Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

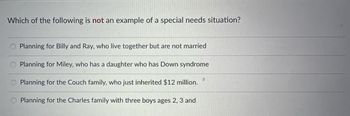

Transcribed Image Text:Which of the following is not an example of a special needs situation?

Planning for Billy and Ray, who live together but are not married

Planning for Miley, who has a daughter who has Down syndrome

Planning for the Couch family, who just inherited $12 million.

Planning for the Charles family with three boys ages 2, 3 and

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Tim and Allison are married and have two children, ages 8 and 13. Allison is a "nonworking" spouse who devotes all of her time to household activities. Estimate how much life insurance Tim and Allison should carry to cover Allison. Life insurance needarrow_forwardSusan and Raphael Galego have completed Step 1 of their needs analysis worksheet and determined that they need $3,522,000 to maintain the projected lifestyle of Raphael (age 41) and their two children (ages 7 and 11) in the event of Susan’s (the primary earner’s) death. The Galegos also have certain financial resources available after Susan’s death, however, so their life insurance needs are lower than this amount. If Susan dies, Raphael will be eligible to receive Social Security survivors’ benefits—approximately $3,500 a month ($42,000 a year) until the youngest child graduates from high school in 9 years. After the children leave home, Raphael will be able to work full-time and earn an estimated $52,000 a year (after taxes) until he retires at age 65. After Raphael turns 65, he’ll receive approximately $3,100 a month ($37,200 a year) from his own Social Security and retirement benefits. The life expectancy for a man within Raphael’s demographic is 80. The couple has also saved…arrow_forwardAnthony and Amy expect to settle down and purchase a home now that Anthony has a stable job with a solid long- term growth company. They are meeting with their loan officer to determine which mortgage would best suit their needs. Amy is a stay-at-home mom raising their two school-age children. She sometimes provides child care services for her immediate family members. Neither Anthony nor Amy have served in the military, Anthony and Amy want to secure a mortgage that offers the lowest monthly payment with a fixed interest rate. Based on this information, which mortgage would be the most appropriate choice?\\n\\nA)\\nAdjustable-rate mortgage\\nB)\\n30-year conventional mortgage\\nC)\\n15-year conventional mortgage\\nD)\\nVA mortgagearrow_forward

- Emma Emerson is a proud woman with a problem. Her daughter has been accepted into a prestigious law school. While Ms. Emerson beams with pride, she is worried sick about how to pay for the school; she is a single parent who has worked hard to support herself and her three children. She had to go heavily into debt to finance her own education. Even though she now has a good job, family needs have continued to outpace her income and her debt burden is staggering. She knows she will be unable to borrow the money needed for her daughter's law school. Ms. Emerson is the chief financial officer (CFO) of a small manufacturing company. She has just accepted a new job offer. Indeed, she has not yet told her employer that she will be leaving in a month. She is concerned that her year-end incentive bonus may be affected if her boss learns of her plans to leave. She plans to inform the company immediately after receiving the bonus. She knows her behavior is less than honorable, but she believes…arrow_forwardSven was recently quoted on a disability policy with an any occupation definition of disability. Sven does want to buy disability coverage, however, the premium was more than he was willing to pay. Sven has some savings built up as an emergency fund and manages his cash flow quite well, so he knows what premium he can afford without impacting his standard of living. What change could Sven consider that would reduce his premium but allow for coverage to continue to meet his objective? a) He could increase the elimination period of the policy b) He could increase the length of his benefit period. c) He could change the definition to own occupation. d) He could decrease the waiting period.arrow_forward6 Stella and Josh are young parents of two children, aged 1and 3 Stella is employed as a senior manager at a company where she is covered under a group i up his job to look after the children and is not covered under any insurance plan. The couple meets with an insurance agent to discuss their options to cover for child the event of Josh's disability. Which of the following recommendations is the agent likely to provide?arrow_forward

- 8arrow_forward6. In relation to the Income of Minors, which of the following is a prescribed person under ITAA36 Div. 6AA:Select one:a. Lulu who is permanently disabled and aged 16b. Carl who is married and is 17 years oldc. Nine-year-old Lucy whose parents are entitled to a carer allowanced. Ten-year-old Franke whose guardians are entitled to a double orphan pensionarrow_forward(Case Study Question) Henry's oldest son has few financial resources. Henry would like to contribute annually to a trust, with his son only receiving the trust income. The remainder of the trust would go to his grandchildren (his son's children) at his son's death. Henry wants his son to receive all the earnings from the trust with no restrictions. He realizes that his son will likely squander trust income he receives but wants to otherwise protect his son from his creditors. Which of the following trusts would you recommend that Henry establish for the benefit of his son? A) An irrevocable trust, including spendthrift provisions B) A support trust C) A Section 2503(b) trustarrow_forward

- Ma 1. Amanda is in her 70s, is in good health, and lives in a large house in a rural area. Amanda asks Bridget, the granddaughter of a close friend, to live in the house with her. Amanda does not need nursing care, but wants someone for companionship and to help with housework and repairs. Amanda promises to transfer the house to Bridget if she will live with her for five years. Bridget does so and continues to work full-time in a nearby town. Amanda transfers title in the house to Bridget. What are the gift tax consequences, if any, to Amanda?arrow_forwardJimmy recently graduated from medical school and is working for a hospital system. He is not worried about his medical school debt because it is relatively low compared to his income, but he would like to begin saving and investing for his children's college education, his retirement, and the purchase of a family home. He is also concerned about protecting his family financially if something were to happen to him. Which of the following financial professionals would be the best option for Jimmy? Question 8 options: Stockbroker. Insurance agent. Certified Financial Planner® Accredited Financial Counselor.arrow_forwardJulia Rivera lives with her two sons, ages 6 and 9. They have had difficulty managing their finances. What purposes could a budget serve for the Riveras? What actions would you suggest for the budgeting process to be successful?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education