Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

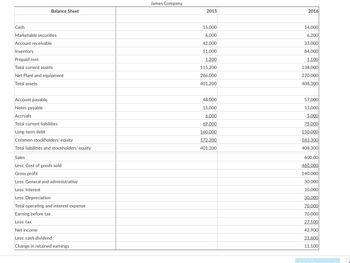

Transcribed Image Text:Cash

Balance Sheet

Marketable securities

Account receivable

Inventory

Prepaid rent

Total current assets

Net Plant and equipment

Total assets

Account payable

Notes payable

Accruals

Total current liabilities

Long-term debt

Common stockholders' equity

Total liabilities and stockholders' equity

Sales

Less; Cost of goods sold

Gross profit

Less: General and administrative

Less: Interest

Less: Depreciation

Total operating and interest expense

Earning before tax

Less: tax

Net income

Less: cash dividend

Change in retained earnings

James Company

2015

15,000

6,000

42,000

51,000

1,200

115,200

286,000

401,200

48,000

15,000

6,000

69,000

160,000

172,200

401,200

2016

14,000

6,200

33,000

84,000

1,100

138,000

270,000

408,300

57,000

13,000

5,000

75,000

150,000

183,300

408,300

600.00

460.000

140.000

30.000

10.000

30.000

70.000

70.000

27.100

42.900

31.800

11.100

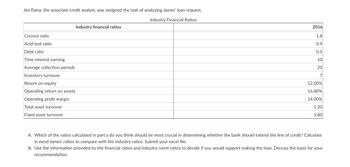

Transcribed Image Text:Jen Fama, the associate credit analyst, was assigned the task of analyzing James' loan request.

Industry Financial Ratios

Current ratio

Acid-test ratio

Debt ratio

Time interest earning

Average collection periods

Inventory turnover

Return on equity

Operating return on assets

Operating profit margin

Total asset turnover

Fixed asset turnover

Industry financial ratios

2016

1.8

0.9

0.5

10

20

7

12.00%

16.80%

14.00%

1.20

1.80

A. Which of the ratios calculated in part a do you think should be most crucial in determining whether the bank should extend the line of credit? Calculate

in excel James' ratios to compare with the industry ratios. Submit your excel file.

B. Use the information provided by the financial ratios and industry-norm ratios to decide if you would support making the loan. Discuss the basis for your

recommendation.

Expert Solution

arrow_forward

Introduction

Ratio analysis is a financial analysis technique that involves the use of ratios to evaluate the performance, liquidity, solvency, and efficiency of a company. Ratio analysis involves comparing two or more financial figures to gain insights into the financial health of a business. The ratios are derived from the financial statements of the company, such as the balance sheet and the income statement.

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- please help me answeer the following given Debt analysis Springfield Bank is evaluating Creek Enterprises, which has requested a $3,780,000 loan, to assess the firm's financial leverage and financial risk. On the basis of the debt ratios for Creek, along with the industr, averages and Creek's recent financial statements, evaluate and recommend appropriate action on the loan request. Industry averages Creek Enterprises Income Statement: Debt ratio 0 50 Times interest earned ratio 7.42 Fixed-payment coverage ratio 2.03 Creek Enterprises Balance Sheet: Creek Enterprises's debt ratio is _____ (Round to two decimal places.) Creek Enterprises's times interest earned ratio is ______ (Round to two decimal places.) Creek Enterprises's fixed-payment coverage ratio is. ______ (Round to two decimal places.) Complete the following summary of ratios and compare Creek Enterprises's ratios vs. the industry average: (Round to two decimal places.) Creek Debt ratio Industry 0.50 Times…arrow_forwardUse the attached information to complete the ratio analysis. The Ratio Analysis is for Liquidity, Solvency and Profitabilityarrow_forwardThe amount of Gross Loans is The following are real Iife data extracted from the Housing Bank financial statements. Use them to answer the questions. Additional Information: Accumulated Provislons for Loan Losses (end balance) 250; Number of Outstanding Shares 315,000,000 (315 MIllon) and share price JD9 (Balance Sheet (in Milion (Assets (JD Cash and Balances at Central Banks Balances at Banks and Financial institutions Deposits at Banks and Financial institutions Total Cash and Due trom Depository institutions Trading Investments Available for Sale Investments Held to Maturity Investments, Net Total Securitles 1,478 743 53 2,221 581 745 1,327 Investments in Affilates 2,369 Loans (or Credit Facilities), Net 93 Fixed Assets, Net 6. Doferred income Tax Assets Other Assets Total Asseta (Uabilitles (JD Customers Deposits Banks & Financial Institutions Deposits 71 6,090 4,430 284 Total Deposits Cash Margins 4,714 290arrow_forward

