FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

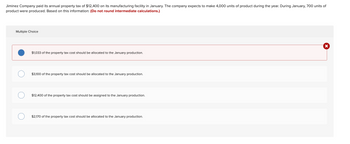

Transcribed Image Text:Jiminez Company paid its annual property tax of $12,400 on its manufacturing facility in January. The company expects to make 4,000 units of product during the year. During January, 700 units of

product were produced. Based on this information: (Do not round intermediate calculations.)

Multiple Choice

X

$1,033 of the property tax cost should be allocated to the January production.

$3,100 of the property tax cost should be allocated to the January production.

$12,400 of the property tax cost should be assigned to the January production.

$2,170 of the property tax cost should be allocated to the January production.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Coparrow_forwardThe Silverman Company spent $14,000 on direct supplies and $19,000 on the salary of production personnel in its first year of business. General, selling, and administrative costs came to $8,000 while lease payments and utilities for the production facilities came to $17,000. At a cost of $15.00 per unit, the company produced 5,000 units, of which 3,000 were sold. When was the year's operating net profit for Silverman? $7,000 $12,000 $28,000 $37,000arrow_forwardGibson Manufacturing Co. expects to make 30,800 chairs during the year 1 accounting period. The company made 3,300 chairs in January. Materials and labor costs for January were $17,800 and $24,500, respectively. Gibson produced 1,400 chairs in February. Material and labor costs for February were $9,400 and $12,900, respectively. The company paid the $770,000 annual rental fee on its manufacturing facility on January 1, year 1. The rental fee is allocated based on the total estimated number of units to be produced during the year. Required Assuming that Gibson desires to sell its chairs for cost plus 25 percent of cost, what price should be charged for the chairs produced in January and February? (Round intermediate calculations and final answers to 2 decimal places.)arrow_forward

- Ashvinarrow_forwardDengerarrow_forwardRizal Co. consigns 30 hardware products to Bonifacio Co. on January 1, 20x1. The unit cost per hardware product is P8,000. Rizal pays P3,000 in transporting the hardware product to Bonifacio Co. At month-end, Bonifacio remits P230,000 for the sale of 14 hardware products, after deducting the following: 15% commission based on selling price Freight out Installation costs P20,000 6,000 REQUIRED: 1. Net income recognized by Rizal Co. on the consignment 2. Carrying amount of inventory to be reported in Rizal's balance sheetarrow_forward

- Baird Manufacturing Co. expects to make 30,500 chairs during the year 1 accounting period. The company made 4,600 chairs in January. Materials and labor costs for January were $16,600 and $24,200, respectively. Baird produced 1,800 chairs in February. Material and labor costs for February were $9,900 and $13,700, respectively. The company paid the $518,500 annual rental fee on its manufacturing facility on January 1, year 1. The rental fee is allocated based on the total estimated number of units to be produced during the year. Required Assuming that Baird desires to sell its chairs for cost plus 30 percent of cost, what price should be charged for the chairs produced in January and February? (Round intermediate calculations and final answers to 2 decimal places.) January February Price per unitarrow_forwardbrahim Corporation has the following estimated costs for the year:Direct Materials Rs. 20,000 Factory Rent Rs. 10,000 Sales Salaries Rs. 50,000 Factory Depreciation Rs. 5,000 Direct Labor Rs. 25,000 Foreman’s Salary Rs. 20,000 Indirect Material Rs. 4,000 Indirect Labor Rs. 3,000 Ibrahim Corporation estimates that 25,000 labor-hours will be worked during the year. If FOH rate is applied on the basis of direct labor hours, the overhead rate per hour will be:arrow_forwardMechem Corporation produces and sells a single product. In April, the company sold 2,000 units. Its total sales were $160,000, its total variable expenses were $78,600, and its total fixed expenses were $55,500. Required: a. Construct the company's contribution format income statement for April. b. Redo the company's contribution format income statement assuming that the company sells 1,900 units. Complete this question by entering your answers in the tabs below. Required a Required b Construct the company's contribution format income statement for April. (Do not round intermediate calculations.) 0 0arrow_forward

- Edmund Supplies Company sold 3,170 metal connectors on account to Door Incorporated for $200 each on September 15. Each metal connector costs Edmund $150 to make. Door has 60 days to return the unused goods. Edmund believes that Door will ultimately return 75 of the connectors. On September 29, Door returns 50 connectors. Edmund has a September 30 fiscal year end. At year end, Edmund believes 75 connectors is a good estimate of the total that will be returned. The cost of recovering these products is immaterial. Edmund expects to be able to resell these goods for a profit. Instructions Prepare the following journal entries on the books of Edmund Company: Entries to record the initial sales on September 15. Entries to record the return of goods September 29. Entries to record the year-end adjustment based on estimated returns on September 30.arrow_forwardShaw company sells good that cost 600,000 to Charm company for 800,000 on January 2, 20x5. the sales price includes an installation fee, which is valued at 80,000. the fair value of the goods is 740,000. the installation is considered a separate performance obligation and is expected to take 6 months to complete. Prepare the journal entries to record the sale on January 2, 20x5. Shaw prepares income statement for the first quarter of 20x5, ending March 31, 20x5 (installation was completed on June 18, 20x5). How much revenue should Shaw recognize related to its sale to Charm?arrow_forwardPaper Corporation expects to have the sales and expenses shown for August, September,andOctober. The company expects to receive 55% of collections for sales in the month the saleoccurs, 35% in the following month, and the remainder to be uncollectible. The companypolicy for manufacturing expenses requires that 70% of the expenses be paid in the monthincurred and 30% in the following month. All other expenses are paid in the month incurred.The company also earns and collects $5,000 of rental revenue eachmonth. At the end of thequarter, Paper Corporation must make an estimated tax payment, which the companyestimates will be 7% of the quarter’s total sales. Prepare the cash budget for the three monthsif cash as of August 1, 2015, totaled $51,500. The company requires a $50,000 minimum cashbalance. July August September October Sales $34,000 $39,000 $46,000 $40,000 Manufacturing costs 15,200 16,800 20,100 19,900 Selling expenses 10,000 10,200 14,500 16,500 Administrative…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education