FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

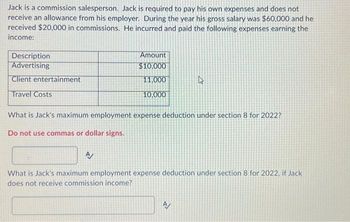

Transcribed Image Text:Jack is a commission salesperson. Jack is required to pay his own expenses and does not

receive an allowance from his employer. During the year his gross salary was $60,000 and he

received $20,000 in commissions. He incurred and paid the following expenses earning the

income:

Description

Advertising

Client entertainment

Travel Costs

Amount

$10,000

11,000

10,000

What is Jack's maximum employment expense deduction under section 8 for 2022?

Do not use commas or dollar signs.

A/

What is Jack's maximum employment expense deduction under section 8 for 2022, if Jack

does not receive commission income?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Kyle, a single taxpayer, worked as a freelance software engineer for the first three months of 2022. During that time, he earned $58,000 of self-employment income. On April 1, 2022, Kyle took a job as a full-time software engineer with one of his former clients, Hoogle Incorporated From April through the end of the year, Kyle earned $172,000 in salary. What amount of FICA taxes (self-employment and employment related) does Kyle owe for the year?arrow_forwardMaemanarrow_forwardElizabeth's regular hourly wage rate is $22, and she receives an hourly rate of $33 for work in excess of 40 hours. During a January pay period, Elizabeth works 49 hours. Elizabeth's federal income tax withholding is $97, and she has no voluntary deductions. Prepare the employer's journal entry to record payroll taxes for the period. Ignore unemployment taxes. Assume the FICA tax rate is 7.65%. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round the answers to 2 decimal places, eg. 15.25) Date Account Titles and Explanation Jan, 15 Payroll Tax Expense FICA Taxes Payable Debit 98.30 Credit 98.30arrow_forward

- Frank is a self-employed CPA whose 2021 net earnings from his trade or business (before the H.R. 10 plan contribution but after the deduction for one-half of self-employment taxes) is $240,000. What is the maximum contribution that Frank can make on his behalf to his H.R. 10 (Keogh) plan in 2021? a. $19,500 b. $48,000 c. $58,000 d. $60,000arrow_forward1.arrow_forwardEly is single, claims one dependent who is under the age of 17, and receives gross wages of $3,975 paid semimonthly. A 2021 Form W-4 is filed with the employer who uses the Percentage Method Tables for Manual Payroll Systems with Forms W-4 from 2020 or Later (see appendix). Assume that Ely has only one job or that step 2 of Form W-4 is not checked. What is the amount of income tax withheld on Ely's gross wages for each pay period? Multiple Choice $499.01 $512.83 $502.09 $577.82arrow_forward

- Kyle, a single taxpayer, worked as a freelance software engineer for the first three months of 2023. During that time, he earned $74,000 of self-employment income. On April 1, 2023, Kyle took a job as a full-time software engineer with one of his former clients, Hoogle Incorporated From April through the end of the year, Kyle earned $168,000 in salary. What amount of FICA taxes (self-employment and employment related) does Kyle owe for the year? Note: Round your intermediate calculations and final answer to the nearest whole dollar amount. Self-employment/FICA taxarrow_forwardMr. Joplin sells a line of computer software for a company in Western Canada. In 2023, he was paid a base salary of $56,000 and received sales commissions of $88,200. He did not receive an allowance, nor was he reimbursed by his employer for any of his expenses. During the year, Mr. Joplin has the following employment-related expenses. View the expenses. View the additional information. Required Determine Mr. Joplin's employment income for 2023. Ignore all GST/HST and PST implications. k First, calculate the deductible CCA on the automobile used by Mr. Joplin. Enter the employment-related usage proportion as a percentage. Full capital cost allowance Employment-related usage proportion Deductible CCA on automobile Expenses Airline tickets Office supplies and shipping expenses Purchase of laptop computer Client entertainment Cost of new automobile (not zero-emission) Operating expenses of automobile $ 2,380 420 2,095 1,770 47,000 10,700 C X Additional Information Assume that $390 of the…arrow_forwardOn the December 31, 2015, payday, Jo is out sick. Prior to this $3,000 paycheck, her 2015 taxable wages were $120,000. If Jo picked up her paycheck on-January 4, 2016, how much FICA should Jo’s employer have withheld? $43.50 $169.50 $229.50 None of the abovearrow_forward

- Valentina is single and claims no dependents. Assume that Valentina has only one job or that step 2 of Form W-4 is not checked. Use the Wage Bracket Method Tables for Manual Payroll Systems with Forms W-4 from 2020 or Later available online in Publication 15, Publication 15-T. "Federal Income Tax Withholding Methods." Use the appropriate wage bracket tables for a manual payroll systems Required: a. If Valentina is paid weekly and her annual wages are $82,680, what is the amount of withholding per paycheck? b. If Valentina is paid monthly with annual wages of $68,640, what is the amount of withholding per paycheck? c. If Valentina is paid biweekly with annual wages of $63,960, what is the amount of withholding per paycheck? d. If Valentina is paid semimonthly with annual wages of $77,160, what is the amount of withholding per paycheck? Amount a Withholdings per paycheck (b Withholdings per paycheck e Withholdings par paycheck d. Withholdings pet paygarrow_forwardMahmet earned wages of $148,800 during 2022. Mahmet qualifies to file as head of household and claims two dependents under the age of 17. How much FICA tax is Mahmet's employer responsible to remit in 2022? Multiple Choice $21,935.40. $21,123.20. $22,543.20arrow_forwardJustin Matthews is a waiter at the Duluxe Lounge. In his first weekly pay in March, he earned $300.00 for the 40 hours he worked. In addition, he reports his tips for February to his employer ($500.00), and the employer withholds the appropriate taxes for the tips from this first pay in March. Calculate his net take-home pay assuming the employer withheld federal income tax (wage-bracket, head of household), social security taxes, and state income tax (2%).arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education