FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

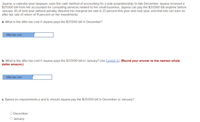

Transcribed Image Text:Jayana, a calendar-year taxpayer, uses the cash method of accounting for a sole proprietorship. In late December Jayana received a

$37,000 bill from her accountant for consulting services related to her small business. Jayana can pay the $37,000 bill anytime before

January 30 of next year without penalty. Assume her marginal tax rate is 37 percent this year and next year, and that she can earn an

after-tax rate of return of 11 percent on her investments.

a. What is the after-tax cost if Jayana pays the $37,000 bill in December?

After-tax cost

b. What is the after-tax cost if Jayana pays the $37,000 bill in January? Use Exhibit 3.1. (Round your answer to the nearest whole

dollar amount.)

After-tax cost

c. Based on requirements a and b, should Jayana pay the $37,000 bill in December or January?

O December

O January

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Frankie lives in NJ, is divorced with one child, and made $80,000 last year. He qualified for several below the line, itemizable deductions (He paid $5,600 in mortgage interest, $9,500 in property taxes, and he donated $550 worth to charity during the year). Frankie can claim one child tax credit of $2,000. His ex-spouse agreed that he can claim head of household this year. Use the Income Tax Table Reference Sheet to answer the following questions. 1. Should Frankie itemize his taxes or take the standard deduction? * A. Itemize B. Standard Please answer very soon will give rating surelyarrow_forwardTin rents her beach house for 60 days and uses it for personal use for 30 days during the year. The rental income is $6,000 and the expenses are as follows: Mortgage interest $9,000 Real estate taxes 3,000 Utilities 2,000 Maintenance 1,000 Insurance 500 Depreciation (rental part) 4,000 Using the IRS approach, total expenses that Tin can deduct on her tax return associated with the beach house are: a.$6,000. b.$0. c.$8,000. d.$12,000.arrow_forwardOn November 1 of this year, Jaxon borrowed $42,000 from Bucksnort Savings and Loan for use in his business. In December, Jaxon paid interest of $3,780 relating to the 12-month period from November of this year through October of next year. How much interest, if any, can Jaxon deduct this year if his business uses the cash method of accounting for tax purposes?arrow_forward

- Carrie, a single taxpayer, finished her undergraduate degree using money from a student loan. She earned $56,000 her first year and paid $2,600 in interest in 2021. She can take a deduction for student loan interest in the amount of: a.$0 b.$2,500 c.$2,600 d.$1,500 e.None of these choices are correctarrow_forwardBruce and Amanda are married during the tax year. Bruce is a botanist at Green Corporation. Bruce earns a salary of $56,000 per year. Green Corporation has an accountable reimbursement plan. During the year, Bruce has $5,000 of employee expenses. Green Corporation reimburses Bruce for only $4,000 of expenses.Bruce decides to put $5,500 into a Traditional IRA. Amanda owns a financial consulting firm as a sole proprietor (it qualifies as a full trade or business). Amanda generates $80,000 of revenues during the year. She has the following business payments associated with her firm:● Utilities: $2,000● Office Rent: $14,000● Self-Employment Tax: $5,000● Salary for her secretary: $20,000● Fines/Penalties: $8,000● Payroll Taxes (Employer Portion): $1,000● Business Meals: $2,000● Bribe to police officer to forgive parking violation $1,500Due to the income and expenses above, Amanda has $39,500 of Qualified Business Income. Also, during the year a tornado damaged the roof of their personal…arrow_forwardKimberly is a self-employed taxpayer. She recently spent $3,300 for airfare to travel to Italy. What amount of the airfare is deductible in each of the following alternative scenarios? (Leave no answers blank. Enter zero if applicable.) c. On the trip, she spent seven days on business activities and three day(s) on personal activities. Deductible amountarrow_forward

- In April of this year Rachel received a $1,780 refund of state income taxes that she paid last year. Last year Rachel claimed itemized deductions of $12,400. Rachel's itemized deductions included state income taxes paid of $850. How much of the refund, if any, must Rachel include in the gross income if the standard deduction last year was $12,000?arrow_forwardElla bought a residential investment property in Cleveland for $200,000. Five years later she spent $250,000 on renovations and then sold the property for $1,200,000. The tax code required Ella to pay a capital gain tax of 15% on her net profit (net profit = sale price - purchase price - renovation costs). If the inflation rate for the past 5 years has been 5% annually, compute the after-tax real rate of return on Ella's investment. Choose your final answer from below while still showing your work. A. 33.17% B. 28.13% C. 26.83% D. 31.84%arrow_forwardLana Long, age 32, chief executive officer of News America borrows $100,000 from her employer as a bridge loan. Assume that the applicable federal rate for year one of the loan is 6 per cent, but that American only charges 2 percent. What are the likely tax consequences for Lana? Explain.arrow_forward

- Arabella Cunningham is 24 years old and single, lives in an apartment, and has no dependents. Last year she earned $55,000 as a sales representative forPlanning Associates; $3,910 of her wages was withheld for federal income taxes. In addition, she had interest income of $142. She takes the standard deduction. Calculate her taxable income, tax liability, and tax refund or taxowed for 2018.arrow_forwardDuring the current year, Kristina, a single taxpayer with no dependents, has a salary of $130,000. She has the following income and (losses) from passive activities in 2021: Rental House ($28,850) Restaurant ( 3,900) Golf Course 7,800 Kristina has suspended loss carryforwards into 2021 of ($2,500) on the rental house and ($11,400) on the restaurant. She has a gain of $6,700 from selling the restaurant in 2021. She actively manages the rental house and is the sole owner. 1. What is Kristina's AGI in 2021? 2. What, if any, are Kristina's suspended loss carryforwards by activity? If she does not have any, explain why. 3. Assume Kristina has no deductions For AGI, no qualified business income, and takes the standard deduction; what is her federal income tax liability for 2021?arrow_forwardKaren is single. Last year she earned $37,300 in wages. Additional tax information for the year is as follows: interest earned: $135; capital gains from sale of stock: $1,650; penalty on early withdrawal of savings: $400; contributions to Keogh retirement fund: $1,800; real estate taxes paid: $3,000; mortgage interest paid: $3,500. The following table gives the standard deduction for various filing statuses. Standard Deductions Single or married filing separately $12,000 Married filing jointly or surviving spouse $24,000 Head of household $18,000 65 or older and/or blindand/or someone else canclaim you (or your spouseif filing jointly) as a dependent: Varies(See www.irs.gov for information.) Find the taxable income for the year.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education