FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

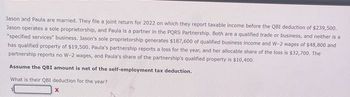

Transcribed Image Text:Jason and Paula are married. They file a joint return for 2022 on which they report taxable income before the QBI deduction of $239,500.

Jason operates a sole proprietorship, and Paula is a partner in the PQRS Partnership. Both are a qualified trade or business, and neither is a

"specified services" business. Jason's sole proprietorship generates $187,600 of qualified business income and W-2 wages of $48,800 and

has qualified property of $19,500. Paula's partnership reports a loss for the year, and her allocable share of the loss is $32,700. The

partnership reports no W-2 wages, and Paula's share of the partnership's qualified property is $10,400.

Assume the QBI amount is net of the self-employment tax deduction.

What is their QBI deduction for the year?

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Alice and Bob, married filing jointly, own AB, LLC (which they tax as a partnership). The LLC is not a specified service business and has QBI of $800,000 after all applicable deductions. AB paid total W-2 wages of $300,000, and the total unadjusted basis of property held by ABC is $3,200,000. Their taxable income before the QBI deduction is $1,000,000. What is their QBI deduction for the current year?arrow_forwardDan and Sam are married and will file a joint return. Their modified adjusted gross income is $97,000. Dan has losses of $14,000 from rental activities in which he actively participates. Sam has a $3,000 loss from a limited partnership in which he does not materially participate. They have no passive income for the year. What is the amount of their allowable passive loss? (a) $0 (b) $3,000 (c) $14,000 (d) $17,000arrow_forwardCheck my work. Bill and Mary filed a joint Federal income tax return this year. Mary owns a 30% interest in MAJIC Partnership, a women’s dress boutique. Mary’s share of the partnership’s net income is $280,000. Her shares of the partnership’s W–2 wages and unadjusted basis of depreciable property are $100,000 and $300,000, respectively. Mary’s share of the partnership income is $280,000 * 20% = $56,000 50% of W-2 wages is $100,000*.5= $50,000 25% of W-2 wages plus 2.5% of adjusted basis of depr prop = $100,000 * 25% +$300,000 * 2.5% =$32,500 The QBI deduction is $50,000 per the limitation phase What is the maximum QBI deduction if MAJIC’s income was from qualified services and Bill and Mary’s total taxable income was $450,000? The QBI deduction can be used for qualified service businesses only if the taxable income before the QBI deduction does not exceed the threshold. Since MAJIC’s…arrow_forward

- Scott and Laura are married and will file a joint tax return. Laura has a sole proprietorship (not a "specified services" business) that generates qualified business income of $300,000. The proprietorship pays W-2 wages of $40,000 and holds property with an unadjusted basis of $10,000. Scott is employed by a local school district. Their taxable income before the QBI deduction is $400,100 (this is also their modified taxable income). A. Determine Scott and Laura's QBI deduction, taxable income, and tax liability for 2022. B. After providing you the original information in the problem, scott finds out that he will be receiving a $6,000 bonus in December 2022 (increasing their taxable income before the QBI deduction by this amount). Redetermine Scott and Laura's QBI deduction taxable income, and tax liability for 2022.arrow_forwardRobin and Nissan are the owners of a gift shop. They are partners in a partnership of the shop. They share profits and losses equally under the partnership agreement. In addition, Robin receives salaries of $60,000 every year from the partnership for taking on the daily management role in the shop. In this income year, the partnership makes a loss of $90,000 after deducting the salaries paid to Gary. Required: Explain the tax implications of Robin and Nissan in this income year.arrow_forwardRoberto is single and has taxable income of $530,000 in 2019. As a 25 percent partner in a partnership that produces $820,000 of ordinary income from manufacturing a product, his share of partnership income is $205,000. The partnership paid $210,000 of W-2 wages and the total unadjusted basis of tangible depreciable business property is $360,000. What is Roberto’s qualified business income deduction?arrow_forward

- Omar (single) is a 50 percent owner in Cougar LLC (taxed as a partnership). Omar works half time for Cougar and receives guaranteed payment of $50,000. Cougar LLC reported $450,000 of business income for the year (2020). Before considering his 50 percent business income allocation from Cougar and the self-employment tax deduction (if any), Omar’s adjusted gross income is $210,000 (includes $50,000 guaranteed payment from Cougar and $160,000 salary from a different employer). Answer the following questions for Omar. What is Omar’s self-employment tax liability (exclude the guaranteed payment)? (Do not round intermediate calculations and round your final answer to the nearest whole dollar.)arrow_forwardJose is married filing a joint return. In 2022, he earned $160,000 of profit from his sole proprietorship, which operates a service business. The business paid no W-2 wages in 2022 and owns no tangible business property. Compute Jose’s allowable QBI deduction if his joint return includes his spouse's salary and reflects taxable income of $300,000 before the deduction. Hint: the correct answer should be $29,749arrow_forwardBrock, age 50, and Erin, age 49, are married with three dependent children. They file a joint return for 2021. Their income from salaries totals $50,000, and they received $8,000 in taxable interest, $5,000 in royalties, and $3,000 in other ordinary income. Brock and Erin's deductions for adjusted gross income amount to $2,500, and they have itemized deductions totaling $19,250. Table for the standard deduction Filing Status Standard Deduction Single $12,550 Married, filing jointly 25,100 Married, filing separately 12,550 Head of household 18,800 Qualifying widow(er) 25,100 Click here to access the tax tables. Calculate the following amounts: a. Gross income 66,000 b. Adjusted gross income c. Itemized deduction or standard deduction amount d. Taxable income e. Income tax liability (before any credits)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education