FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

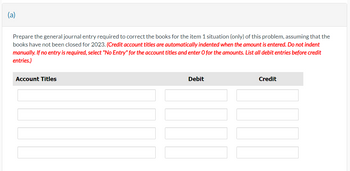

Transcribed Image Text:(a)

Prepare the general journal entry required to correct the books for the item 1 situation (only) of this problem, assuming that the

books have not been closed for 2023. (Credit account titles are automatically indented when the amount is entered. Do not indent

manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit

entries.)

Account Titles

Debit

|||

Credit

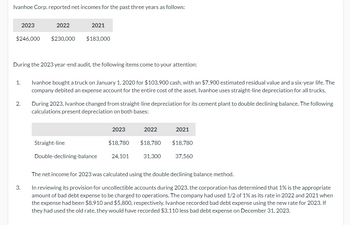

Transcribed Image Text:Ivanhoe Corp. reported net incomes for the past three years as follows:

$246,000 $230,000

1.

2023

2.

2022

3.

During the 2023 year-end audit, the following items come to your attention:

2021

$183,000

Ivanhoe bought a truck on January 1, 2020 for $103,900 cash, with an $7,900 estimated residual value and a six-year life. The

company debited an expense account for the entire cost of the asset. Ivanhoe uses straight-line depreciation for all trucks.

During 2023, Ivanhoe changed from straight-line depreciation for its cement plant to double declining balance. The following

calculations present depreciation on both bases:

Straight-line

2023

$18,780

Double-declining-balance 24,101

2022

2021

$18,780 $18,780

31,300

37,560

The net income for 2023 was calculated using the double declining balance method.

In reviewing its provision for uncollectible accounts during 2023, the corporation has determined that 1% is the appropriate

amount of bad debt expense to be charged to operations. The company had used 1/2 of 1% as its rate in 2022 and 2021 when

the expense had been $8,910 and $5,800, respectively. Ivanhoe recorded bad debt expense using the new rate for 2023. If

they had used the old rate, they would have recorded $3,110 less bad debt expense on December 31, 2023.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Audit strategy must include: Characteristics of the engagement (Scope) Timing of reporting Materiality Risk assessment procedures performed Audit approacharrow_forwardWiater Company operates a small manufacturing facility. On January 1, 2021, an asset account for the company showed the following balances: Equipment Accumulated Depreciation (beginning of the year) $ 344,000 212,000 During the first week of January 2021, the following cash expenditures were incurred for repairs and maintenance: Routine maintenance and repairs on the equipment Major overhaul of the equipment that improved efficiency $ 3,550 41,000 The equipment is being depreciated on a straight-line basis over an estimated life of 15 years with a $26,000 estimated residual value. The annual accounting period ends on December 31. Required: - Indicate the effects (accounts, amounts, and + for increase and – for decrease) of the following two items on the accounting equation, using the headings shown below. (Enter any decreases to Assets, Liabilities or Stockholder's Equity with a minus sign.) 1. The adjustment for depreciation made last year at the end of 2020. 2. The two expenditures…arrow_forwardAshvinbhaiarrow_forward

- PROBLEM 8 - AUDITING PROBLEMCompute the following:1. The corrected pre-tax profit for 20212. What is the net effect of the foregoing errors on the total assets at December 31, 2021? 3. What is the total understatement of the total liabilities at December 31, 2021?arrow_forwardVijayarrow_forwardThe Chief Financial Officer of Company X decides to purchase 1000 units of a key component for the company’s core Widget line for $1.0 million in cash. The purchase is recorded as the final entry at the close of business on the last working day of Fiscal Year 2019. As a result.... The Gross Margin declines. The Payables Turnover ratio increases. The Return on Equity increases. The Cash Flow Margin declines.arrow_forward

- The following data are accumulated by Geddes Company in evaluating the purchase of $150,000 of equipment, having a four-year useful life: Net Income Net Cash Flow Year 1 $44,000 $81,500 Year 2 26,000 63,500 Year 3 10,000 47,500 Year 4 3,000 40,500 This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. Open spreadsheet Assuming that the desired rate of return is 12%, determine the net present value for the proposal. If required, round to the nearest dollar. Net present value $fill in the blank 2arrow_forwardDengararrow_forwardThe accounting records of Ehrlich Inc. show the following data for 20201. Life insurance expense on officers was $10,000.2. Equipment was acquired in early January for $450,000. Straight-line depreciation over a 6-year life is used, with no salvagevalue. For tax purposes, Ehrlich used a 30% rate to calculate depreciation.3. Interest revenue on municipal bonds totaled $3,600.4. Product warranties were estimated to be $90,000 in 2020. Actual repair and labor costs related to the warranties in 2020were $24,000. The remainder is estimated to be paid evenly in 2021 and 2022.5. Sales on an accrual basis were $500,000. For tax purposes, $400,000 was recorded on the installment-sales method.6. Fines incurred for securities violations were $10,600.7. Pretax financial income was $460,000. The tax rate is 30%.Instructions(a) Prepare a schedule starting with pretax financial income in 2020 and ending with taxable income in 2020.(b) Prepare the journal entry for 2020 to record income taxes payable,…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education