FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:+

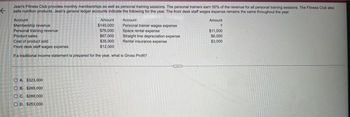

Jean's Fitness Club provides monthly memberships as well as personal training sessions. The personal trainers earn 50% of the revenue for all personal training sessions. The Fitness Club also-

sels nutrition products. Jean's general ledger accounts indicate the following for the year. The front desk staff wages expense remains the same throughout the year

Amount

2

$11,000

$6,000

$3,000

Account

Membership revenue

Personal training revenue

Product sales

Amount

$145,000

$76,000

$67.000

$35,000

$12,000

OA $323,000

OB. $285,000

OC. $288,000

OD. $253,000

Account

Personal trainer wages expense

Space rental expense

Straight line depreciation expense

Rental insurance expense

Cost of product sold

Front desk staff wages expense

If a traditional income statement is prepared for the year, what is Gross Profit?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 1.Jill is paid a yearly salary of $90,000. How does she make per month? 2. A salesman is paid a 6% commission on his net sales. Find his gross wages for the past month if his gross sales totaled $91,568 and he had $5,568 of returns and allowances. 3. A salesman receives a salary of $500 per week plus an 8% commission on all sales in excess of $1,800. What were his wages last week, if gross sales totaled $18,714 and returns were $5,714? Group of answer choices A.$1,481.12 B.$1,981.12 C.$1,040 D.$1,396 4. An auctioneer earns a commission on the total value of the property he sells. If he earns $2,700 on the sale of $18,000 worth of property, at what percentage rate is he paid? Group of answer choices A.0.15% B.15% C.1.5% D.1 1/2% 5. A computer programmer, who is covered by the Fair Labor Standards Act, is paid a salary of $1,260 a week for a normal work week of 35 hours. If she works 42 hours in a week, her gross pay for the week would be Group…arrow_forwardPaul's Pool Service provides pool cleaning, chemical application, and pool repairs for residential customers. Clients are billed weekly for services provided and usually pay 50 percent of their fees in the month the service is provided. In the month following service, Paul collects 40 percent of service fees. The final 10 percent is collected in the second month following service. Paul purchases his supplies on credit and pays 50 percent in the month of purchase and the remaining 50 percent in the month following purchase. Of the supplies Paul purchases, 85 percent is used in the month of purchase, and the remainder is used in the month following purchase. The following information is available for the months of June, July, and August, which are Paul's busiest months: ⚫ June 1 cash balance $16,000. ⚫ June 1 supplies on hand $4,400. ⚫ June 1 accounts receivable $9,100. • June 1 accounts payable $4,300. • Estimated sales for June, July, and August are $27,300, $41,000, and $43,900,…arrow_forwardOver the winter months, Pharoah Co. pre-sells fertilizing and weed control lawn services to be performed from May through September, inclusive. If payment is made in full by April 1, a 5% discount is allowed. In March, 275 customers took advantage of the discount and purchased the summer lawn service package for $760 each. In June, 225 customers purchased the package for $800, and in July, 84 purchased it for the same price. For customers who pay after May 1, service starts in the month the customer makes the payment. How much revenue should be recognized by the Pharoah Co. in each of the months of March, April, May, June, July, August, and September? (Round answers to 0 decimal places, e.g. 5,275. Do not leave any answer field blank. Enter O for amounts.) March $ April $ May $ June $ July August September $arrow_forward

- Don, an office equipment sales representative, earns a weekly salary plus a commission on his sales. One week his total compensation on sales of $8000 was $600. The next week his total compensation on sales of $9000 was $650. Find Don's weekly salary and his commission rate. Don's commission rate is 7%. sk my instructor Q 4 G PROTEIN Clear all Check answer TUF GAMINarrow_forwardKashi Sales, L.L.C., produces healthy, whole-grain foods such as breakfast cereals, frozen dinners, and granola bars. Assume payroll for the month of January was $500,000 and the following withholdings, fringe benefits, and payroll taxes apply:Federal and state income tax withheld $135,000Health insurance premiums (Blue Cross) paid by employer 13,000Contribution to retirement plan (Fidelity) paid by employer 60,000FICA tax rate (Social Security and Medicare) 7.65%Federal and state unemployment tax rate 6.20%Assume that Kashi has paid none of the withholdings or payroll taxes by the end of January (record them as payables), and no employee’s cumulative wages exceed the relevant wage bases.Required:1. Record the employee salary expense, withholdings, and salaries payable.2. Record the employer-provided fringe benefits.3. Record the employer payroll taxes.arrow_forwardRoyall Company purchased a delivery truck at $25,000 plus 8% sales taxes. Royall paid $3,000 in cash and financed the rest at 6% requiring 40 equal monthly payments at the end of each month. Compute the amount of the monthly payment that Royall must pay.arrow_forward

- Paul’s Pool Service provides pool cleaning, chemical application, and pool repairs for residential customers. Clients are billed weekly for services provided and usually pay 50 percent of their fees in the month the service is provided. In the month following service, Paul collects 40 percent of service fees. The final 10 percent is collected in the second month following service. Paul purchases his supplies on credit and pays 50 percent in the month of purchase and the remaining 50 percent in the month following purchase. Of the supplies Paul purchases, 85 percent is used in the month of purchase, and the remainder is used in the month following purchase. The following information is available for the months of June, July, and August, which are Paul’s busiest months: June 1 cash balance $16,000. June 1 supplies on hand $4,400. June 1 accounts receivable $9,100. June 1 accounts payable $4,300. Estimated sales for June, July, and August are $27,300, $41,000, and $43,900, respectively.…arrow_forwardPlease provide working also i post this 3rd timearrow_forwardPaul's Pool Service provides pool cleaning, chemical application, and pool repairs for residential customers. Clients are billed weekly for services provided and usually pay 40 percent of their fees in the month the service is provided. In the month following service, Paul collects 50 percent of service fees. The final 10 percent is collected in the second month following service. Paul purchases his supplies on credit, and pays 50 percent in the month of purchase and the remaining 50 percent in the month following purchase. Of the supplies Paul purchases, 70 percent is used in the month of purchase, and the remainder is used in the month following purchase. The following information is available for the months of June, July, and August, which are Paul's busiest months: June 1 cash balance $16,700. June 1 supplies on hand $4,500. June 1 accounts receivable $9,400. • June 1 accounts payable $4,400. • Estimated sales for June, July, and August are $28,200, $42,300, and $45,000,…arrow_forward

- Service Industry AccountingThe Spectrum Fitness Club charges a nonrefundable annual membership fee of $1,200 for its services. For this fee, each member received a fitness evaluation (value $200), a monthly magazine (annual value $25), and two hours’ use of the equipment each week (annual value $1,100). Each of the three elements of the annual membership can be purchased separately. The initial direct costs to obtain the membership are $180. The direct cost of the fitness evaluation is $100, and the monthly direct costs to provide the other services are estimated to be $25 per person. Give the journal entries to record the transactions in 2019 relative to a membership sold on May 1, 2019.arrow_forwardPlease allarrow_forward11. The sales clerks of Teresa's Treasures are paid a salary of $225 per week plus a commission of 8% on all sales they make. Find the amount of commission and gross earnings for these employees. (Round your answers to 2 decimal places. Omit the "$" sign in your response.) Sales for the Week Name Commission Gross Earnings Tina Valendez $2,392.50 $4 Jan Yarrow $3,480.75 2$ $4arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education