FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

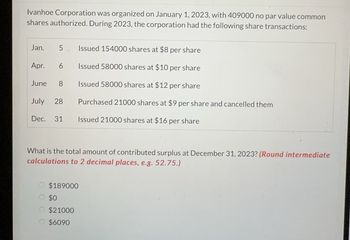

Transcribed Image Text:Ivanhoe Corporation was organized on January 1, 2023, with 409000 no par value common

shares authorized. During 2023, the corporation had the following share transactions:

Jan.

5

Apr. 6

June 8

July 28

Dec. 31

VA

Issued 154000 shares at $8 per share

Issued 58000 shares at $10 per share

Issued 58000 shares at $12 per share

Purchased 21000 shares at $9 per share and cancelled them

Issued 21000 shares at $16 per share

What is the total amount of contributed surplus at December 31, 2023? (Round intermediate

calculations to 2 decimal places, e.g. 52.75.)

O $189000

$0

$21000

$6090

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Queenstown Corporation issues 4,000, $4 cumulative preferred shares at $80 each and 12,000 common shares at $18 at the beginning of 2022. Each preferred share is convertible into four common shares. During the years 2022 and 2023, the following transactions affected Queenstown Corporation's shareholders' equity accounts: 2022 Dec. 10 Declared and paid $12,000 of annual dividends to preferred shareholders. 2023 Dec. 10 Dec. 21 Required: a) b) Declared and paid the annual dividend to preferred shareholders and a $4,000 dividend to common shareholders. The preferred shares were converted into common shares. Journalize each of the 2022 and 2023 transactions. After the preferred shares are converted, what is the total number of common shares issued?arrow_forwardsolve pleasearrow_forwardWildhorse Corporation was organized on January 1, 2025. It is authorized to issue 9,200 shares of 8%, $100 par value preferred stock, and 538,600 shares of no-par common stock with a stated value of $1 per share. The following stock transactions were completed during the first year. Jan. 10 Mar. 1 Apr. May Aug. 1 1 1 Sept. 1 Nov. 1 Issued 80,120 shares of common stock for cash at $6 per share. Issued 5,470 shares of preferred stock for cash at $112 per share. Issued 24,910 shares of common stock for land. The asking price of the land was $90,180; the fair value of the land was $80,120. Issued 80,120 shares of common stock for cash at $9 per share. Issued 9,200 shares of common stock to attorneys in payment of their bill of $51,900 for services rendered in helping the company organize. Issued 9,200 shares of common stock for cash at $11 per share. Issued 1,090 shares of preferred stock for cash at $113 per share. Prepare the journal entries to cord the above transactions. (List all…arrow_forward

- On January 1, 2018, Vermont Maple Corp. had 2,650,000 shares of commons stock issued and outstanding. During 2018, it had the following transactions that affected the common stock account:arrow_forward3. How much is the TOTAL subscribed share capital (assuming subscriptions receivable is collectible on January 5, 2022)? 4. How much is the TOTAL share premium?arrow_forwardThe shareholders' equity section of Charles Corporation at December 31, 2024, included the following: $4 preferred shares, cumulative, 10,000 shares authorized, 4,000 shares issued $400,000 Common shares, 500,000 shares authorized, 350,000 shares issued 2,000,000 Dividends were not declared on the preferred shares in 2024 and are in arrears. On September 15, 2025, the board of directors of Charles Corporation declared all of the annual dividends on the preferred shares for 2024 and 2025, to shareholders of record on October 1, 2025, payable on October 15, 2025. The amount of total dividends declared on preferred shares on September 15, 2025, is $32,000. $16,000. $20,000. ○ $64,000.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education