Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

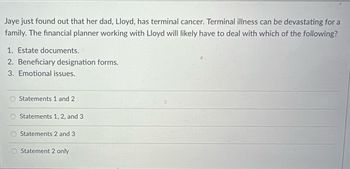

Transcribed Image Text:Jaye just found out that her dad, Lloyd, has terminal cancer. Terminal illness can be devastating for a

family. The financial planner working with Lloyd will likely have to deal with which of the following?

1. Estate documents.

2. Beneficiary designation forms.

3. Emotional issues.

Statements 1 and 2

Statements 1, 2, and 3

Statements 2 and 3

Statement 2 only

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Problem 19-36 (LO. 7) At the time of her death, Ariana held the following assets. Personal residence (title listed as "Ariana and Peter, tenants by the entirety with right of survivorship") Savings account (listed as "Ariana and Rex, joint tenants with right of survivorship") with funds provided by Rex Certificate of deposit (listed as "Ariana, payable on proof of death to Rex") with funds provided by Ariana Unimproved real estate (title listed as "Ariana and Rex, equal tenants in common") Insurance policy on Ariana's life, issued by Lavender Company (Ariana's estate is the designated beneficiary) Insurance policy on Ariana's life, Issued by Crimson Company (Rex is the designated beneficiary, but Ariana can change beneficiaries) Fair Market Value $900,000 40,000 100,000 500,000 300,000 400,000 Assuming that Peter and Rex survive Ariana, how much is included in Ariana's probate estate? Ariana's gross estate? (Refer to text Section 18-3a as needed.) Ariana's probate estate includes $…arrow_forward6 Stella and Josh are young parents of two children, aged 1and 3 Stella is employed as a senior manager at a company where she is covered under a group i up his job to look after the children and is not covered under any insurance plan. The couple meets with an insurance agent to discuss their options to cover for child the event of Josh's disability. Which of the following recommendations is the agent likely to provide?arrow_forwardProblem 10-9 (LO10.1) Using the "nonworking" spouse method, what should be the life insurance needs for a family whose youngest child is 5 years old? Insurance needarrow_forward

- 8arrow_forwardPersonally Established Retirement Accounts These days, almost anyone can open personal, tax-sheltered retirement accounts whether or not they're enrolled in a plan at work. Terms and provisions vary among plans, so it pays to do some homework before deciding which is best for your circumstances and goals. To help you focus on the aspects of different plans, answer the following questions. Madeline is a sole proprietor. She wants to create a retirement plan that requires the least amount of setup and maintenance effort. What type of plan is Madeline most likely going to open? SEP-IRA О Кеogh Chun is a small-business owner. She wants to create a profit-sharing or money-purchase retirement plan. What type of plan is Chun most likely going to open? SEP-IRA О Кеogh Alison is 58 years old and opened a traditional IRA when she was 53. Alison earns less than $100,000 per year. Her contribution for this year is $7,000. This contribution is made entirely with: pretax dollars. O after-tax…arrow_forwardHi! Can you help me solve with the attached image. Thank you!arrow_forward

- ! 2 ed ok t Required information [The following information applies to the questions displayed below.] Tom Hruise was an entertainment executive who had a fatal accident on a film set. Tom's will directed his executor to distribute his cash and stock to his spouse, Kaffie, and the real estate to a church, The First Church of Methodology. The remainder of Tom's assets were to be placed in trust for three children. Tom's estate consisted of the following: Assets: Personal assets Cash and stock Intangible assets (film rights) Real estate Liabilities: Mortgage Other liabilities $ 1,040,000 24,200,000 72,500,000 15,200,000 $ 112,940,000 $ 3,400,000 4,300,000 $ 7,700,000 ces a. Tom made a taxable gift of $5.30 million in 2011. Compute the estate tax for Tom's estate. (Refer to Exhibit 25-1 and Exhibit 25-2.) Note: Enter your answers in dollars, not millions of dollars. Estate Tax Duearrow_forwardJimmy recently graduated from medical school and is working for a hospital system. He is not worried about his medical school debt because it is relatively low compared to his income, but he would like to begin saving and investing for his children's college education, his retirement, and the purchase of a family home. He is also concerned about protecting his family financially if something were to happen to him. Which of the following financial professionals would be the best option for Jimmy? Question 8 options: Stockbroker. Insurance agent. Certified Financial Planner® Accredited Financial Counselor.arrow_forwardIsis quit her job at A Corp. While at A Corp., Isis was enrolled in their group health insurance plan. Now, Isis works for C Corp., which also has a group insurance plan. According to the Health Insurance Portability and Accountability Act, C Corp. must ______. a. pay A Corp. so that Isis can maintain her health insurance through A Corp b. wait to enroll Isis in C Corp.'s plan until she has been employed with the company for 1 year c. reimburse Isis for any out-of-pocket expenses she incurred while unemployed d. allow her to participate in the company group health insurance planarrow_forward

- Please Explain Proper Step by Step and Do Not Give Solution In Image Format And Fast Answering Please & Thanks In Advance ?arrow_forwardDengararrow_forwardRequired information Skip to question [The following information applies to the questions displayed below.] Tom Hruise was an entertainment executive who had a fatal accident on a film set. Tom's will directed his executor to distribute his cash and stock to his spouse, Kaffie, and the real estate to a church, The First Church of Methodology. The remainder of Tom's assets were to be placed in trust for three children. Tom's estate consisted of the following: Assets: Personal assets $ 1,020,000 Cash and stock 25,900,000 Intangible assets (film rights) 81,000,000 Real estate 16,900,000 $ 124,820,000 Liabilities: Mortgage $ 5,100,000 Other liabilities 6,000,000 $ 11,100,000 a. Tom made a taxable gift of $7.00 million in 2011. Compute the estate tax for Tom's estate. (Refer to Exhibit 25-1 and Exhibit 25-2.) Note: Enter your answers in dollars, not millions of dollars.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education