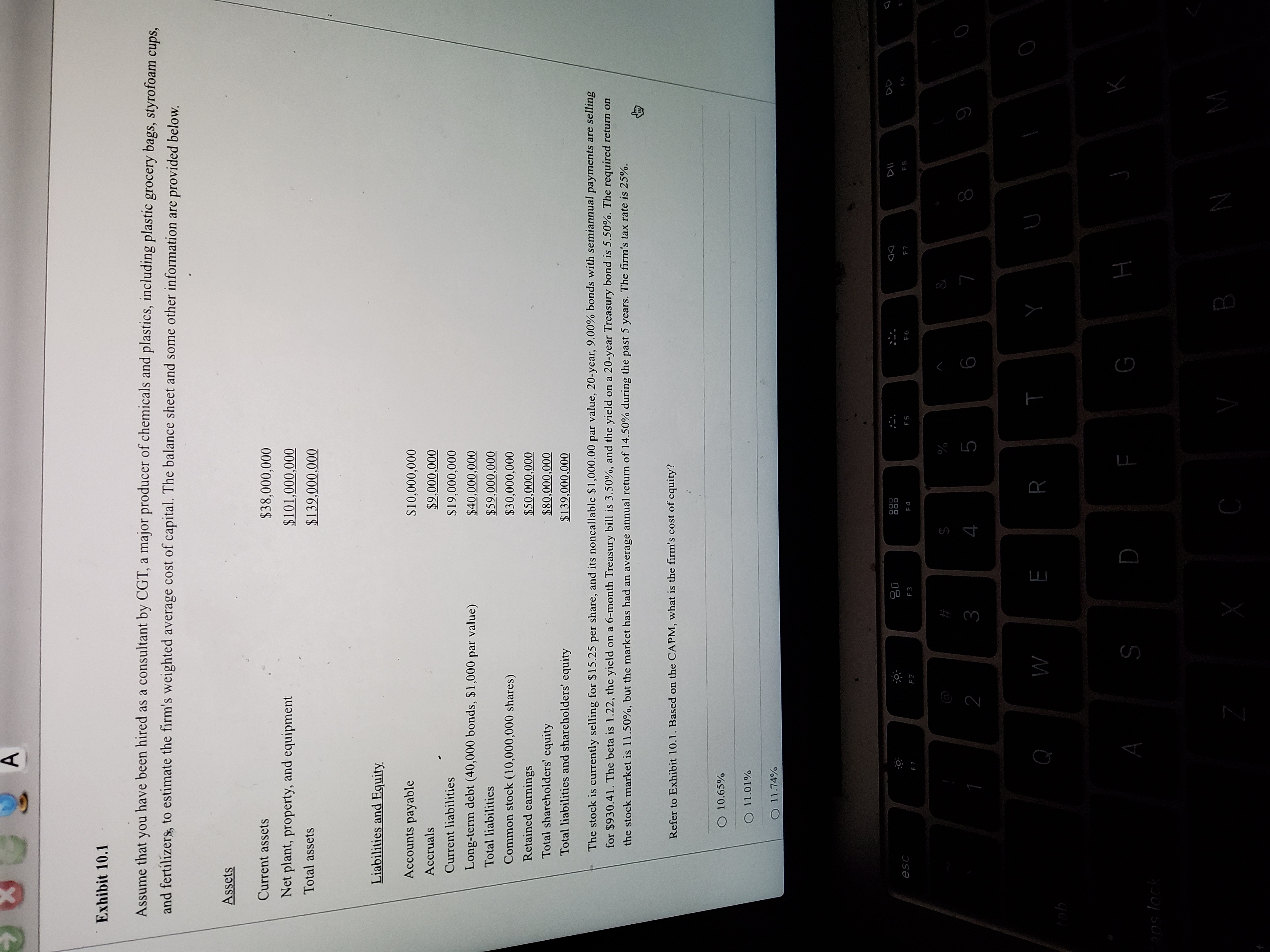

Exhibit 10.1

Assume that

no.

have been hired as a consultant by CGT, a major producer of chemicals and plastics, including plastic grocery bags, styrofoam cups,

and fertilizers, to estimate the firm's weighted average cost of capital. The balance sheet and some other information are provided below.

Assets

Current assets

$38,000,000

Net plant, property, and equipment

Total assets

$139,000,000

Liabilities and Equity

Accounts payable

$10,000,000

Accruals

$9,000,000

Current liabilities

$19,000,000

Long-term debt (40,000 bonds, $1,000 par value)

$40,000,000

Total liabilities

$59,000,000

Common stock (10,000,000 shares)

$30,000,000

Retained earnings

$50,000,000

Total shareholders' equity

$80,000,000

Total liabilities and shareholders' equity

$139,000,000

The stock is currently selling for $15.25 per share, and its noncallable $1,000.00 par value, 20-year, 9.00% bonds with semiannual payments are selling

for $930.41. The beta is 1.22, the yield on a 6-month Treasury bill is 3.50%, and the yield on a 20-year Treasury bond is 5.50%. The required return on

the stock market is 11.50%, but the market has had an average annual return of 14.50% during the past 5 years. The firm's tax rate is 25%.

Refer to Exhibit 10.1. Based on the CAPM, what is the firm's cost of equity?

O 10.65%

O 11.01%

O 11.74%

000

000

DD

F4

F5

F3

F2

$

%

%#3

9

6

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A firm has a debt-to-equity ratio of 2. What is its equity multiplier? 01 O 2.5 03 O 1.5 O 2arrow_forwardCalculate the Weighted Average Cost of Capital (WACC) Cost of Equity = 11.02% Cost of Debt = 5.35% Debt-to-Equity Ratio = 15.52%arrow_forwardThe price-earnings per share of A, B, C, D and E is P6.00, P6.25, P6.80, P6.90 and P6.20. If A has earnings per share of P1,200.00, it would currently be ____ by ____ compared to the group average. a. Overvalued by P516 b. Undervalued by P540 c. Undervalued by P516 d. Overvalued by P550arrow_forward

- What is the debt ratio for a firm with a debt-equity ratio of 0.5? Multiple Choice O 35% 33.3% 54% 66.7%arrow_forwardExample The following data were assembled for General Stores Corporation: Equity (Market Risk) Premium: 4.9% Size Premium: 1.8% Value Premium: 3.0% Current Risk-Free Rate: 3.5% Market Beta: 1.05 Size Beta: -0.315 Value Beta: -0.224 Using the data above, estimate General Stores' cost of equity using the Fama- French Model.arrow_forwardklp.1arrow_forward

- The assets of company X have a beta equal to 1. Assume that the company's debt has a beta equal to 0.5 and that X's equity has a beta equal to 2. Consider an investor who holds 10% of the company's total debt liabilities and 10% of the company's equity. The beta of the investor's portfolio is equal to A) 0.1 B)1 C) 0.25 D) 1.25arrow_forward4. Rivoli Inc. hired you as a consultant to help estimate its cost of capital. You have been provided with the following data: D0 = $0.80; P 0 = $25.00; and g = 8.00% ( constant). Based on the DCF approach, what is the cost of equity from retained earnings? Do not round your intermediate calculations. a . 9.85% b. 14.32% c. 11.46% d . 9.74% e. 13.17%arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education