FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

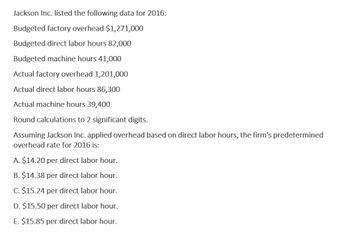

Transcribed Image Text:Jackson Inc. listed the following data for 2016:

Budgeted factory overhead $1,271,000

Budgeted direct labor hours 82,000

Budgeted machine hours 41,000

Actual factory overhead 1,201,000

Actual direct labor hours 86,300

Actual machine hours 39,400

Round calculations to 2 significant digits.

Assuming Jackson Inc. applied overhead based on direct labor hours, the firm's predetermined

overhead rate for 2016 is:

A. $14.20 per direct labor hour.

B. $14.38 per direct labor hour.

C. $15.24 per direct labor hour.

D. $15.50 per direct labor hour.

E. $15.85 per direct labor hour.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Carla Vista Limited is a company that produces machinery to customer orders, using a normal job-order cost system. It applies manufacturing overhead to production using a predetermined rate. This overhead rate is set at the beginning of each fiscal year by forecasting the year's overhead and relating it to direct labour costs. The budget for 2022 was as follows: Direct labour Manufacturing overhead $1,804,000 902,000 As at the end of the year, two jobs were incomplete. These were 1768B, with total direct labour charges of $113,600, and 1819C, with total direct labour charges of $390,100. Machine hours were 287 hours for 17688 and 647 hours for 1819C. Direct materials issued for 1768B amounted to $220,000, and for 1819C they amounted to $420,500. Total charges to the Manufacturing Overhead Control account for the year were $898,500, and direct labour charges made to all jobs amounted to $1,583,600, representing 247,500 direct labour hours. There were no beginning inventories. In…arrow_forwardThe chief cost accountant for Voltaire Beverage Co. estimated that total factory overhead cost for the Blending Department for the coming fiscal year beginning May 1 would be $2,340,000 and total direct labor costs would be $1,800,000. During May, the actual direct labor cost totaled $145,000 and factory overhead cost incurred totaled $192,100. Question Content Area a. What is the predetermined factory overhead rate based on direct labor cost? Enter your answer as a whole percent not in decimals. fill in the blank 1772e2fb3039fb1_1 % Question Content Area b. Journalize the entry to apply factory overhead to production for May. If an amount box does not require an entry, leave it blank. blank - Select - - Select - - Select - - Select - Question Content Area c. What is the May 31 balance of the account Factory Overhead—Blending Department? Amount: $fill in the blank 1ea1070e903a021_1 Debit or Credit? d. Does the balance in part (c) represent overapplied or underapplied factory…arrow_forwardLakeside Inc. estimated manufacturing overhead costs for 2014 at $378,000, based on 180,000 estimated direct labor hours. Actual direct labor hours for 2014 totaled 195,000. The manufacturing overhead account contains debit entries totaling $391,500. The manufacturing overhead for 2014 was (Round your immediate calculations to one decimal place) a) $18,000 overallocated b) $31,500 underallocated c) $18,000 underallocated d) $31,500 overallocatedarrow_forward

- During the year, 3,600 units were produced, 14,500 hours were worked, and the actual manufacturing overhead was $49,000. Actual fixed manufacturing overhead costs equalled the budgeted fixed manufacturing overhead costs. Overhead is applied based on direct labour hours. (a) Calculate the total, fixed, and variable predetermined manufacturing overhead rates. (Round answers to 2 decimal places, e.g. 15.25.) Variable manufacturing overhead $ Fixed manufacturing overhead $ Total manufacturing overhead $ Rate 2.25arrow_forwardCoronado Corporation accumulates the following data relative to jobs started and finished during the month of June 2022. Costs and Production Data Raw materials unit cost Raw materials units Direct labor payroll Direct labor hours Manufacturing overhead incurred Manufacturing overhead applied Machine hours expected to be used at normal capacity Budgeted fixed overhead for June Variable overhead rate per machine hour Fixed overhead rate per machine hour Overhead controllable variance $ Overhead volume variance Actual $ $4.40 11,000 $177,600 14,800 $242,800 Standard $4.30 10,100 $174,420 15,300 Overhead is applied on the basis of standard machine hours. 3.20 hours of machine time are required for each direct labor hour. The jobs were sold for $475,000. Selling and administrative expenses were $40,100. Assume that the amount of raw materials purchased equaled the amount used. Compute the overhead controllable variance and the overhead volume variance. $244,800 49,960 $89,928 $3.20 $1.80…arrow_forwardAnsarrow_forward

- please solve for overhead rate per direct labor cost, overhead rate per direct labor hour, and overhead rate per machine hourarrow_forwardCavy Company estimates that total factory overhead costs will be $1,039,500 for the year. Direct labor hours are estimated to be 110,000.arrow_forwardTech Solutions computes its predetermined overhead rate annually based on direct labor - hours. At the beginning of the year, it estimated 50,000 direct labor - hours would be required for the period's estimated level of client service. The company also estimated $ 225,000 of fixed overhead cost for the coming period and variable overhead of $0.50 per direct labor - hour. The firm's actual overhead cost for the year was $238, 100 and its actual total direct labor was 53, 100 hours. Required: 1. Compute the predetermined overhead rate. 2. During the year, Tech Solutions started and completed the Xavier Company engagement. The following information was available for this job: Direct materials $ 44, 850 Direct labor cost $ 28, 200 Direct labor - hours worked 200 Compute the total job cost for Xavier Company.arrow_forward

- Gensource Company provided the following information from its accounting records for 2021: Estimated production 60,000 labor hours Actual production 56,000 labor hours Estimated overhead $1,800,000 Actual overhead $1,740,000 How much is the predetermined overhead rate if the Company bases it on direct labor hours? Select one: O a. $29.00 per hour b. $32.14 per hour c. $30.00 per hour d. $31.07 per hourarrow_forwardI want to answer this questionarrow_forwardLakeside Company estimated manufacturing overhead costs for 2014 at $390,000, based on 160,000 estimated direct labor hours. Actual direct labor hours for 2014 totaled 195,000. The manufacturing overhead account contains debit entries totaling $391,500. The manufacturing overhead for 2014 was: (Round your intermediate calculations to one decimal place)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education