FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

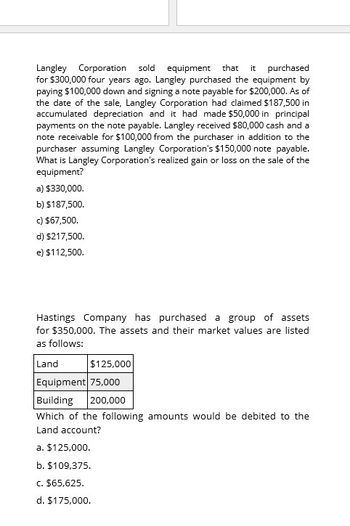

Transcribed Image Text:Langley Corporation sold equipment that it purchased

for $300,000 four years ago. Langley purchased the equipment by

paying $100,000 down and signing a note payable for $200,000. As of

the date of the sale, Langley Corporation had claimed $187,500 in

accumulated depreciation and it had made $50,000 in principal

payments on the note payable. Langley received $80,000 cash and a

note receivable for $100,000 from the purchaser in addition to the

purchaser assuming Langley Corporation's $150,000 note payable.

What is Langley Corporation's realized gain or loss on the sale of the

equipment?

a) $330,000.

b) $187,500.

c) $67,500.

d) $217,500.

e) $112,500.

Hastings Company has purchased a group of assets

for $350,000. The assets and their market values are listed

as follows:

Land

$125,000

Equipment 75,000

Building

200,000

Which of the following amounts would be debited to the

Land account?

a. $125,000.

b. $109,375.

c. $65,625.

d. $175,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Amos, Inc. puchased land for $55,000 cash. They also incurred commissions of $ 1,650, property taxes of $6,000, and title insurance of $500. The $6,000 in property taxes includes $4,000 in back taxes paid by Amos, Inc. on behalf of the seller and $ 2,000 due for the current year after the purchase date. Amos also paid a contractor $ 10,000 to tear down a dilapidated building on the property. The capitalized cos of the land is: A. $61, 150 B. $73, 150 C.$ 71, 150 D. $70,650arrow_forwardHadley Company purchased an asset with a list price of $135580. Hadley paid $413 of transportation-in cost, $968 to train an employee to operate the equipment, and $637 to insure the asset against theft after it has been set up in the factory. The asset was purchased under terms 2/20/n30 and Hadley paid for the asset within the discount period. Based on this information, Hadley would capitalize the asset on its books at what dollar amount? $_______________arrow_forwardMill Creek Golf Club, Inc. purchased a computer for $2,900, debiting Computer Equipment. During 2022 and 2023, Mill Creek Golf Club, Inc. recorded total depreciation of $2,300 on the computer. On January 1, 2024, Mill Creek Golf Club, Inc. traded in the computer for a new one, paying $2,700 cash. The fair market value of the new computer is $4,500. Journalize Mill Creek Golf Club, Inc.'s exchange of computers. Assume the exchange had commercial substance. Let's begin by calculating the gain or loss on the exchange of computer equipment on January 1. Market value of assets received Less: Book value of asset exchanged Cash paid Gain or (Loss) Journalize Mill Creek Golf Club, Inc.'s exchange of computers. (Record a single compound journal entry. Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Date Jan. 1 Accounts and Explanation Debit Creditarrow_forward

- Corazon Company purchased an asset with a list price of $17,600. Corazon paid $1,400 of transportation-in cost, $1,700 to train an employee to operate the equipment, and $1,100 to insure the asset against theft after it has been set up in the factory. The asset was purchased under terms 1/20, n/30 and Corazon paid for the asset within the discount period. Based on this information, Corazon would capitalize the asset on its books at: Multiple Choice O O O $19,124. $17,600. $19,300. $20,524.arrow_forwardHauswirth Corporation sold (or exchanged) a warehouse in year 0. Hauswirth bought the warehouse several years ago for $72.500. and it has claimed $24,800 of depreciation expense against the building. Required: a. Assuming that Houswirth receives $59,700 in cash for the warehouse, compute the amount and character of Hauswirth's recognized gain or loss on the sale. b. Assuming that Hauswirth exchanges the warehouse in a like-kind exchange for some land with a fair market value of $59,700 compute Houswirth's realized gain or loss, recognized gain or loss, deferred gain or loss, and basis in the new land. c. Assuming that Houswirth receives $26.500 in cash in year 0 and a $57,000 note receivable that is payable in year 1, compute the amount and character of Hauswirth's gain or loss in year 0 and in year 1. Complete this question by entering your answers in the tabs below. Required a Required b Required c Assuming that Hauswirth receives $59,700 in cash for the warehouse, compute the amount…arrow_forwardCorning Industries owns a patent for which it paid $77,000. At the end of the current year, accumulated amortization on the patent totaled $14,000. Due to adverse economic conditions, Corning’s management determined that it should assess whether an impairment loss should be recognized for the patent. The estimated undiscounted future cash flows to be provided by the patent total $45,000, and the patent's fair value is $30,000. (a) What is the amount of the impairment loss, if any, on the patent at the end of the current year? (b) What is the book value of the patent after any impairment loss is recorded?arrow_forward

- Rossy Investigations purchased land, paying $94,000 cash plus a $230,000 note payable. In Addition, Rossy Investigations paid delinquent property tax of $4,000, title insurance costing $5,000, and $4,000 to level the land and remove an unwanted building. The company then constructed an office building at a cost of $440,000. It also paid $52,000 for a fence around the property, $19,000 for a sign near the entrance, and $5,000 for special lighting on the grounds. Determine the cost of the land, land improvements, and building. Account Land Land Improvements Purchase price Note payable Property tax Title insurance Remove building Construct building Fence Sign Lighting Totals Buildingarrow_forwardDuring its inception, Devon Company purchased land for $250,000 and a building for $200,000. After exactly 3 years, it transferred these assets and cash of $50,000 to a newly created subsidiary, Regan Company, in exchange for 20,000 shares of Regan's $10 par value stock. Devon uses straight-line depreciation. Useful life for the building is 20 years, with zero residual value. An appraisal revealed that the building has a fair value of $250,000. What will Devon record as Additional Paid in Capital as a result of this transaction? Group of answer choices additional paid-in capital of $0. additional paid-in capital of $270,000. additional paid-in capital of $350,000. additional paid-in capital of $300,000.arrow_forwardConnors Corporation acquired manufacturing equipment for use in its assembly line. Below are four independent situations relating to the acquisition of the equipment. 1. The equipment was purchased on account for $30,000. Credit terms were 3/10, 1/30. Payment was made within the discount period and the company records the purchases of equipment net of discounts. 2. Connors gave the seller a noninterest-bearing note. The note required payment of $32,000 one year from date of purchase. The fair value of the equipment is not determinable. An interest rate of 12% properly reflects the time value of money in this situation. 3. Connors traded in old equipment that had a book value of $8,500 (original cost of $19,000 and accumulated depreciation of $10,500) and paid cash of $27,000. The old equipment had a fair value of $4,500 on the date of the exchange. The exchange has commercial substance. 4. Connors issued 1,500 shares of its no-par common stock in exchange for the equipment. The market…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education