FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

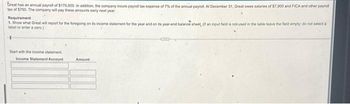

Transcribed Image Text:Great has an annual payroll of $170.000. In addition, the company incurs payroll tax expense of 7% of the annual payroll. At December 31, Great owes salaries of $7.900 and FICA and other payroll

tax of $750. The company will pay these amounts early next year.

Requirement

1. Show what Great will report for the foregoing on its income statement for the year and on its year-end balance sheet, (If an input field is not used in the table leave the field empty; do not select a

label or enter a zero.)

Start with the income statement.

Income Statement Account

Amount

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following totals for the month of June were taken from the payroll register of Concord Company. Salaries and wages FICA taxes withheld Income taxes withheld Medical insurance deductions Federal unemployment taxes State unemployment taxes$640004896 17600 3200 384 3456 The entry to record the accrual of Concord's Company's payroll taxes would include a credit to FICA Taxes Payable for$3840. credit to Payroll Tax Expense for$3840. debit to Payroll Tax Expense for$8736. credit to Payroll Tax Expense for$8736arrow_forwardFor each of the following situations, indicate the amount shown as current or long-term liability on the balance sheet of Anchor, Inc., at December 31: a. Anchor's general ledger shows a credit balance of $125,000 in Long-Term Notes Payable. Of the amount, a $25,000 installment becomes due on June 30 of the following year. b. Anchor estimates its unpaid income tax liability for the current year is $34,000; it plans to pay this amount in March of the following year. c. On December 31, Anchor received a $15,000 invoice for merchandise shipped on December 28. The merchandise has not yet been received. The merchandise was shipped F.O.B. shipping point. d. During the year, Anchor collected $10,500 of state sales tax. At year-end, it has not yet remitted $1,400 of these taxes to the state department of revenue. e. On December 31, Anchor's bank approved a $5,000, 90-day loan. Anchor plans to sign the note and receive the money on January 2 of the following year. Current Liability Long-Term…arrow_forward1 ences Piperel Lake Resort's four employees are paid monthly. Assume an income tax rate of 20%. Required: Complete the payroll register below for the month ended January 31, 2021. (Do not round intermediate values. Round the final answers to 2 decimal places.) Click here to view the CPP Tables for 2021. Click here to view the El Tables for 2021. Employee Wynn, L Short, M. Pearl, P Quincy, B Totals $ $ Gross Pay 2,000.00 1,750.00 1,950.00 1,675.00 7,375.00 El Premium Income Taxes Medical Ins. $ Deductions $ 65.00 65.00 65.00 65.00 260.00 A CPP $ $ United Way 40.00 100.00 0.00 50.00 190.00 Total Deductions Pay Net Pay Distribution Office Salaries 1,750.00 Guide Salaries S 2.000.00 1,950.00 1,675.00arrow_forward

- A company's payroll for the month ended January 31 is summarized as follows: Total wages Federal income tax withheld FICA taxes (employee portion withheld) FICA taxes (employer portion) $10,000 $1,200 $700 $700 The company remits payroll taxes on the 15th of the following month. In its financial statements for the month ended January 31, what amounts should the company report as total payroll tax liability and as payroll tax expense? O Payroll tax liability: $1,400; Payroll tax expense: $700 O Payroll tax liability: $1,900; Payroll tax expense: $1,400 O Payroll tax liability: $2,600; Payroll tax expense: $700 O Payroll tax liability: $1,900; Payroll tax expense: $700 O Payroll tax liability: $1,200; Payroll tax expense: $1,400arrow_forwardThe following totals for the month of April were taken from the payroll register of Concord Company. Salaries and wages FICA taxes withheld Income taxes withheld Medical insurance deductions Federal unemployment taxes State unemployment taxes $72500 5514 15400 2610 194 1301 The entry to record the Payroll Tax Expense would include a O credit to Salaries and Wages Payable. O debit to Federal Unemployment Payable. credit to FICA Taxes Payable. O credit to Payroll Tax Expense. 99+arrow_forwardThe payroll register for Gamble Company for the week ended April 29 indicated the following: Salaries$1,560,000Social security tax withheld93,600Medicare tax withheld23,400Federal income tax withheld312,000 In addition, state and federal unemployment taxes were calculated at the rate of 5.4% and 0.6%, respectively, on $260,000 of salaries. Required:A. Journalize the entry to record the payroll for the week of April 29.*B. Journalize the entry to record the payroll tax expense incurred for the week of April 29.* *Refer to the Chart of Accounts for exact wording of account titles.arrow_forward

- bh.0arrow_forwardAssuming no employees are subject to ceilings for their earnings, Harris Company has the following information for the pay period of January 15–31. Gross payroll $18,729 Federal income tax withheld $3,167 Social security rate 6% Federal unemployment tax rate 0.8% Medicare rate 1.5% State unemployment tax rate 5.4% Salaries Payable would be recorded in the amount of a.$12,996.13 b.$14,400.80 c.$14,157.33 d.$18,729.00arrow_forwardusing the earnings data developed in e3-1 and assuming that thus was the first week of employment for R. Herbert with crestview Manufacturing Co, prepare the journal entries for the following: a. the week's payrollarrow_forward

- XYZ Company is processing payroll for the week ending January 9th. Employee earnings total $5,000. Federal income tax withheld from employee paychecks totaled $1,100. The social security tax rate is 6%, the Medicare tax rate is 1.5%, the state unemployment tax rate is 5.4% and the federal unemployment tax rate is .8%. a) Journalize the payroll entry for the week. DATE Debit Credit X/X b) Journalize the payroll tax entry for the week. DATE Debit Credit X/Xarrow_forward2. Below is the payroll register for Akai company's September 30, 2024, weekly payroll: Deductions Gross Employee Federal Income Marital Tax Status Earnings Withheld Social State Tax Withheld Security Medicare Tax Withheld Tax Medical Insurance Withheld Dental Insurance Withheld Withheld Net Pay a. Akai, J. Single $1,200.00 $168.00 $96.00 $74.40 $17.40 $80.00 $20.00 $744.20 b. Green, W. Single 840.00 117.60 67.20 52.08 12.18 80.00 20.00 490.94 c. Hernandez, L. Married 1,280.00 128.00 102.40 79.36 18.56 125.00 30.00 796.68 d. Vang, G. Married 1,100.00 110.00 88.00 68.20 15.95 125.00 30.00 662.85 e. Hurst, A. Married 680.00 68.00 54.40 42.16 9.86 125.00 30.00 350.58 Totals $5,100.00 $591.60 $408.00 $316.20 $73.95 $535.00 $130.00 $3,045.25 A. Based on the information in the September 30, 2024, payroll register, and the list of general ledger accounts below, record the payroll journal entry below DATE 20-- Sept. 30 GENERAL JOURNAL PAGE DESCRIPTION DOC. NO. POST. REF. DEBIT CREDIT General…arrow_forwardThe invoice date for a bill is September 15 with the terms 2/15, n/40. The discount date and due date are A.September 30 and October 25 b.September 30 and December 9 c.September 17 and October 25 d. October 2 and October 25arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education