FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

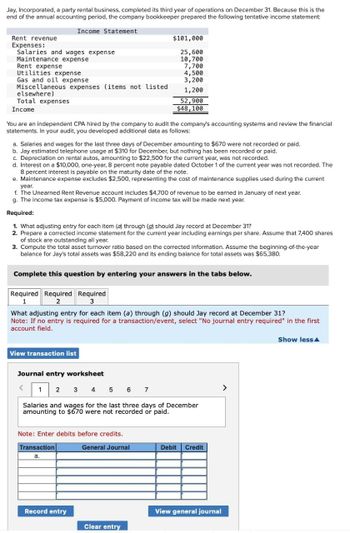

Transcribed Image Text:Jay, Incorporated, a party rental business, completed its third year of operations on December 31. Because this is the

end of the annual accounting period, the company bookkeeper prepared the following tentative income statement:

Rent revenue

Income Statement

$101,000

Expenses:

Salaries and wages expense

25,600

Maintenance expense

10,700

Rent expense

7,700

Utilities expense

4,500

Gas and oil expense

3,200

Miscellaneous expenses (items not listed

1,200

elsewhere)

Total expenses

Income

52,900

$48,100

You are an independent CPA hired by the company to audit the company's accounting systems and review the financial

statements. In your audit, you developed additional data as follows:

a. Salaries and wages for the last three days of December amounting to $670 were not recorded or paid.

b. Jay estimated telephone usage at $310 for December, but nothing has been recorded or paid.

c. Depreciation on rental autos, amounting to $22,500 for the current year, was not recorded.

d. Interest on a $10,000, one-year, 8 percent note payable dated October 1 of the current year was not recorded. The

8 percent interest is payable on the maturity date of the note.

e. Maintenance expense excludes $2,500, representing the cost of maintenance supplies used during the current

year.

f. The Unearned Rent Revenue account includes $4,700 of revenue to be earned in January of next year.

g. The income tax expense is $5,000. Payment of income tax will be made next year.

Required:

1. What adjusting entry for each item (a) through (g) should Jay record at December 31?

2. Prepare a corrected income statement for the current year including earnings per share. Assume that 7,400 shares

of stock are outstanding all year.

3. Compute the total asset turnover ratio based on the corrected information. Assume the beginning-of-the-year

balance for Jay's total assets was $58,220 and its ending balance for total assets was $65,380.

Complete this question by entering your answers in the tabs below.

Required Required Required

1

2

3

What adjusting entry for each item (a) through (g) should Jay record at December 31?

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first

account field.

View transaction list

Journal entry worksheet

1

2

34567

Salaries and wages for the last three days of December

amounting to $670 were not recorded or paid.

Note: Enter debits before credits.

Transaction

a.

General Journal

Debit

Credit

Record entry

View general journal

Clear entry

>

Show less▲

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following monthly data are taken from Ramirez Company at July 31: Sales salaries, $360,000; Office salaries, $72,000; Federal income taxes withheld, $108,000; State income taxes withheld, $24,000; Social security taxes withheld, $26,784; Medicare taxes withheld, $6,264; Medical insurance premiums, $8,500; Life insurance premiums, $5,500; Union dues deducted, $2,500; and Salaries subject to unemployment taxes, $53,000. The employee pays 40% of medical and life insurance premiums. Assume that FICA taxes are identical to those on employees and that SUTA taxes are 5.4% and FUTA taxes are 0.6%. 1. & 2. Using the above information, complete the below table and prepare the journal entries to record accrued payroll, including employee deductions, and cash payment of the net payroll (salaries payable) for July. 3. Using the above information, complete the below table. 4. Record the accrued employer payroll taxes and other related employment expenses and the cash payment of all…arrow_forwardThe following monthly data are taken from Ramirez Company at July 31: Sales salaries, $380,000; Office salaries, $76,000; Federal income taxes withheld, $114,000; State income taxes withheld, $25,500; Social security taxes withheld, $28,272; Medicare taxes withheld, $6,612; Medical insurance premiums, $9,000; Life insurance premiums, $6,000; Union dues deducted, $3,000; and Salaries subject to unemployment taxes, $54,000. The employee pays 40% of medical and life insurance premiums. Assume that FICA taxes are identical to those on employees and that SUTA taxes are 5.4% and FUTA taxes are 0.6%. 1. & 2. Using the above information, complete the below table and prepare the journal entries to record accrued payroll, including employee deductions, and cash payment of the net payroll (salaries payable) for July. 3. Using the above information, complete the below table. 4. Record the accrued employer payroll taxes and other related employment expenses and the cash payment of all liabilities…arrow_forwardBeach Vacations pays salaries and wages on the last day of each month. Payments made on December 31, 20X1, for amounts incurred during December are shown below. Cumulative amounts paid prior to the December 31 payroll for the persons named are also shown. a. Francis Fisher, president, gross monthly salary, $11,880, gross earnings paid prior to December 31, $130,680. b. Sandy Swartz, vice president, gross monthly salary, $10,900; gross earnings paid prior to December 31, $109,000. c. Juan Rios, independent accountant who audits the company's accounts and performs certain consulting services, $10,900, gross amount paid prior to December 31, $27,250. d. Harry House, treasurer, gross monthly salary, $5,800; gross earnings paid prior to December 31, $63,800. e. Payment to Daily Security Services for Eddie Martin, a security guard who is on duty on Saturdays and Sundays, $1,180; amount paid to Daily Security Services prior to December 31, $11,800. Required: 1. Assume a 1.45 percent Medicare…arrow_forward

- Current Attempt in Progress Swifty Wholesalers Ltd. has a December 31 year end. The company incurred the following transactions related to current liabilities: 1. Swifty's cash register showed the following totals at the end of the day on March 17: pre-tax sales $55,000, GST $2,750, and PST $3,850. 2. 3. Swifty remitted $49,000 of sales taxes owing from March to the government on April 30. Swifty paid its employees for the week of August 15 on August 20. The gross pay was $80,000. The company deducted $4,240 for CPP, $1,264 for El, $6,400 for pension, and $16,020 for income tax from the employees' pay. 4. Swifty recorded the employer portions of CPP and El for the week of August 15 on August 20 for $4,240 and $1,770, respectively. 5. On September 15, all amounts owing for employee income taxes, CPP, and El pertaining to the payroll transactions above were paid. 6. On December 31, Swifty's legal counsel believes that the company will have to pay damages of $62,000 next year to a local…arrow_forwardPrepare the journal entriesarrow_forward(Click the icon to view the information.) The company is subject to a 40% income tax rate. Read the requirements. Requirements a. Prepare a single statement of comprehensive income beginning with operating income. b. Prepare separate statements of net income and comprehensive income. Print - X Done More info 1. Operating income amounted to $310,000. 2. The company sold investments in bonds at a pre-tax loss of $19,000. 3. Tall reported a $5,800 unrealized loss on an available-for-sale portfolio that is included in other comprehensive income. 4. The company reported a $17,000 unrealized gain on its trading portfolio, which is included in net income. 5. Tall committed to discontinue its retail lumber stores division on January 1 of the current year. The retail lumber stores meet the criteria to be presented as a discontinued operation. The retail lumber stores accounted for 25% of the company's operating income. The stores were operated all year. 6. The retail lumber stores division was…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education