FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

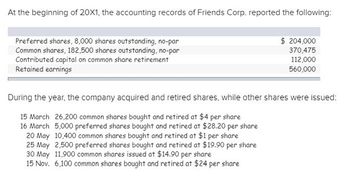

Transcribed Image Text:At the beginning of 20X1, the accounting records of Friends Corp. reported the following:

Preferred shares, 8,000 shares outstanding, no-par

Common shares, 182,500 shares outstanding, no-par

Contributed capital on common share retirement

Retained earnings

$ 204,000

370,475

112,000

560,000

During the year, the company acquired and retired shares, while other shares were issued:

15 March 26,200 common shares bought and retired at $4 per share

16 March 5,000 preferred shares bought and retired at $28.20 per share

20 May 10,400 common shares bought and retired at $1 per share

25 May 2,500 preferred shares bought and retired at $19.90 per share

30 May 11,900 common shares issued at $14.90 per share

15 Nov. 6,100 common shares bought and retired at $24 per share

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- The charter of a corporation provides for the issuance of 119,000 shares of common stock. Assume that 55,000 shares were originally issued and 11,100 were subsequently reacquired. What is the number of shares outstanding? a. 55,000 b. 43,900 c. 119,000 d. 11,100arrow_forwardThe charter of a corporation provides for the issuance of 109,000 shares of common stock. Assume that 55,000 shares were originally issued and 12,900 were subsequently reacquired. What is the number of shares outstanding? a.42,100 b.12,900 c.109,000 d.55,000arrow_forwardIssued shares are the number of O authorized shares that have been sold. O shares a corporation is legally able to sell. shares sold each year by the corporation. O authorized shares in the corporation's articles of incorporation.arrow_forward

- The charter of a corporation provides for the issuance of 117,000 shares of common stock. Assume that 64,000 shares were originally issued and 11,700 were subsequently reacquired. What is the number of shares outstanding? a. 52,300 b. 64,000 c. 11,700 d. 117,000arrow_forwardSpartan Corporation redeemed 25 percent of its shares for $1,800 on July 1 of this year, in a transaction that qualified as an exchange under IRC §302(a). Spartan’s accumulated E&P at the beginning of the year was $1,800. Its current E&P is $16,300. Spartan made dividend distributions of $2,700 on June 1 and $6,000 on August 31. Determine the beginning balance in Spartan’s accumulated E&P at the beginning of the next year. See Revenue Rules 74-338 and 74-339 for help in making this calculation. (Round your intermediate calculations to the nearest whole dollar amount.)arrow_forwardThe charter of a corporation provides for the issuance of 138,000 shares of common stock. Assume that 54,000 shares were originally issued and 13,100 were subsequently reacquired. What is the number of shares outstanding?arrow_forward

- The charter of a corporation provides for the issuance of 136,000 shares of common stock. Assume that 66,000 shares were originally issued and 10,900 were subsequently reacquired. What is the number of shares outstanding? a.66,000 b.136,000 c.10,900 d.55,100arrow_forwardOriole Inc. (OI) is a backyard pond design and installation company. Ol was incorporated during 2023, with an unlimited number of common shares, and 42,000 preferred shares with a $3 dividend rate authorized. Ol follows ASPE. The following transactions took place during the first year of operations with respect to these shares: Jan. 1 Jan. 15 Feb. 20 Mar. 3 May 10 Sept. 23 Nov. 28 Dec. 31 The articles of incorporation were filed and state that an unlimited number of common shares and 42,000 preferred shares are authorized. Dec. 31 25,200 common shares were sold by subscription to 3 individuals, who each purchased 8,400 shares for $42 per share. The terms require 8% of the balance to be paid in cash immediately. The balance was to be paid by December 31, 2024, at which time the shares will be issued. 58,800 common shares were sold by subscription to 7 individuals, who each purchased 8,400 shares for $42 per share. The terms require that 8% of the balance be paid in cash immediately,…arrow_forwardThe charter of a corporation provides for the issuance of 114,000 shares of common stock. Assume that 51,000 shares were originally issued and 6,800 were subsequently reacquired. What is the number of shares outstanding?arrow_forward

- If a corporation fails to declare a dividend on cumulative preferred stock in a given year, the dividends in arrears accumulate from period to period. the dividends in arrears are recorded as liabilities. the common shareholders may still receive dividends in the current year. all of these options apply.arrow_forwardThe charter of a corporation provides for the issuance of 120,000 shares of common stock. Assume that 45,000 shares were originally issued and 6,100 were subsequently reacquired. What is the number of shares outstanding? a.38,900 b.6,100 c.51,100 d.45,000arrow_forwardThe charter of a corporation provides for the issuance of 95,662 shares of common stock. Assume that 37,907 shares were originally issued and 3,885 were subsequently reacquired. What is the amount of cash dividends to be paid if a $2 per share dividend is declared? a.$68,044 b.$3,885 c.$95,662 d.$37,907arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education