MATLAB: An Introduction with Applications

6th Edition

ISBN: 9781119256830

Author: Amos Gilat

Publisher: John Wiley & Sons Inc

expand_more

expand_more

format_list_bulleted

Question

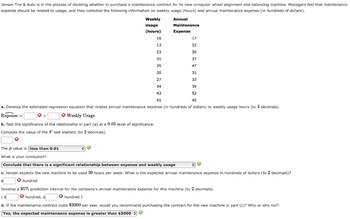

Transcribed Image Text:Jensen Tire & Auto is in the process of deciding whether to purchase a maintenance contract for its new computer wheel alignment and balancing machine. Managers feel that maintenance

expense should be related to usage, and they collected the following information on weekly usage (hours) and annual maintenance expense (in hundreds of dollars).

Annual

Maintenance

Expense

Weekly

Usage

(hours)

16

17

13

22

23

30

31

37

35

47

20

31

27

33

34

39

43

52

41

40

a. Develop the estimated regression equation that relates annual maintenance expense (in hundreds of dollars) to weekly usage hours (to 3 decimals).

Expense =

*+

Weekly Usage

b. Test the significance of the relationship in part (a) at a 0.05 level of significance.

Compute the value of the F test statistic (to 2 decimals).

The p value is less than 0.01

What is your conclusion?

Conclude that there is a significant relationship between expense and weekly usage

c. Jensen expects the new machine to be used 30 hours per week. What is the expected annual maintenance expense in hundreds of dollars (to 2 decimals)?

✩ hundred

$

Ⓒ

Develop a 95% prediction interval for the company's annual maintenance expense for this machine (to 2 decimals).

($

hundred, $

hundred)

d. If the maintenance contract costs $3000 per year, would you recommend purchasing the contract for the new machine in part (c)? Why or why not?

Yes, the expected maintenance expense is greater than $3000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A major brokerage company has an office in Miami, Florida. The manager of the office is evaluated based on the number of new clients generated each quarter. Data were collected that show the number of new customers added during each quarter between 2015 and 2018. A multiple regression model was developed with the number of new customers as the dependent and the following four independent variables: Period (1, …, 16): A variable that measures the trend; Q1 = 1 for first quarter, Q1 = 0 otherwise; Q2 = 1 for second quarter, Q2 = 0 otherwise; Q3 = 1 for third quarter, Q3 = 0 otherwise. Questions: 1. Explain each of the four slopes (Period, Q1, Q2, Q3). 2. How many new customers would you expect in the second quarter of the following year (2019)?arrow_forwardCan brand, battery life, and internal storage capacity affect a smartphone's price? Use MegaStat and α = .05 to perform a regression analysis for the Smartphones01BS dataset and answer the following questions. When you copy and paste output from MegaStat to answer a question, remember to choose to "Keep Formatting" to paste the text.arrow_forwardUse the Financial database from “Excel Databases.xls” on Blackboard. Use Total Revenues, Total Assets, Return on Equity, Earnings Per Share, Average Yield, and Dividends Per Share to predict the average P/E ratio for a company. Use Excel to develop the multiple linear regression model. Assume a 5% level of significance. Which independent variable is the strongest predictor of the average P/E ratio of a company? A. Total Revenues B. Average Yield C. Earnings Per Share D.Return on Equity E. Total Assets F.Dividends Per Share Company Type Total Revenues Total Assets Return on Equity Earnings per Share Average Yield Dividends per Share Average P/E Ratio AFLAC 6 7251 29454 17.1 2.08 0.9 0.22 11.5 Albertson's 4 14690 5219 21.4 2.08 1.6 0.63 19 Allstate 6 20106 80918 20.1 3.56 1 0.36 10.6 Amerada Hess 7 8340 7935 0.2 0.08 1.1 0.6 698.3 American General 6 3362 80620 7.1 2.19 3 1.4 21.2 American Stores 4 19139 8536 12.2 1.01 1.4 0.34 23.5 Amoco 7 36287…arrow_forward

- A cafe company wants to determine how the money they spend on Google ads impacts their monthly revenue. Over 6 consecutive months, they vary the amount they spend on their Ads (in $) and record the associated revenue (in $) for each month. The data is shown below: l Revenue 50 427 75 472 100 467 125 529 150 518 175 543 A) Develop a regression equation for predicting monthly revenue based on the amount spent with Ads. What is the y-intercept? B) What is the sample correlation between these two variables? C) What is the slope of your regression equation? Give your answer to two decimal places. D) Using a 0.05 level of significance, does this regression equation appear to have any value for predicting revenue based on Ads?arrow_forwardA medical researcher wishes to determine how the dosage (in milliliters) of an experimental drugaffects the heart rate (in beats per minute) of patients with an elevated heart rate. The data for asample of eight patients with an elevated heart rate are provided in the following table.Drug Dosage 0 5 10 20 25 30 40 50Heart Rate 135 124 106 89 85 72 68 62(a) Determine the linear regression model that will best predict a patient’s heart rate based on thedosage of the drug received. (b) How well does the linear regression model fit this sample data? (c) If a patient with an elevated heart rate is administered a 35 ml dose of this drug, predict theresulting heart rate of the patient.arrow_forwardWe have data from 209 publicly traded companies (circa 2010) indicating sales and compensation information at the firm-level. We are interested in predicting a company's sales based on the CEO's salary. The variable sales; represents firm i's annual sales in millions of dollars. The variable salary; represents the salary of a firm i's CEO in thousands of dollars. We use least-squares to estimate the linear regression sales; = a + ßsalary; + ei and get the following regression results: . regress sales salary Source Model Residual Total sales salary cons SS 337920405 2.3180e+10 2.3518e+10 df 1 207 208 Coef. Std. Err. .9287785 .5346574 5733.917 1002.477 MS 337920405 111980203 113066454 Number of obs F (1, 207) Prob > F R-squared t P>|t| = Adj R-squared = Root MSE 1.74 0.084 5.72 0.000 = = -.1252934 3757.543 = 209 3.02 0.0838 0.0144 0.0096 10582 [95% Conf. Interval] 1.98285 7710.291 This output tells us the regression line equation is sales = 5,733.917 +0.9287785 salary. Interpret the…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning

Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON

Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman

The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

MATLAB: An Introduction with Applications

Statistics

ISBN:9781119256830

Author:Amos Gilat

Publisher:John Wiley & Sons Inc

Probability and Statistics for Engineering and th...

Statistics

ISBN:9781305251809

Author:Jay L. Devore

Publisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...

Statistics

ISBN:9781305504912

Author:Frederick J Gravetter, Larry B. Wallnau

Publisher:Cengage Learning

Elementary Statistics: Picturing the World (7th E...

Statistics

ISBN:9780134683416

Author:Ron Larson, Betsy Farber

Publisher:PEARSON

The Basic Practice of Statistics

Statistics

ISBN:9781319042578

Author:David S. Moore, William I. Notz, Michael A. Fligner

Publisher:W. H. Freeman

Introduction to the Practice of Statistics

Statistics

ISBN:9781319013387

Author:David S. Moore, George P. McCabe, Bruce A. Craig

Publisher:W. H. Freeman