Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

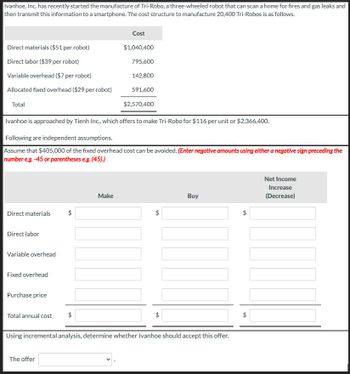

Transcribed Image Text:Ivanhoe, Inc. has recently started the manufacture of Tri-Robo, a three-wheeled robot that can scan a home for fires and gas leaks and

then transmit this information to a smartphone. The cost structure to manufacture 20,400 Tri-Robos is as follows.

Cost

Direct materials ($51 per robot)

$1,040,400

Direct labor ($39 per robot)

795,600

Variable overhead ($7 per robot)

142,800

Allocated fixed overhead ($29 per robot)

591,600

$2,570,400

Total

Ivanhoe is approached by Tienh Inc., which offers to make Tri-Robo for $116 per unit or $2,366,400.

Following are independent assumptions.

Assume that $405,000 of the fixed overhead cost can be avoided. (Enter negative amounts using either a negative sign preceding the

number e.g. -45 or parentheses e.g. (45).)

Direct materials

Direct labor

Variable overhead

Fixed overhead

Purchase price

+A

Total annual cost

$

Make

+A

$

Buy

+A

Using incremental analysis, determine whether Ivanhoe should accept this offer.

The offer

Net Income

Increase

(Decrease)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Computador has a manufacturing plant in Des Moines that has the theoretical capability to produce 243,000 laptops per quarter but currently produces 91,125 units. The conversion cost per quarter is 7,290,000. There are 60,750 production hours available within the plant per quarter. In addition to the processing minutes per unit used, the production of the laptops uses 10 minutes of move time, 20 minutes of wait time, and 5 minutes of rework time. (All work is done by cell workers.) Required: 1. Compute the theoretical and actual velocities (per hour) and the theoretical and actual cycle times (minutes per unit produced). 2. Compute the ideal and actual amounts of conversion cost assigned per laptop. 3. Calculate MCE. How does MCE relate to the conversion cost per laptop?arrow_forwardBox Springs. Inc., makes two sizes of box springs: queen and king. The direct material for the queen is $35 per unit and $55 is used in direct labor, while the direct material for the king is $55 per unit, and the labor cost is $70 per unit. Box Springs estimates it will make 4,300 queens and 3,000 kings in the next year. It estimates the overhead for each cost pool and cost driver activities as follows: How much does each unit cost to manufacture?arrow_forwardSalley is developing material and labor standards for her company. She finds that it costs $0.55 per pound of material per widget. Each widget requires 6 pounds of material per widget. Salley is also working with the operations manager to determine what the standard labor cost is for a widget. Upon observation, Salley notes that it takes 3 hours in the assembly department and 1 hour in the finishing department to complete one widget. All employees are paid $10.50 per hour. A. What is the standard materials cost per unit for a widget? 8. What is the standard labor cost per unit for a widget?arrow_forward

- Jobs, Inc. has recently started the manufacture of Tri-Robo, a three-wheeled robot that can scan a home for fires and gas leaks and then transmit this information to a smartphone. The cost structure to manufacture 20,000 Tri-Robos is as follows. Cost Direct materials ($50 per robot) $1,000,000 Direct labor ($40 per robot) 800,000 Variable overhead ($6 per robot) 120,000 Allocated fixed overhead ($30 per robot) 600,000 Total $2,520,000 Jobs is approached by Tienh Inc., which offers to make Tri-Robo for $115 per unit or $2,300,000.Following are independent assumptions. (A2) Assume that none of the fixed overhead can be avoided. However, if the robots are purchased from Tienh Inc., Jobs can use the released productive resources to generate additional income of $375,000. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).)arrow_forwardJobs, Inc. has recently started the manufacture of Tri-Robo, a three-wheeled robot that can scan a home for fires and gas leaks and then transmit this information to a smartphone. The cost structure to manufacture 20,400 Tri-Robos is as follows. Cost Direct materials ($51 per robot) $1,040,400 Direct labor ($39 per robot) 795,600 Variable overhead ($7 per robot) 142,800 Allocated fixed overhead ($29 per robot) 600,000 Total $2,578,800 Jobs is approached by Tienh Inc., which offers to make Tri-Robo for $116 per unit or $2,366,400.Following are independent assumptions. Assume that $405,000 of the fixed overhead cost can be avoided. (Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Make Buy Net IncomeIncrease(Decrease) Direct materials $enter a dollar amount $enter a dollar amount $enter a dollar amount Direct labor enter a dollar amount…arrow_forwardJobs, Inc. has recently started the manufacture of Tri-Robo, a three-wheeled robot that can scan a home for fires and gas leaks and then transmit this information to a smartphone. The cost structure to manufacture 20,000 Tri-Robos is as follows. Direct materials ($50 per robot) Direct labor ($40 per robot) Variable overhead ($6 per robot) Allocated fixed overhead ($30 per robot) Total Cost (a1) $1,000,000 800,000 120,000 600,000 $2,520,000 Jobs is approached by Tienh Inc., which offers to make Tri-Robo for $115 per unit or $2,300,000. Following are independent assumptions. Assume that $405,000 of the fixed overhead cost can be avoided. (Enter negative amounts using either a negative sign MA W P s X f Earrow_forward