- What is the overall assement of the company's credit risk (explain)? Is there any difference between the two years?arrow_forwardCalculate the following ratios from the income statement and balance sheet all are required 1-Payables Turnover 2-Debt-Equity Ratio 3-Debt Ratio 4-Total Asset Turnover 5-Fixed Asset Turnover Statement of financial positionas at 31 December 2018 2018 2017 Note RO RO ASSETS Non-current assets Property, plant and equipment 14 8,407,572 9,300,442 Deferred tax assets 12 40,977 18,550 8,448,549 9,318,992 Current assets Inventories 15 430,885 422,421 Trade and other receivables 16 1,129,440 1,235,724 Due from related parties 24 70,300 73,050 Cash and bank balances 17 6,856,734 6,439,709 Total current assets 8,487,359 8,170,904 Total assets 16,935,908 17,489,896 EQUITY…arrow_forwardUsing the financial statements in the image, calculate the following ratios for both the FY 2017 and FY 2018: Current Ratio Quick Ratio Total Asset Turnover Average Collection Total Debt to Total Assets Times Interest Earned Net Profit Margin Return on Assets Return on Equity Modified Du Point Equation for FY 2018 PE Ratio Market to Book Ratioarrow_forward

- Given the following information, calculate for 2016 the number of days of working capital financing the firm will need to obtain from other sources? (i.e., show the calculations of the Days Outstanding (including embedded Turnover ratios) for each of Accounts Receivable, Inventory, and Accounts Payable, as well as the intermediate calculation of Purchases used to calculate Days Outstanding for Payables, and finally, the number of days of external working capital financing required.arrow_forwarda) Consider the financial ratios of ABK Bank and the average ratios of peer banks based on 2015 year-end data shown in the table below: Ratios ABK Bank Peer Banks Return on equity (ROE) 14.50% 7.40% Return on assets (ROA) Asset utilisation (AU) Expense ratio (ER) 1.68% 0.85% 6.65% 5.50% 4.95% 4.62% TAX 0.02% 0.03% Note that TAX = applicable income tax/total assets Compare and critically discuss the performance of ABK Bank and that of its peer banks. Conduct a return on equity decomposition analysis for ABK bank and the peer banks as part of your discussion. What are the possible limitations in your analysis?arrow_forwardI need assistance calculating ratios with the attached income statement and balance sheet: Fiscal 2017 Fiscal 2016 Gross margin, as reported 35.6% 35.2% Mark-to-market effects (0.1) (0.4) Restructuring costs 0.3 0.5 Project-related costs 0.3 0.3 Adjusted gross margin 36.1% 35.6% Calculate the following financial ratios for 2016 and 2017 4. Reutrn on assets (2015, total assets = $21,932.0 million) 5. Return on common stockholders' equity (2015, total stockholders' equity = $4996.7 million) 6. Current ratioarrow_forward

- Suppose the following information was taken from the 2017 financial statements of FedEx Corporation, a major global transportation/delivery company. (in millions) 2017 2016 Accounts receivable (gross) $ 3,302 $ 4,396 Accounts receivable (net) 3,273 4,367 Allowance for doubtful accounts 29 29 Sales revenue 32,226 39,472 Total current assets 6,758 6,532 Answer each of the following questions. (a) Calculate the accounts receivable turnover and the average collection period for 2017 for FedEx Corporation. (Round answers to 1 decimal place, e.g. 12.5. Use 365 days for calculation.)arrow_forwardYou have been asked by the CFO to analyze a prospective customer who has requested sales on credit. Use the financial statements for TechnoTCL, Inc Download financial statements for TechnoTCL, Inc to calculate the attached ratios and complete the assignment. Prepare a brief presentation (maximum of 4 slides) to the CFO including the calculations and 2-3 sentences interpreting each ratio. Slide One: Calculate and interpret the following debt ratios: debt ratio, debt-equity ratio, and times interest earned for all three years. Slide Two: Analyze one of the debt ratios including why the ratio is used and what the actual results for TechnoTCL might indicate. Slide Three: Calculate and interpret the following profitability ratios: operating profit margin, net profit margin, return on assets, and return on equity for all three years. Slide Four: Analyze one of the profitability ratios including why the ratio is used and what the actual results for TechnoTCL might indicate. echnoTCL,…arrow_forwardThe table below provides selected financial data for the Vogon Construction Co. in Years t and t-1. Interest Expense Short-Term Debt Long-Term Debt Total Liabilities Selected Financial Information Vogon Construction Co. Year t-1 Year t 32.4 12.6 61.0 67.1 140.0 461.0 35.3 388.4 What interest rate (on average) does the company pay on its borrowed funds? Express your answer in percentage form rounded to one decimal place.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education