Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

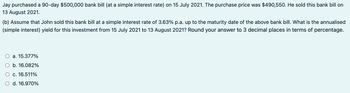

Transcribed Image Text:Jay purchased a 90-day $500,000 bank bill (at a simple interest rate) on 15 July 2021. The purchase price was $490,550. He sold this bank bill on

13 August 2021.

(b) Assume that John sold this bank bill at a simple interest rate of 3.63% p.a. up to the maturity date of the above bank bill. What is the annualised

(simple interest) yield for this investment from 15 July 2021 to 13 August 2021? Round your answer to 3 decimal places in terms of percentage.

O a. 15.377%

O b. 16.082%

O c. 16.511%

O d. 16.970%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 1 steps

Knowledge Booster

Similar questions

- Joshua borrowed $500 on January 1, 2021, and paid $30 in interest. The bank charged him a service charge of $21. He paid it all back at once on December 31, 2021. What was the APR? (Enter your answer as a percent rounded to 1 decimal place.) APR %arrow_forwardCheyenne Corp. borrowed $1080000 from National Bank on May 31, 2019. The 3-year, 7% note required annual payments of $411536 beginning May 31, 2020. The total amount of interest to be paid over the life of the loan is O $75600. O $154608. O $301688. O $226800.arrow_forwardB10.arrow_forward

- On 1 January 2019, Azzurri Berhad sold a stock item with a cost of RM50,000 to Mancini Berhad. The terms of the sale include a five-yearly instalment of RM15,000, each payable at the end of every year. The cash selling price of the stock is RM60,000. An effective interest rate of 7.931% should be used in any calculations With reference to relevant Malaysian Financial Reporting Standards (MFRS), prepare the respective journal entries for the years ended 31 December 2019 and 31 December 2020arrow_forwardCrane Company issues a 12%, 5-year mortgage note on January 1, 2025, to obtain financing for new equipment. Land is used as collateral for the note. The terms provide for semiannual installment payments of $47,300. Click here to view the factor table What are the cash proceeds received from the issuance of the note? (For calculation purposes, use 5 decimal places as displayed in the factor table provided. Round answer to 2 decimal places, e.g. 25.25.) Crane Company should receive $arrow_forwardohn purchased a 150-day $500,000 bank bill (at a simple interest rate) on 15 July 2021. The purchase price was $490,550. He sold this bank bill on 13 August 2021. (b) Assume that John sold this bank bill at a simple interest rate of 3.17% p.a. up to the maturity date of the above bank bill. What is the annualised (simple interest) yield for this investment from 15 July 2021 to 13 August 2021? Round your answer to 3 decimal places in terms of percentage. a. 9.924% b. 10.905% c. 11.182% d. 10.647%arrow_forward

- On January 1, 2020, Ann Price loaned $157773 to Joe Kiger. A zero-interest-bearing note (face amount, $210000) was exchanged solely for cash; no other rights or privileges were exchanged. The note is to be repaid on December 31, 2022. The prevailing rate of interest for a loan of this type is 10%. The present value of $210000 at 10% for three years is $157773. What amount of interest income should Ms. Price recognize in 2020? $44350. $63000. $15777. $21000.arrow_forwardOn January 1, 2023, Karen Hong lent $64612 to Ben Bachu. A zero-interest-bearing note (face amount, $86000) was exchanged solely for cash; no other rights or privileges were exchanged. The note is to be repaid on December 31, 2025. The market rate of interest for a loan of this type is 10%. To the nearest dollar, and using the effective interest method, how much interest revenue should Ms. Hong recognize in 2023? $19383 $6461 $25800 ○ $8600arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education