FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

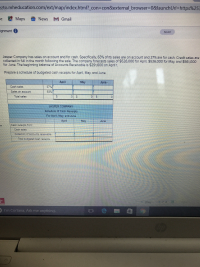

Transcribed Image Text:Jasper Company has sales on account and for cash. Speclfically, 63% of Its sales are on account and 37% are for cash. Credit sales are

collected In full in the month following the sale. The compay forecasts sales of $526.000 for April, $536.,000 for May, and $561,000

for June. The beginning balance of Accounts Recetvable Is S291.600 on Aprll 1.

Prepare a schedule of budgeted cash recelpts for Aprl, May, and June.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Sunland Clothing Store had a balance in the Accounts Receivable account of $500000 at the beginning of the year and a balance of $510000 at the end of the year. Net credit sales during the year amounted to $5050000. The average collection period of the receivables in terms of days was 36.9 days. O 36.1 days. O 365 days. O 36.5 days.arrow_forwardPrime Products hopes to borrow $51,000 on April 1 and repay it plus interest of $860 on June 30. The following data are available for the months April through June, during which the loan will be used: a. On April 1, the start of the loan period, the cash balance will be $24,400. Accounts receivable on April 1 will total $151,200, of which $129,600 will be collected during April and $17,280 will be collected during May. The remainder will be uncollectible. b. The company estimates 30% of a month's sales are collected in the month of sale, 60% in the month following sale, and 8% in the second month following sale. The other 2% are bad debts that are never collected. Budgeted sales and expenses for the three- month period follow: Sales (all on account) Merchandise purchases Payroll Lease payments April $285,000 $194,000 May $ 548,000 June $ 251,000 $ 179,000 $ 171,000 $ 35,400 $ 35,400 $ 19,900 $ 35,800 $ 35,800 $ 35,800 Advertising Equipment purchases Depreciation $ 64,400 $ 64,400 $…arrow_forwardSpencer Consulting, which invoices its clients on terms 2/10, n/30, had credit sales for May and June of $56,000 and $64,000, respectively. Analysis of Spencer's operations indicates that the pattern of customers' payments on account is as follows (percentages are of total monthly credit sales): Receiving Discount Beyond Discount Period Totals In month of sale In month of following sale 50% 20% 70% 15% 10% 25% Uncollectible accounts, returns, and allowances 5% 100% Determine the estimated cash collected on customers' accounts in June.arrow_forward

- Sheridan Company has the following accounts in its general ledger at July 31: Accounts Receivable $45,600 and Allowance for Doubtful Accounts $2,850. During October, the following transactions occurred. Oct. 15 Sold $17,900 of accounts receivable to Nelson Factors, Inc. who assesses a 4% finance charge. 25 Made sales of $1,100 on VISA credit cards. The credit card service charge is 3%. 1. Journalize the transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. List all debit entries before credit entries.)arrow_forward(Pro forma accounts receivable balance calculation) The accounts receivable for Pastors Brewing Company on March 31, 2016 was $22,500. Firm sales are roughly evenly split between credit and cash sales, with 40 percent of the credit sales collected in the month after the sale and the remainder 2 months after the sale. Historical and projected sales for the brewing company are given here: end of April? a. Under these circumstances, what should the balance in accounts receivable be at b. How much cash did Pastors' realize during April from sales and collections? a. Under these ci $(Round to f t Data table MONTH January February SALES $20,000 $25,000 MONTH March O SALES $30,000 $34,000 April (projected) (Click on the icon located on the top-right corner of the data table above in order to copy its contents into a spreadsheet.) D Xarrow_forwardCurrent Attempt in Progress Manuel Company had cash sales of $86,800 (including taxes) for the month of June. Sales are subject to 8.50% sales tax. Prepare the entry to record the sales. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Account Titles and Explanation Debit Creditarrow_forward

- The Amherst Corporation has a 45-day accounts receivable period. The estimated quarterly sales for this year are $28,000, $41,000, $35,500, and $32,500, respectively, for the next four quarters. What is the accounts receivable balance at the beginning of the quarter 2? Each quarter has 90 days. Multiple Choice $36,750 $34,500 $20,500 $14,000 $28,000arrow_forwardRed Sun Company has a current accounts receivable balance of $350,000. Credit sales for the year just ended were $2,380,000. �The average collection period is ____. Question 8 options: 91.3 53.7 75.1 42.9 85.9arrow_forwardLundquist Company received a 60-day, 6% note for $37,500, dated July 23, from a customer on account. Required: a. Determine the due date of the note. b. Determine the maturity value of the note. Assume 360 days in a year. c. Journalize the entry to record the receipt of the payment of the note at maturity. Refer to the Chart of Accounts for exact wording of account titles. ASSETS 110 Cash 111 Petty Cash 120 Accounts Receivable 129 Allowance for Doubtful Accounts 132 Notes Receivable 141 Merchandise Inventory 145 Office Supplies 146 Store Supplies 151 Prepaid Insurance 181 Land 191 Store Equipment 192 Accumulated Depreciation-Store Equipment 193 Office Equipment 194 Accumulated Depreciation-Office Equipment LIABILITIES 210 Accounts Payable 211 Salaries Payable 213 Sales Tax Payable 214 Interest Payable 215 Notes Payable EQUITY 310 Owner, Capital 311 Owner, Drawing 312 Income Summary REVENUE 410…arrow_forward

- Kathy Hansen has a revolving credit account. The finance charge is calculated on the previous month's balance, and the annual percentage rate is 21%. Complete the account activity table for Kathy. (Round your answers to the nearest cent.) Month PreviousMonth'sBalance(in $) FinanceCharge(in $) Purchasesand CashAdvances Paymentsand Credits New BalanceEnd of Month(in $) April $641.17 $11.22 $31.45 $85.00 $598.84 May $283.33 $135.00arrow_forwardA credit card balance at the beginning of November is $4,000. On Nov. 3 a $300 charge is made. On Nov. 8 a $1000 charge is made. On Nov. 15 a $900 payment is made. On Nov. 17 a $200 charge is made. On Nov. 21 a $800 charge is made. using the average daily balance method, Caculate the interest charged if the account has a 17.5% rate and the billing period is 30 days.arrow_forwardAccounts receivable management This table,, shows that Blair Supply had an end-of-year accounts receivable balance of $300,060 The table also shows how much of the receivables balance originated in each of the previous six months. The company had annual sales of $2.40 million and it normally extends 30-day credit terms to its customers. a. Use the year-end total to evaluate the firm's collection system. b. If 70% of the firm's sales occur between July and December, would this affect the validity of your conclusion in part a? Explain. a. The average collection period is days. (Round to two decimal places.) Data table (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Month of Amounts receivable origin July $3,880 August 2,005 September 33,995 October 15,150 November 52,005 December 193,025 Year-end accounts receivable $300,060 - Xarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education