Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

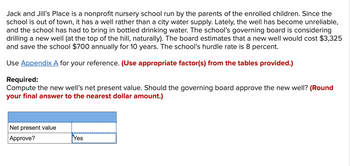

Transcribed Image Text:Jack and Jill's Place is a nonprofit nursery school run by the parents of the enrolled children. Since the

school is out of town, it has a well rather than a city water supply. Lately, the well has become unreliable,

and the school has had to bring in bottled drinking water. The school's governing board is considering

drilling a new well (at the top of the hill, naturally). The board estimates that a new well would cost $3,325

and save the school $700 annually for 10 years. The school's hurdle rate is 8 percent.

Use Appendix A for your reference. (Use appropriate factor(s) from the tables provided.)

Required:

Compute the new well's net present value. Should the governing board approve the new well? (Round

your final answer to the nearest dollar amount.)

Net present value

Approve?

Yes

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Jack and Jill's Place is a nonprofit nursery school run by the parents of the enrolled children. Since the school is out of town, it has a well rather than a city water supply. Lately, the well has become unreliable, and the school has had to bring in bottled drinking water. The school's governing board is considering drilling a new well (at the top of the hill, naturally). The board estimates that new well would cost $2,458 and save the school $400 annually for 10 years. The school's hurdle rate is 9 percent. Use Appendix A for your reference. (Use appropriate factor(s) from the tables provided.) Required: Compute the internal rate of return on the new well. Should the governing board approve the new well? Internal rate of return Approve?arrow_forwardAre the answers to A & B correct? Could I get some help on the multiple choice (B&C)?arrow_forward• Other financial information as of October 31, 2023: Cash in checking account, $7,000. Petty cash, $300. Outstanding mortgage balance, $352,000. Accounts payable arising from invoices for supplies and utilities that are unpaid as of October 31, 2023, and due in November 2023, $4,500. • No other unpaid bills existed on October 31, 2023. • The club purchased $25,000 worth of exercise equipment during the current fiscal year. Cash of $10,000 was paid on delivery, with the balance due on October 1. This amount had not been paid as of October 31, 2023. An additional $25,00 (cash) of equipment purchases is planned for the coming year. • The club began operations in 2022 in rental quarters. In October 2022, it purchased its current property (land and building) for $600,000, paying $120,000 down and agreeing to pay $32,000 plus 9% interest annually on the unpaid loan balance each November 1, starting November 1, 2023. • Membership rose 3% in 2023. The club has experienced approximately this…arrow_forward

- Grow It All Farms Ltd. is an agri-business that grows a variety of different grains on the land that it owns. Operations have been steadily expanding over the last few years. The company has now reached a point where it needs to create a reservoir for irrigation purposes. Management has applied to the municipality for permission to create the reservoir by creating a diversion from a creek that flows through land that the company owns. The permit has been approved on the condition that Grow It All Farms restore the land and creek to its natural state when operations cease. The company is required to provide the municipality with financial statements on an annual basis. Management agreed to the condition and has engaged an engineering firm to scope and price out the work. The cost to create the reservoir and divert the creek is $4,180,000. The cost of the restoration is estimated to be $6.180.000 in 20 years. Grow It All Farms borrows at an average rate of 6% from its lenders (a) Prepare…arrow_forwardIn the aftermath of Hurricane Thelma, the U.S. Army Corps of Engineers is considering two alternative approaches to protect a freshwater wetland from the encroaching seawater during high tides. The first alternative, the construction of a 5-mile long, 20-foot-high levee, would have an investment cost of $25,000,000 with annual upkeep costs estimated at$725,000. A new roadway along the top of the levee would provide two major benefits: (1) improved recreational access for fishermen and (2) reduction of the driving distance between the towns at opposite ends of the proposed levee by 11 miles. The annual benefit for the levee has been estimated at $1,500,000. The second alternative, a channel-dredging operation, would have an investment cost of $15,000,000. The annual cost of maintaining the channel is estimated at $375,000. There are no documented benefits for the channel-dredging project. Using a MARR of 8% and assuming a 25-year life for either alternative, apply the incremental B–C…arrow_forwardRussell Forest Products Limited needed to upgrade a burner at its sawmill in Cochrane, Ontario, to comply with the new air pollution standards. The new burner, which is used to burn the scrap wood from its sawing operations, will not only reduce the amount of pollution, but will supply heat for the plant facility, including the wood dryer. In order to encourage Russell Forest Products Limited in its compliance with the stan- dards, the Province of Ontario extended an interest-free loan of $400,000 on December 31, 2011. The only conditions in obtaining the interest-free loan are that the loan proceeds be applied directly to the construction costs and that the loan be repaid in full on December 31, 2019. RussellForest Products Limited borrowed the remaining funds from the bank for the construction of the burner and will be paying interest at the rate of 7% per year. Instructions (a) Discuss the issues related to obtaining the interest-free loan from the Province of Ontario. (b)…arrow_forward

