Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

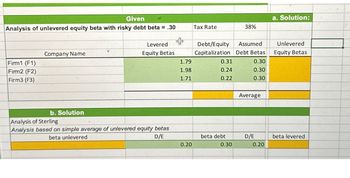

Transcribed Image Text:Given

Analysis of unlevered equity beta with risky debt beta = .30

Firm1 (F1)

Firm2 (F2)

Firm3 (F3)

Company Name

b. Solution

Levered

Equity Betas

Analysis of Sterling

Analysis based on simple average of unlevered equity betas

beta unlevered

D/E

1.79

1.98

1.71

0.20

Tax Rate

Debt/Equity

Assumed

Capitalization Debt Betas

0.30

0.30

0.30

0.31

0.24

0.22

beta debt

38%

0.30

Average

D/E

0.20

a. Solution:

Unlevered

Equity Betas

beta levered

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Q#2:Debt to Assets Ratio Debt to Equity Before-tax cost of debt0.0 0 6%0.1 0.11 7%0.2 0.25 9%0.3 0.43 12.5%0.4 0.66 15.5%Krf= 3%, Market Risk Premuim = 5%, T=30%, BUL = 0.9.Required: Determine, its capital structure. Q#3: A firm has 20 million shares outstanding, with a $30 per share market price. The firm has $10million in extra cash that it plans to use in a stock repurchase;…arrow_forwardWhat is its free cash flow to equity? Do not round intermediate calculations. Round your answer to the nearest cent.arrow_forwardWhich company is more liquid and which company is more solvent? HAL SLB Liquidity Current Ratio 2.32 1.17 Quick Ratio 1.51 0.79 Solvency Liabilities to equity 1.72 0.93 Times-interest-earned 4.45 5.68arrow_forward

- am. 123.arrow_forwardD4) Finance Consider a portfolio composed of shares AAA and BBB as shown in the following table. At 95% confidence level, select the correct statement AAA BBB Value 2,470,000 785,750 % investment 76% 24% Volatilities 2.32 % 2.69 % Correlation for both assets 0.65 Portfolio Value for both assets 3,255,750 a) The Component VaR of the Asset AAA is 92,223 and the component VaR of the Asset BBB is 27955.69 b) The contribution to the VaR of the Asset AAA is 77% and the one of the Asset 2 is 23% c) Both answers are correctarrow_forwardQuestion content area top Part 1 (Capital asset pricing model) Anita, Inc. is considering the following investments. The current rate on Treasury bills is 7 percent, and the expected return for the market is 12.5 percent. Using the CAPM, what rates of return should Anita require for each individual security? Stock Beta H 0.71 T 1.62 P 0.89 W 1.37 (Click on the icon in order to copy its contents into a spreadsheet.) Question content area bottom Part 1 a. The expected rate of return for security H, which has a beta of 0.71, is enter your response here%. (Round to two decimal places.) Part 2 b. The expected rate of return for security T, which has a beta of 1.62, is enter your response here%. (Round to two decimal places.) Part 3 c. The expected rate of return for security P, which has a beta of 0.89, is enter your response here%. (Round to two decimal places.) Part 4 d. The expected rate of return for…arrow_forward

- Match each definition that follows with the term (a–h) it defines. Question 7 options: a company's ability to make interest payments and repay debt at maturity focuses on a company’s ability to generate net income useful for comparing one company to another or to industry averages use debt to increase the return on an investment measures the risk that interest payments will not be made if earnings decrease the percentage analysis of the relationship of each component in a financial statement to a total within the statement a percentage analysis of increases and decreases in related items on comparative financial statements an analysis of a company’s ability to pay its current liabilities 1. solvency 2. leverage 3. times interest earned 4. horizontal analysis 5. vertical analysis 6. common-sized financial statements 7. current position analysis 8.…arrow_forwardAsset value = monthly debt payments + equity True Falsearrow_forwardQb 08.arrow_forward

- 48 The Sunland Products Co. currently has debt with a market value of $300 million outstanding. The debt consists of 9 percent coupon bonds (semiannual coupon payments) which have a maturity of 15 years and are currently priced at $1,434.63 per bond. The firm also has an issue of 2 million preferred shares outstanding with a market price of $10 per share. The preferred shares pay an annual dividend of $1.20. Sunland also has 14 million shares of common stock outstanding with a price of $20.00 per share. The firm is expected to pay a $2.20 common dividend one year from today, and that dividend is expected to increase by 5 percent per year forever. If Sunland is subject to a 40 percent marginal tax rate, then what is the firm's weighted average cost of capital? Excel Template (Note: This template includes the problem statement as it appears in your textbook. The problem assigned to you here may have different values. When using this template, copy the problem statement from this screen…arrow_forwardIV. Conclusion: Based on your findings on ratio analysis and interpretation, what conclusion can you make? V. Recommendations: - What recommendations can you give to the company with regards to your findings? - What recommendations can you give to the investor with regards to your findings?arrow_forwardPlease also explain why other options are incorrectarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education