Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Please Explain Proper Step by Step and Do Not Give Solution In Image Format And Fast Answering Please ? And Thanks In Advance

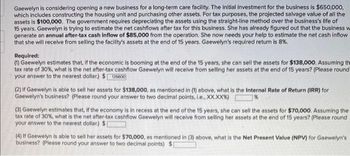

Transcribed Image Text:Gaewelyn is considering opening a new business for a long-term care facility. The initial investment for the business is $650,000,

which includes constructing the housing unit and purchasing other assets. For tax purposes, the projected salvage value of all the

assets is $100,000. The government requires depreciating the assets using the straight-line method over the business's life of

15 years. Gaewelyn is trying to estimate the net cashflows after tax for this business. She has already figured out that the business w

generate an annual after-tax cash inflow of $85,000 from the operation. She now needs your help to estimate the net cash inflow

that she will receive from selling the facility's assets at the end of 15 years. Gaewelyn's required return is 8%.

Required:

(1) Gaewelyn estimates that, if the economic is booming at the end of the 15 years, she can sell the assets for $138,000. Assuming the

tax rate of 30%, what is the net after-tax cashflow Gaewelyn will receive from selling her assets at the end of 15 years? (Please round

your answer to the nearest dollar.) $126600

(2) If Gaewelyn is able to sell her assets for $138,000, as mentioned in (1) above, what is the Internal Rate of Return (IRR) for

Gaewelyn's business? (Please round your answer to two decimal points, i.e., XX.XX%) 7%

(3) Gaewelyn estimates that, if the economy is in recess at the end of the 15 years, she can sell the assets for $70,000. Assuming the

tax rate of 30%, what is the net after-tax cashflow Gaewelyn will receive from selling her assets at the end of 15 years? (Please round

your answer to the nearest dollar) $[

(4) If Gaewelyn is able to sell her assets for $70,000, as mentioned in (3) above, what is the Net Present Value (NPV) for Gaewelyn's

business? (Please round your answer to two decimal points) $[

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 7 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardPlease answer multichoice question in photoarrow_forwardAnswer the question and show work plzarrow_forward

- Please correct and incorrect option explain and correct answerarrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardplease help with the question that is attached as a picture. thanksarrow_forward

- All blanks need to be filled please and thank you, it's incomplete as of now.arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardA system contains many processes. Three common processes that are “grouped” together are transaction corrections, adjustments, and cancellations. These three elements work to properly serve customers. Imagine a system that allows you to register for a class online. The online system must give you a way to correct any errors you made, such as registering for the wrong class. This would be a transaction correction. The system should also allow you to make adjustments, such as adding or dropping classes. Finally, the system should allow you to make cancellations, such as cancelling the registration process entirely. Notice that all three of these processes, correction, adjustment, and cancellation, work together to provide you with one service, which is registering for classes. What type of requirements are transaction corrections, adjustments, and cancellations? Select one. Question 4 options: A Functional Requirements B Nonfunctional Requirementsarrow_forward

- Search Google images for bad data visualizations. Post a link to the image.Describe what is inaccurate or misleading about the visualization. Replace the inaccurate and misleading information with what you think makes the image a good visualization.arrow_forwardWhen should you use Power BI Services?arrow_forwardJessica’s client is expanding and needs to upgrade her version of QuickBooks Online. What steps will Jessica take to upgrade in QuickBooks Online Accountant? -Gear icon > Company Settings > Payments > Upgrade -Gear icon > Subscriptions and billing > Accountant-billed subscriptions > Select Action > Upgrade -Gear icon > Company Settings > Advanced > Upgrade -Gear icon > Subscriptions and billing > Billing details > Edit billing informationarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education