- The Shannon Community Kitchen provides hot meals to homeless and low-income individuals and families; it is the organization's only program. It is the policy of the kitchen to use restricted resources for which the purpose has been met before resources without donor restrictions. The Kitchen had the following revenue and expense transactions during the 2023 fiscal year. 1. Cash donations without donor restrictions of $26,200 were received. A philanthropist also contributed $4,200, which was to be used for the purchase of Thanksgiving dinner foodstuffs. 2. A local grocery store provided fresh produce with a fair value of $1,300. The produce was immediately used. 3. Volunteers from the local university contributed 160 hours to preparation and serving of meals. The estimated fair value of their labor was $1,950. 4. The Kitchen received a $6,200 federal grant for the purchase of institutional kitchen appliances. 5. A local foundation gave the Kitchen $7,200 to support serving hot meals…arrow_forwardA city government adds streetlights within its boundaries at a total cost of $336,000. These lights should burn for at least 12 years but can last significantly longer if maintained properly. The city develops a system to monitor these lights with the goal that 97 percent will be working at any one time. During the year, the city spends $50,200 to clean and repair the lights so that they are working according to the specified conditions. The city also spends another $87,600 to construct lights for several new streets. a. Prepare the entries assuming infrastructure assets are capitalized with depreciation recorded on government-wide financial statements. b. Prepare the entries assuming infrastructure assets are capitalized with government using the modified approach on government- wide financial statements. Complete this question by entering your answers in the tabs below. Required A Required B Prepare the entries assuming infrastructure assets are capitalized with depreciation recorded…arrow_forward2) The council members of a small town have decided that the earth levee that protects the town flooding should be rebuilt and strengthened. The town engineer estimates that the cost of the work at the end of the first year will be $85,000. He estimates that in subsequent years the annual repair costs will decline by $10,000 making the second-year cost $75,000; the third year $65,000, and so forth. The council members want to know what the equivalent present cost is for the first 5 years of repair work if annual effective interest is 4%.arrow_forward

- When Hurricane Katrina struck New Orleans, there was a significant loss of aquarium fish at the Audubon Aquarium of the Americas. FEMA originallystated that the aquarium needed to buy the fish from commercial vendors, a method the agency said would cost $616,849 but would comply with disaster aid laws. FEMA later reversed their decision and allowed the aquarium staff to catch the fish themselves at a total cost of $99,766. If it is assumed that the aquarium staff spent the $99,766 equally over a 12-month period of time, what rate of return per month did their effort represent? Assume FEMA would have given the aquarium the $616,849 at the end of month 12.arrow_forwardCan some one please help me to answer the following question. PLEASE AND THANK YOU!!!!arrow_forwardThe board of education for the Central Catskill School District is considering the acquisition of several minibuses for use in transporting students to school. Five of the school district's bus routes are underpopulated, with the result that the full-size buses on those routes are not fully utilized. After a careful study, the board has decided that it is not feasible to consolidate these routes into fewer routes served by full-size buses. The area in which the students live is too large for that approach, since some students' bus ride to school would exceed the state maximum of 60 minutes. The plan under consideration by the board is to replace five full-size buses with eight minibuses, each of which would cover a much shorter route than a full-size bus. The bus drivers in this rural school district are part-time employees whose compensation costs the school district $21,000 per year for each driver. In addition to the drivers' compensation, the annual costs of operating and…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education