Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Module 6 Question 3

Webb Solutions, Inc. has the following financial structure:

Accounts payable $500,000

Short-term debt $250,000

Current liabilities $750,000

Long-term debt $750,000

Shareholders' equity $500,000

Total $2,000,000.

Short-term debt $250,000

Current liabilities $750,000

Long-term debt $750,000

Shareholders' equity $500,000

Total $2,000,000.

a. Compute Webb's debt ratio and interest-bearing debt ratio.

b. If the market value of Webb's equity is $2,000,000 and the value of the firm's debt is equal to its book value, assuming excess cash is zero, what is the debt-to-enterprise-value ratio for Webb?

c. If you were a bank loan officer who was analyzing whether or not to loan more money to Webb, which of the ratios calculated in parts a and b is most relevant to your analysis?

a. What is Webb's debt ratio?

Expert Solution

arrow_forward

Step 1

The mathematical relationship between two variables is called a ratio. Most often, investors employed ratio analysis to evaluate a company's financial performance before making an investment decision.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 3 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

If you were a bank loan officer who was analyzing whether or not to loan more money to Webb, which of the ratios calculated in parts a and b is most relevant to your analysis? (Select the best choice below.)

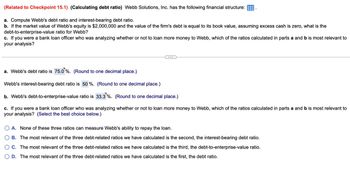

Transcribed Image Text:(Related to Checkpoint 15.1) (Calculating debt ratio) Webb Solutions, Inc. has the following financial structure:

a. Compute Webb's debt ratio and interest-bearing debt ratio.

b. If the market value of Webb's equity is $2,000,000 and the value of the firm's debt is equal to its book value, assuming excess cash is zero, what is the

debt-to-enterprise-value ratio for Webb?

c. If you were a bank loan officer who was analyzing whether or not to loan more money to Webb, which of the ratios calculated in parts a and b is most relevant to

your analysis?

a. Webb's debt ratio is 75.0%. (Round to one decimal place.)

Webb's interest-bearing debt ratio is 50%. (Round to one decimal place.)

b. Webb's debt-to-enterprise-value ratio is 33.3%. (Round to one decimal place.)

c. If you were a bank loan officer who was analyzing whether or not to loan more money to Webb, which of the ratios calculated in parts a and b is most relevant to

your analysis? (Select the best choice below.)

A. None of these three ratios can measure Webb's ability to repay the loan.

B. The most relevant of the three debt-related ratios we have calculated is the second, the interest-bearing debt ratio.

C. The most relevant of the three debt-related ratios we have calculated is the third, the debt-to-enterprise-value ratio.

D. The most relevant of the three debt-related ratios we have calculated is the first, the debt ratio.

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

If you were a bank loan officer who was analyzing whether or not to loan more money to Webb, which of the ratios calculated in parts a and b is most relevant to your analysis? (Select the best choice below.)

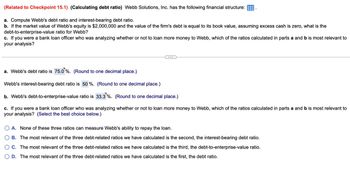

Transcribed Image Text:(Related to Checkpoint 15.1) (Calculating debt ratio) Webb Solutions, Inc. has the following financial structure:

a. Compute Webb's debt ratio and interest-bearing debt ratio.

b. If the market value of Webb's equity is $2,000,000 and the value of the firm's debt is equal to its book value, assuming excess cash is zero, what is the

debt-to-enterprise-value ratio for Webb?

c. If you were a bank loan officer who was analyzing whether or not to loan more money to Webb, which of the ratios calculated in parts a and b is most relevant to

your analysis?

a. Webb's debt ratio is 75.0%. (Round to one decimal place.)

Webb's interest-bearing debt ratio is 50%. (Round to one decimal place.)

b. Webb's debt-to-enterprise-value ratio is 33.3%. (Round to one decimal place.)

c. If you were a bank loan officer who was analyzing whether or not to loan more money to Webb, which of the ratios calculated in parts a and b is most relevant to

your analysis? (Select the best choice below.)

A. None of these three ratios can measure Webb's ability to repay the loan.

B. The most relevant of the three debt-related ratios we have calculated is the second, the interest-bearing debt ratio.

C. The most relevant of the three debt-related ratios we have calculated is the third, the debt-to-enterprise-value ratio.

D. The most relevant of the three debt-related ratios we have calculated is the first, the debt ratio.

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 1 2 Debt Ratio (current) 3 Equity Ratio (current) 4 Cost of Debt 5 Market Risk Premium 6 Equity Beta 7 Debt Beta 8 Risk Free Rate 9 Corporate Tax Rate 10 11 12 a. Cost of Equity 13 b. WACC 14 c. 15 Unlvered beta 16 Debt to Equity Ratio 17 Debt to Equity Beta 18 Cost of Equity 19 Debt to Ratio Given 20 Equity Ratio 21 Revised WACC 22 Solution 30.00% 70.00% 6.00% 5.25% 1.20% 0.29 4.50% 35.00% 40%arrow_forwardPlease do not give solution in image format thankuarrow_forwardMiracle Bank's balance sheet is the following. Assets Reserves Loans Short-term securities a. 70 Miracle Bank's leverage ratio is Ob. 0.0857 c. 8.57 Miracle Bank Od. 80 Liabilities & Owners' Equity $600 Deposits 6,400 Debt 1000 Capital (owners' equity) $7,000 990 10arrow_forward

- RATIO ANALYSIS. Debt Ratio Activity 6 · Understand the information provided by the debt ratio. · Identify the expected range and whether an increasing or decreasing trend is preferred. Purpose: The debt ratio compares total liabilities to total assets. This ratio measures the proportion of assets financed by debt. It is a measure of long-term solvency. Total liabilities DEBT RATI0 = Total assets JOHNSON & CITIGROUP 12/31/99 HEWLETT- PACKARD 10/3 1/99 JOHNSON 1/03/99 WAL-MART 1/31/99 ($ in 000s) Assets $716,937,000 $35,297,000 $26,211,000 $49,996,000 Liabilities 667,251,000 17,002,000 12,621.000 28,884,000 Stockholders' Equity $ 49,686,000 $18,295,000 $13,590,000 $21,112,000 Source: Disclosure, Inc, Compact D/SEC, 2000. 1. For each-company listed above, compute the debt ratio. Record your results below. Debt ratio: 0.93 2. The debt ratios computed above are primarily in the ranġe (less than 0,40 / 0.40 through 0.70 / over 0.70): 3. % of Wal-Mart's assets are financed by debt. 4.…arrow_forward10arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education