FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

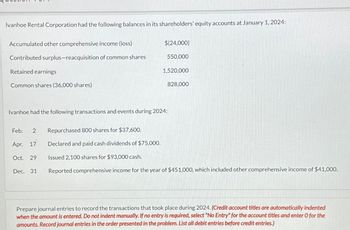

Transcribed Image Text:Ivanhoe Rental Corporation had the following balances in its shareholders' equity accounts at January 1, 2024:

Accumulated other comprehensive income (loss)

$(24,000)

Contributed surplus-reacquisition of common shares

550,000

Retained earnings

1,520,000

Common shares (36,000 shares)

828,000

Ivanhoe had the following transactions and events during 2024:

Feb. 2

Repurchased 800 shares for $37,600.

Apr. 17

Declared and paid cash dividends of $75,000.

Oct. 29

Issued 2,100 shares for $93,000 cash.

Dec. 31

Reported comprehensive income for the year of $451,000, which included other comprehensive income of $41,000.

Prepare journal entries to record the transactions that took place during 2024. (Credit account titles are automatically indented

when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the

amounts. Record journal entries in the order presented in the problem. List all debit entries before credit entries.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- Horticultural Products Inc. reported $1,324,050 profit in 2023 and declared preferred dividends of $65,100. The following changes in common shares outstanding occurred during the year. pan. 1 102,000 common shares were outstanding. Mar. 1 Declared and issued a 30% common share dividend. Aug. 1 Sold 40,000 common shares. Nov. 1 Sold 20,000 common shares. Calculate the weighted-average number of common shares outstanding during the year and earnings per share. (Round the "Earnings per share" answer to 2 decimal places.) Weighted-average outstanding shares Earnings per sharearrow_forwardMarutzky Corporation had a net income of $2,200,000 for the year 2018. On January 1, 2018, the corporation had 300,000 shares of common stock outstanding and issued an additional 250,000 shares of common stock on October 1, 2018. Calculate the earnings per shares using the weighted-average number of common shares outstanding.arrow_forwardJava Company earned net income of $85,000 during the year ended December 31, 2024. On December 15, Java declared the annual cash dividend on its 4% preferred stock (par value, $120,000) and a $0.25 per share cash dividend on its common stock (50,000 shares). Java then paid the dividends on January 4, 2025. Read the requirements. Requirement 1. Journalize for Java the entry declaring the cash dividends on December 15, 2024. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Date 2024 Dec. 15 Accounts and Explanation Debit Credit Requirements 1. Journalize for Java the entry declaring the cash dividends on December 15, 2024. 2. Journalize for Java the entry paying the cash dividends on January 4, 2025. Xarrow_forward

- Pet Boutique Corp. reported $4,549,230 of profit for 2023. On November 2, 2023, it declared and paid the annual preferred dividends of $261,880. On January 1, 2023, Pet Boutique had 73,500 and 567,000 outstanding preferred and common shares, respectively. The following transactions changed the number of shares outstanding during the year: Feb. 1 Declared and issued a 20% common share dividend. Apr.30 Sold 119,130 common shares for cash. May 1 Sold 49,410 preferred shares for cash. Oct. 31 Sold 37,800 common shares for cash. a. What is the amount of profit available for distribution to the common shareholders? Earnings available to common shareholders b. What is the weighted-average number of common shares for the year? Weighted-average outstanding shares M # harrow_forwardBlossom Corporation has outstanding 150,000 common shares that were issued at $12 per share. The balances at January 1, 2023, were $19 million in its Retained Earnings account: $4.10 million in its Contributed Surplus account, and $0.90 million in its Accumulated Other Comprehensive Income account. During 2023, Blossom's net income was $3,300,000 and comprehensive income was $3,450,000. A cash dividend of $0.80 per share was declared and paid on June 30, 2023, and a 6% stock dividend was declared at the fair value of the shares and distributed to shareholders of record at the close of business on December 31, 2023. You have been asked to give advice on how to properly account for the stock dividend. The existing company shares are traded on a national stock exchange. The shares' market price per share has been as follows: Oct. 31, 2023 Nov. 30, 2023 Dec. 31, 2023 Average price over the two-month period (a) $31 34 Account Titles and Explanation 38 35 Prepare a journal entry to record…arrow_forwardHi, How do I record these transactions? Thanksarrow_forward

- I need solution pleasearrow_forwardJAE Corp. completed the following transactions during Year 2: Issued 3,000 shares of $10 par common stock for $25 per share. Repurchased 500 shares of its own common stock for $26 per share. Resold 200 shares of treasury stock for $30 per share. Required How many shares of common stock were outstanding at the end of the period? How many shares of common stock had been issued at the end of the period? Organize the transactions data in accounts under the accounting equation. Prepare the stockholders’ equity section of the balance sheet reflecting these transactions.arrow_forwardVikramarrow_forward

- The outstanding share capital of Sheng Inc. includes 45,000 shares of $9.60 cumulative preferred and 80,000 common shares, all issued during the first year of operations. During its first four years of operations, the corporation declared and paid the following amounts in dividends: Year 2021 2022 2023 2024 Total Dividends Declared Preferred Common $ e 460,000 1,028,000 460,000 Required: Determine the total dividends paid in each year to each class of shareholders. Also determine the total dividends paid to each clas over the four years. 2021 2022 otal Dividends 2023 2024 Totalarrow_forwardThe annual report for Sneer Corporation disclosed that the company declared and paid preferred dividends in the amount of $140.000 in the current year. It also declared and paid dividends on common stock in the amount of $2.40 per share. During the current year, Sneer had 1 milion common shares authorized; 340,000 shares had been issued; and 136,000 shares were in treasury stock. The opening balance in Retained Earnings was $840,000 and Net Income for the current year was $340,000 Required: 1. Prepare journal entries to record the declaration, and payment, of dividends on (a) preferred and (b) common stock. 2. Using the information given above, prepare a statement of retained earnings for the year ended December 31 3. Prepare a journal entry to close the dividends account.arrow_forwardThe following events are for Toronto Investment Inc.: 2020 Jan. 14 Purchased 18,200 shares of Quatro Inc. common shares for $161,900. Quatro has 91,000 common shares outstanding and has acknowledged the fact that its policies will be significantly influenced by Toronto. Oct. 1 Quatro declared and paid a cash dividend of $3.10 per share. Dec. 31 Quatro announced that profit for the year amounted to $655,000. 2021 April 1 Quatro declared and paid a cash dividend of $3.20 per share. Dec. 31 Quatro announced that profit for the year amounted to $738,100. 31 Toronto sold 6,500 shares of Quatro for $106,820. Prepare general journal entries (Included Picture as sample) 1. Record the purchase of investment (Jan 14, 2020) 2. Record the collection of dividends (Oct 01, 2020) 3. Record the equity share of profits in investment (Dec 31, 2020)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education