- Jobs, Inc. has recently started the manufacture of Tri-Robo, a three-wheeled robot that can scan a home for fires and gas leaks and then transmit this information to a smartphone. The cost structure to manufacture 20,000 Tri-Robos is as follows. Direct materials ($50 per robot) Direct labor ($40 per robot) Variable overhead ($6 per robot) Allocated foxed overhead ($30 per robot) Total Direct material Direct labor Jobs is approached by Tienh Inc, which offers to make Tri-Robo for $115 per unit or $2,300,000 Following are independent assumptions Variabile overhead Assume that $405,000 of the foxed overhead cost can be avoided. (Enter negative amounts using either a negative sign preceding the mumber a 45 or parentheses es (45)) Fled overhead Purchase price Cost S $1.000.000 800,000 120,000 Make 600,000 $2,520,000 Buy Net Income Increase (Decrease)arrow_forwardSunland has recently started to manufacture RecRobo, a three-wheeled robot that can scan a home for fires and gas leaks and then transmit this information to a mobile phone. The cost structure to manufacture 20,000 RecRobos is as follows: Direct materials ($37 per robot) Direct labour ($29 per robot) Variable overhead ($4 per robot) Allocated fixed overhead ($23 per robot) Total Cost $740,000 580,000 --dinthe 80,000 460,000 $1,860,000 Sunland is approached by Sipacore Inc., which offers to make RecRobo for $70 per unit or $1,400,000. Using incremental analysis, determine whether Sunland should accept this offer under each of the following independent assumptions: (1) Assume that $300,000 of the fixed overhead cost is avoidable. (If an amount reduces the net income then enter with a negative sign 15.000-thonic 1150001 14/hilltowaaks monsible imaland forearrow_forwardWaterway has recently started to manufacture RecRobo, a three-wheeled robot that can scan a home for fires and gas leaks and then transmit this information to a mobile phone. The cost structure to manufacture 19,900 RecRobos is as follows: Cost Direct materials ($45 per robot) $895,500 Direct labor ($31 per robot) 616,900 Variable overhead ($8 per robot) 159,200 Allocated fixed overhead ($23 per robot) 457,700 Total $2,129,300 Waterway is approached by Cinrich Inc., which offers to make RecRobo for $83 per unit or $1,651,700. Using incremental analysis, determine whether Waterway should accept this offer under this following independent assumption: (see attachement). In attachement: see dropdown options. Please don't forget to answer: should the offer be accepted or not.arrow_forward

- Waterway has recently started to manufacture RecRobo, a three-wheeled robot that can scan a home for fires and gas leaks and then transmit this information to a mobile phone. The cost structure to manufacture 19,900 RecRobos is as follows: Cost Direct materials ($45 per robot) $895,500 Direct labor ($31 per robot) 616,900 Variable overhead ($8 per robot) 159,200 Allocated fixed overhead ($23 per robot) 457,700 Total $2,129,300 Waterway is approached by Cinrich Inc., which offers to make RecRobo for $83 per unit or $1,651,700. Using incremental analysis, determine whether Waterway should accept this offer under this following independent assumption: (see attachement). In attachement: see dropdown options. Please don't forget to answer: should the offer be accepted or not.arrow_forwardZee-Drive Ltd. is a computer manufacturer. One of the items they make is monitors. Zee-Drive has the opportunity to purchase 19,000 monitors from an outside supplier for $211 per unit. One of the company's cost-accounting interns prepared the following schedule of Zee-Drive's cost to produce 19,000 monitors: Total cost of producing 19,000 monitors Unit cost Direct materials $ 2,204,000 $116 Direct labor 1,330,000 70 Variable factory overhead 665,000 35 Fixed manufacturing overhead 570,000 30 Fixed non-manufacturing overhead 722,000 38 $ 5,491,000 $ 289 You are asked to look over the intern's estimate before the information is shared with members of management who will decide to continue to make the monitors or buy them. The company's controller believes that the estimate may be incorrect because it includes costs that are not relevant. If Zee-Drive buys the monitors, the direct labor force currently employed in producing the monitors will be terminated and there would be no termination…arrow_forwardBuddy Pets has recently started to manufacture talking toy pets.The cost structure to manufacture 13,700 of these toy pets is as follows: Direct materials ($32 per pet) $438,400 Direct labour ($26 per pet) 356,200 Variable overhead ($13 per pet) 178,100 Allocated fixed overhead ($24 per pet) 328,800 Total $1,301,500 Buddy Pets is approached by Maxum Inc., which offers to make the toy pets for $84 per unit.Using incremental analysis, determine whether Buddy Pets should accept this offer under each of the following independent assumptions: Please dont provide solutions image based thanxarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning