FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

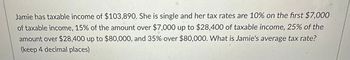

Transcribed Image Text:Jamie has taxable income of $103,890. She is single and her tax rates are 10% on the first $7,000

of taxable income, 15% of the amount over $7,000 up to $28,400 of taxable income, 25% of the

amount over $28,400 up to $80,000, and 35% over $80,000. What is Jamie's average tax rate?

(keep 4 decimal places)

Expert Solution

arrow_forward

Step 1: Introduction to Average Tax rate

Average Tax rate:-

- It is the total tax liability divided by the total taxable income of the taxpayer.

- Formula -

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Similar questions

- Alison Jacobs (single) purchased a home in Las Vegas, Nevada, for $480,000. She moved into the home on September 1, year 0. She lived in the home as her primary residence until July 1 of year 4, when she sold the home for $744,000. If Alison's tax rate on long-term capital gains is 15 percent, what amount of tax will Alison pay on the $264,000 gain? (Enter only numbers with no dollar signs or other punctuation.)arrow_forwardquincy is single. his income of $250000 includes wages of $210000, $1500 of interest,$3500 of tax exempt interest, $2500 of dividends, $300000 of rental income. Quincy will calculate his net investment income tax on... $6800 $36800 $40300 $250300arrow_forwardDuela Dent is single and had $178,400 in taxable income. Use the rates from Table 2.3. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Calculate her income taxes. Income taxes $ 57,088.00arrow_forward

- Bill Blake pays a property tax of $2,500. In his community, the tax rate is 55 mills. What is Bill's assessed value? Round to the nearest dollar.arrow_forwardMy daughter earns a salary of $40,800 per year, payable monthly. She is married and claims four withholding allowances. What is her federal income tax? Gross monthly is $3400arrow_forwardI need both answer please .....arrow_forward

- es Chuck, a single taxpayer, earns $77,800 in taxable income and $11,500 in interest from an investment in City of Heflin bonds. (Use the U.S tax rate schedule.) Required: a. How much federal tax will he owe? b. What is his average tax rate? c. What is his effective tax rate? d. What is his current marginal tax rate? Complete this question by entering your answers in the tabs below. Required A Required B Federal tax Required C How much federal tax will he owe? Note: Do not round intermediate calculations. Round "Federal tax" to nearest whole dollar amount. $ Required D 12,424arrow_forwardJorge and Anita, married taxpayers, earn $150,000 in taxable income and $40,000 in interest from an investment in City of Heflin bonds. Using the U.S. tax rate schedule for married filing jointly, how much federal tax will they owe? What is their average tax rate? What is their effective tax rate? What is their current marginal tax rate? Note: Round your percentage answers to 2 decimal places. Federal tax Average tax rate Effective tax rate Marginal tax rate % % % Schedule Y-1-Married Filing Jointly or Qualifying surviving spouse If taxable income is over: But not over: The tax is: $ 22,000 $ 89,450 $ 190,750 $364,200 $462,500 $ 693,750 $ 0 $ 22,000 $ 89,450 $ 190,750 $364,200 $ 462,500 $ 693,750 10% of taxable income $2,200 plus 12% of the excess over $22,000 $10,294 plus 22% of the excess over $89,450 $32,580 plus 24% of the excess over $190,750 $74,208 plus 32% of the excess over $364,200 $105,664 plus 35% of the excess over $462,500 $186,601.5 plus 37% of the excess over $693,750arrow_forwardBob is single and his tax rates are 10% on the first $8375 of taxable income, 15% of the amount over $8375 up to $34,000 of taxable income and 25% on the remainder. He has $61,090taxable income. What's his tax liability?arrow_forward

- Elizabeth has three children ages 10, 17, and 19. All the children live with her, are full-time students, and claimed as dependents on her tax return. Elizabeth's AGI is $100,000 in 2023 and she files head of household. Her tax liability before the application of any credits is $8,400. What is the maximum Child Tax Credit she can claim on her 2023 tax return? $4.000 O $6,000 $2,000 $0arrow_forwardFelix and Freddie are married with annual taxable income of $230,000. They pay income tax according to the following schedule: over not tax rate 0 $43,850 15% $43,850 $105,950 ??? $105,950 $361,450 31% If the total personal income tax they pay is $58,695, which of the following comes closest to the tax rate for income between $43,850 and 105,950 (the middle tax rate)? Select one: a. 21% b. 24% c. 23% d. 22% e. 25%arrow_forwardJamie has taxable income of $45,000. She is single, and her tax rate is 10% on the first $9,525 of the taxable income, 12% on the amount over $9,525 up to $38,700 of the taxable income, and 22% on the remainder. What are Jamie’s tax liability, marginal tax rate, and average tax rate? (Show all work. Round dollar amounts to the nearest cent and percentages to two decimal places.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education