FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

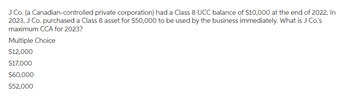

Transcribed Image Text:J Co. (a Canadian-controlled private corporation) had a Class 8 UCC balance of $10,000 at the end of 2022. In

2023, J Co. purchased a Class 8 asset for $50,000 to be used by the business immediately. What is J Co.'s

maximum CCA for 2023?

Multiple Choice

$12,000

$17,000

$60,000

$52,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- aj.3arrow_forward4 Bella Inc. has invested in a piece of land on January 1, 2022. The company uses the revaluation model for its land, and the revaluation takes place annually. 5 6 7 More information about the land acquisition cost and fair values is provided below: 8 January 1, 2022 Acquisition cost 519000 paid for in cash 9 December 31, 2022 Fair value 532000 10 December 31, 2023 Fair value 535000 Fair value 529000 11 December 31, 2024 12 13 During June 2025, the company sold the land for 14 0 1 2 3 15 Required 16 Prepare all journal entries related to the land from January 1, 2022 to June 2025, assuming the asset adjustment method is used. 17 18 Enter your answer here: 9 534000 45arrow_forwardArmando Corporation incurred the following expenses: 2022 2023 Salaries 515,000 614,000 Materials 90,000 70,000 Insurance and utilities 14,000 19,000 Promotion expense 11,000 18,000 Advertising -0- 20,000 Cost of market survey 8,000 -0- The new product will be available for sale July 1, 2024. The company would like to capitalize and amortize the expenditures. Calculate the amount of research and experimental expenditures for: a. 2022 b. 2023 Calculate the deduction for R&D expenses for: C. 2022 d. 2023 e. 2024 If the answer is 0, just type a 0. Use commas as appropriate, ie 55,000. Round answers to the nearest dollar.arrow_forward

- Want Answer of the following questionarrow_forwardD2.arrow_forward1. A special manufacturing and handling device was purchased by Alfonso Manufacturing for $200,000 and is depreciated over MACRS. CFBT is estimated to amount to $800,000 for the first 2 years followed by $600,000 thereafter until the asset is retained. The effective tax rate, Te is 35% and interest is 10% per year. In present worth dollars determine the CFAT and determine if it was a viable purchase. (Note answer must be in a tabular format)arrow_forward

- 5arrow_forwardCatherine Steele owns two rental properties originally valued at $275,000 (Property 1t land $70,000, building $55,000) (Property 2 land $90,000, building $60,000) The buildings are Class 1 (4%) properties. Net rental income before CCA in 2020 was $11,000 • The UCC on building 1 at the beginning of 2020 was $50,00o. • The UCC on building 2 at the beginning of 2020 was $40,000 • Property 2 was soid in 2020 for $250,000 (land $200,000, bulding $50,000) Required Calculate Catherine's net rental income for 2020 then subtract the allowable CCA to arrive at her Net Income from rental property Numeric Responsearrow_forwardBE9.5 (LO 2) Kowloon Group purchased land and a building on January 1, 2020. Management's best estimate of the value of the land was HK$1,000,000 and of the building HK$2,000,000. However, management told the accounting department to record the land at HK$2,250,000 and the building at HK$750,000. The building is being depreciated on a straight-line basis over 20 years with no residual value. Why do you suppose management requested this accounting treatment? Is it ethical? Compute depreciation and evaluate treatment.arrow_forward

- Rhino Company, a real estate entity, had a building with a The building was used as offices of the entity's administrative Problem 22-10 (IFRS) a carrying ámount of P20,000,000 on December 31, 2021 staff. On December 31, 2021, the entity intended to rent out the building to independent third parties. The staff will be moved to a new building purchased early in 2021. On December 31, 2021, the original building had a fair value of P35,000,000. On December 31, 2021, the entity also had land that was held for sale in the ordinary course of business. The land had a carrying amount of P10,000,000 and fair value of P15,000,000 on December 31, 2021. On such date, the entity decided to hold the land for capital appreciation. The accounting policy is to carry all investment property at fair value. 1. On December 31, 2021, what amount should be recognized in revaluation surplus as a result of transfer of the building to investment property? a, 20,000,000 b. 35,000,000 c. 15,000,000 d. 0. 2. On…arrow_forwardSh4 Please help me. Solution Thankyouarrow_forwardQuestion 1 For a multifamily acquisition, the seller credit for property tax is $54,356.20. The property tax bill for 2023 is $124,000. What date is the closing set for in 2023? O 6/8/2023 O 6/7/2023 O 6/10/2023 O 6/9/2023 O6/11/2023arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education