FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

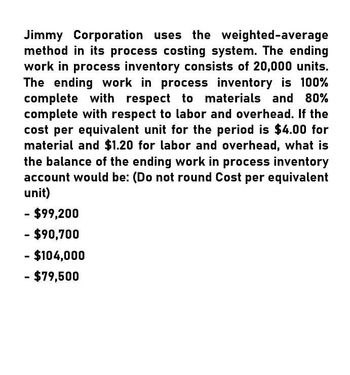

Transcribed Image Text:Jimmy Corporation uses the weighted-average

method in its process costing system. The ending

work in process inventory consists of 20,000 units.

The ending work in process inventory is 100%

complete with respect to materials and 80%

complete with respect to labor and overhead. If the

cost per equivalent unit for the period is $4.00 for

material and $1.20 for labor and overhead, what is

the balance of the ending work in process inventory

account would be: (Do not round Cost per equivalent

unit)

- $99,200

- $90,700

$104,000

- $79,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- A Company produced 80,900 units during its first year of operations and sold 77,100 at 21.60 per unit. The company chose practical activity-at 80,900 units to compute its predetermined overhead rate. Manufacturing costs are as follows: Direct materials Direct labor Expected and actual variable overhead Expected and actual fixed overhead 457,085 87,372 300,139 432,006 Calculate the unit cost and the cost of finished goods inventory under absorption costing and calculate the unit cost and the cost of finished goods inventory under variable costing.arrow_forwardAssuming a weighted average method of process costing, compute the average cost per unit for Material A.arrow_forwardAssuming that there was no beginning work in process inventory, and the ending work in process inventory is 30% complete as to direct materials costs, the number of equivalent units for direct materials costswould be: a) less than the units started in production b) less than the units completed c) equal to the units completed d) equal to the units started in productionarrow_forward

- Assuming that there was no beginning work in process inventory, and the ending work in process inventory is 30% complete as to direct materials costs, the number of equivalent units for direct materials costswould be a) less than the units started in production b) less than the units completed c) equal to the units completed d) equal to the units started in productionarrow_forwardThe total costs of goods allocated to units transferred out is:arrow_forwardhow many units were in ending Work in Process Inventory?arrow_forward

- Bixby Carpet Manufacturing Inc. uses a process costing system and calculates per-unit costs using the weighted average method. The following data relates to the first production department (the Weaving Department) of its Rayon carpet brand for the month of November. Note that since carpet is sold by the square yard, each “unit” refers to a square yard of carpet: Beginning Work in Process Inventory: 300 units, 40% complete with respect to conversion. Ending Work in Process Inventory: 400 units, 25% complete with respect to conversion. All direct materials are added at the beginning of the process, and conversion costs are assumed to be incurred uniformly throughout production. The cost of direct materials in beginning Work in Process Inventory was $21,200, and conversion costs in beginning Work in Process were $4,900.During the month, $110,800 of direct materials were added to production. Direct labor for the period was $23,120. Overhead is allocated on at 25% of direct…arrow_forwardThe Gasson Company uses the weighted-average method in its process costing system. The company's ending work in process inventory consists of 20,000 units, The ending work in process inventory is 100% complete with respect to materials and 70% complete with respect to labor and overhead. If the costs per equivalent unit for the period $3.20 for the materials and $2.00 for labor and overhead, what is the balance of the ending work in process inventory account would be: (Do not round Cost per equivalent unit) A. $104,000 B. $63,500 C. $92,000 D. $83,500arrow_forwardCompute the total costs of the units (gallons) (a) completed and transferred out to the Packaging Department, and (b) in the Department ending Work-in-Process Inventory. Complete the Production Cost Report that you began in Requirement 1 by calculating the costs per equivalent unit in this step, and then by calculating the the total cost of units completed and transferred out and of units in ending inventory in the following step. (Complete all input fields. Enter a "0" for any zero balances. Round the cost per equivalent unit amounts to the nearest cent and all other amounts to the nearest dollar. Abbreviation used: EUP = equivalent units of production.)arrow_forward

- Domesticarrow_forwardDuring March, the following costs were charged to the manufacturing department: $15,480 for materials; $14,900 for labor; and $13,900 for manufacturing overhead. The records show that 31,000 units were completed and transferred, while 3,400 remained in ending inventory. There were 34,400 equivalent units of material and 32,360 of conversion costs. Using the weighted-average method, what is the cost of inventory transferred and the balance in work in process inventory? When required, round cost per unit to two decimal places and the final answers to the nearest dollar. Cost of inventory transferred $fill in the blank 1 Balance in work in process $fill in the blank 2arrow_forwardSolve itarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education