Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Please write all your steps regarding each calculation. Also, refer to the formula sheet; if any formula is used, please label it. Anyways thank you.

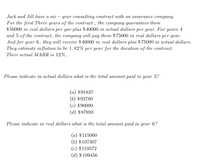

Transcribed Image Text:Jack and Jill have a six

year consulting contract with an insurance company.

For the first Three years of the contract , the company guarantees them

$50000 in real dollars per yar plus $40000 in actual dollars per year. For years

and 5 of the contract, the company will pay them $75000 in real dollars per year.

And for year 6, they will receive $40000 in real dollars plus $75000 in actual dollars.

They estimate inflation to be 1.82% per year for the duration of the contract.

Their actual MARR is 12%.

Please indicate in actual dollars what is the total amount paid in year 3?

(а) $91837

(b) $92780

(c) $90000

(d) $87893

Please indicate in real dollars what is the total amount paid in year 6?

(a) $115000

(b) $107307

(c) $119572

(d) $109456

![List of Equations:

M

i̟

1+

M

i=|1+

СК

-1

i-

-1

(1+i)* –1

N

i

-

(A/F, i, N) =

(F/A, i, N) =

(1+i)* – 1

(1+i)* – 1

i(1+i)*

i(1+i)*

(P/A, i, N) :

(A/P, i,N) =

_(1+i)" – 1

-

(1 +i)™ – iN – 1

(1+i)" – iN –1

-

-

-

(P/G,i, N):

(A/G,i, N) =

%3D

N

(1+i)

i[(1 +i)^ – 1]

1-(1+ g) (1+ i)*

N

(P/A,g, i, N)=

if itg

i -g

N

(P/A,g i, N)=

(1+i)

if i=g

А

PW — СЕ

CR(i) — (Р — S)(А/Р, і, N) + iS

Bn = A(P/A,i,N-n)

In = (Bn-1)*i= A(P/A,i,N-n+1)*i

PPn = A(P/F,i,N-n+1)

P-S

Ds/(n) =

Р-S

BVs/(n)=P – n

N

BV 45(n) = P(1–d)"

Da, (n) = dP(1– d)

n-1

for n>1

CA, = rd{1-4)a-

CCA1 = P(d/2)

ССА

(1-d)"-2

for n>2

G=t * (Udisposal – S)

G=t-(Udisposal – P) – tcG+(S – P)

-

d

i'= i- f)

(1+f)

i =i' +f+i'*f

n-1

U

n

2

MARRA = MARRR +f+ MARRR f

*](https://content.bartleby.com/qna-images/question/783ce383-43f3-4332-85c6-260e48a9a7aa/9ce49e80-56ed-497a-b989-601be5a452b9/gz0m02j_thumbnail.jpeg)

Transcribed Image Text:List of Equations:

M

i̟

1+

M

i=|1+

СК

-1

i-

-1

(1+i)* –1

N

i

-

(A/F, i, N) =

(F/A, i, N) =

(1+i)* – 1

(1+i)* – 1

i(1+i)*

i(1+i)*

(P/A, i, N) :

(A/P, i,N) =

_(1+i)" – 1

-

(1 +i)™ – iN – 1

(1+i)" – iN –1

-

-

-

(P/G,i, N):

(A/G,i, N) =

%3D

N

(1+i)

i[(1 +i)^ – 1]

1-(1+ g) (1+ i)*

N

(P/A,g, i, N)=

if itg

i -g

N

(P/A,g i, N)=

(1+i)

if i=g

А

PW — СЕ

CR(i) — (Р — S)(А/Р, і, N) + iS

Bn = A(P/A,i,N-n)

In = (Bn-1)*i= A(P/A,i,N-n+1)*i

PPn = A(P/F,i,N-n+1)

P-S

Ds/(n) =

Р-S

BVs/(n)=P – n

N

BV 45(n) = P(1–d)"

Da, (n) = dP(1– d)

n-1

for n>1

CA, = rd{1-4)a-

CCA1 = P(d/2)

ССА

(1-d)"-2

for n>2

G=t * (Udisposal – S)

G=t-(Udisposal – P) – tcG+(S – P)

-

d

i'= i- f)

(1+f)

i =i' +f+i'*f

n-1

U

n

2

MARRA = MARRR +f+ MARRR f

*

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education