FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

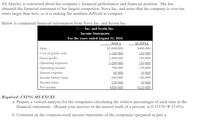

Transcribed Image Text:Jill Akerley is concerned about her company's financial performance and financial position. She has

obtained the financial statement of her largest competitor, Nova Inc. and notes that the company is over ten

times larger than hers, so it is making the numbers difficult to compare.

Below is condensed financial information from Nova Inc. and Scotia Inc.:

Nova Inc. and Scotia Inc.

Income Statements

For the years ended August 31, 2024

NOVA

SCOTIA

Sales

$5,000,000

$400,000

Cost of goods sold

2,100,000

120,000

Gross profit

2,900,000

280,000

Operating expenses

2,200,000

130,000

Operating income

700,000

150,000

Interest expense

60,000

10,000

Income before taxes

640,000

140,000

Income taxes

150,000

30,000

Net income

$490,000

$110,000

Required: USING MS EXCEL

a. Prepare a vertical analysis for the companies calculating the relative percentages of each item in the

financial statements. (Round your answers to the nearest tenth of a percent, ie 0.13578 → 13.6%)

b. Comment on the common-sized income statements of the companies (prepared in part a.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The balance sheet of ATLF, Inc. reports total assets of $950,000 and $1,050,000 at the beginning and end of the year, respectively. Net income and sales for the year are $100,000 and $800,000, respectively. What is ATLF's profit margin? Select one: a. 8% b. 15% c. 10% d. 80% e. 12.5%arrow_forwardCommon-Sized Income Statement Revenue and expense data for the current calendar year for Tannenhill Company and for the electronics industry are as follows. Tannenhill's data are expressed in dollars. The electronics industry averages are expressed in percentages. Electronics Tannenhill Industry Company Average Sales $1,540,000 100 % Cost of goods sold 1,016,400 72 Gross profit $523,600 28 % Selling expenses $308,000 15 % Administrative expenses 123,200 7 Total operating expenses $431,200 22 % Operating income $92,400 6 % Other revenue 30,800 2 $123,200 8 % Other expense 15,400 1 Income before income tax $107,800 7 % Income tax expense 46,200 4 Net income $61,600 3 % a. Prepare a common-sized income statement comparing the results of operations for Tannenhill Company with the industry average. If required, round percentages to one decimal place. Enter all amounts as positive numbers. Tannenhill Company Common-Sized Income Statement For the Year Ended December 31 Tannenhill Tannenhill…arrow_forwardAT&T and Verizon produce and market telecommunications products and are competitors. Key financial figures for these businesses for a recent year follow. Which company is more successful in returning net income from its assets invested?arrow_forward

- [The following information applies to the questions displayed below.] CommercialServices.com Corporation provides business-to-business services on the Internet. Data concerning the most recent year appear below: Sales Net operating income Average operating assets $ 4,700,000 $ 188,000 $ 940,000 The following questions are to be considered independently. 2. The entrepreneur who founded the company is convinced that sales will increase next year by 40% and that net operating income will increase by 250%, with no increase in average operating assets. What would be the company's ROI? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Return on investment (ROI) %arrow_forwardBellingham Industries, a manufacturer of the furniture industry, had the following financial performance for the last two years as shown on their income statements below: Billingham Industries, Inc. Comparative Income Statement For the Years Ended December 31, 2021 and 2020 2021 2020 Amount Amount Sales $1,280,000 $1,180,000 Cost of goods sold 644,800 613,600 Gross profit 635,200 566,400 Selling expenses 230,500 188,800 Administrative expenses 182,500 177,000 Total operating expenses 413,000 365,800 Income from operations 222,200 200,600 Other income 77,000 70,800 Income before income tax 299,200 271,400 Income tax expense 121,600 106,200 Net income $177,600 $165,200 1. Prepare a horizontal analysis using the form provided to…arrow_forwardBellingham Industries, a manufacturer of the furniture industry, had the following financial performance for the last two years as shown on their income statements below: Billingham Industries, Inc. Comparative Income Statement For the Years Ended December 31, 2021 and 2020 2021 2020 Amount Amount Sales $1,280,000 $1,180,000 Cost of goods sold 644,800 613,600 Gross profit 635,200 566,400 Selling expenses 230,500 188,800 Administrative expenses 182,500 177,000 Total operating expenses 413,000 365,800 Income from operations 222,200 200,600 Other income 77,000 70,800 Income before income tax 299,200 271,400 Income tax expense 121,600 106,200 Net income $177,600 $165,200 1. Prepare a horizontal analysis using the form provided to…arrow_forward

- please answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forwardBramble Corp. reported the following in its 2025 and 2024 income statements. Net sales Cost of goods sold Operating expenses Income tax expense Net income Gross profit rate 2025 $154,000 86,240 27,720 21,560 $18,480 (a1) Determine the company's gross profit rate and profit margin for both years. (Round answers to 1 decimal place, eg. 52.7%) Profit margin 2024 $124,000 69,440 16,120 13,640 $24,800 2025 2024 %arrow_forwardPlease help with all the calculations and answer The 2016 income statement for J.Galarraga Corporation is below: Revenues $ 14,000,000Cost of Goods Sold 6,500,000Gross Margin $ 7,500,000Selling Expenses 3,400,000Administrative Expenses 700,000Net Operating Income $ 3,400,000 The company's margin of safety is $8,500,000. What would our revenues need to be to earn the NOI of $5,100,000?A. $ 16,300,000B. $ 19,750,000C. $ 18,250,000D. $ 15,700,000E. None of the abovearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education