FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

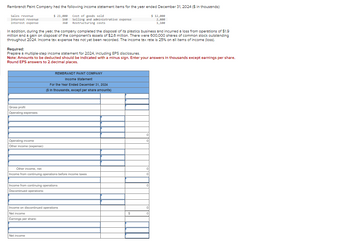

Transcribed Image Text:Rembrandt Paint Company had the following income statement items for the year ended December 31, 2024 ($ in thousands):

Sales revenue

Interest revenue

Cost of goods sold

$ 12,000

$ 21,000

168 Selling and administrative expense

368 Restructuring costs

Interest expense

2,800

1,108

In addition, during the year, the company completed the disposal of its plastics business and incurred a loss from operations of $1.9

million and again on disposal of the component's assets of $2.6 million. There were 600,000 shares of common stock outstanding

throughout 2024. Income tax expense has not yet been recorded. The income tax rate is 25% on all items of income (loss).

Required:

Prepare a multiple-step income statement for 2024, including EPS disclosures.

Note: Amounts to be deducted should be indicated with a minus sign. Enter your answers in thousands except earnings per share.

Round EPS answers to 2 decimal places.

Gross profit

Operating expenses:

Operating income

Other income (expense):

REMBRANDT PAINT COMPANY

Income Statement

For the Year Ended December 31, 2024

($ In thousands, except per share amounts)

Other income, net

Income from continuing operations before income taxes

Income from continuing operations

Discontinued operations:

Income on discontinued operations

Net income

Earnings per share:

Net income

S

0

0

0

0

0

0

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On its December 31 prior year balance sheet, Calgary Industries reports equipment of $540,000 and accumulated depreciation of $91,000. During the current year, the company plans to purchase additional equipment costing $97,000 and expects depreciation expense of $47,000. Additionally, it plans to dispose of equipment that originally cost $59,000 and had accumulated depreciation of $7,300. The balances for equipment and accumulated depreciation, respectively, on its December 31 current year budgeted balance sheet are: Multiple Choice $578,000; $138,000. $481,000, $91,000, O $637,000; $130,700 $637,000; $138,000 $578,000, $130,700.arrow_forwardAshvinbhaiarrow_forwardA chemical company has a total income of 1.62 million per year and total expenses of 716057 not including depreciation. At the start of the first year of operation, a composite account of all depreciable assets shows a value of 1.24 with a MACRS recovery period of 7 years, and a straight-line recovery period of 9.4 years. Thirty-five percent of all profits before taxes must be paid out for income taxes. What would be the reduction in income tax charges for the first year of operation if the MACRS method were used for the depreciation accounting instead of the straight-line method?-arrow_forward

- During 2018, Raines Umbrella Corporation had sales of $738,000. Cost of goods sold, administrative and selling expenses, and depreciation expenses were $562,000, $99,000, and $133,000, respectively. In addition, the company had an interest expense of $104,000 and a tax rate of 30 percent. (Ignore any tax loss carryback or carryforward provisions.) Assume Raines Umbrella Corporation paid out $17,000 in cash dividends. If spending on net fixed assets and net working capital was zero, and if no new stock was issued during the year, what is the firm's net new long-term debt? Multiple Choice O $77,450 O $44,000 O $94,000 $0 O $19,500arrow_forwardDuring 2020, Riverbed Corporation reported net sales of $5,542,800 and net income of $1,560,000. Its balance sheet reported average total assets of $1,490,000. Calculate the asset turnover. (Round answer to 2 decimal places, e.g. 1.25.) Asset turnover timesarrow_forwardMainline Clinic, a for-profit business, had revenues of $11.1 million last year. Expenses other than depreciation totaled 67 percent of revenues, and depreciation expense was $1.3 million. All revenues were collected in cash during the year, and all expenses other than depreciation were paid in cash. Mainline must pay taxes at a rate of 39 percent of pretax (operating) income. Now, suppose the company changed its depreciation calculation procedures (still within GAAP) such that its depreciation expense doubled. How would this change affect Mainline’s net income? If net income would go down, enter the amount of the change as a negative number. If net income would go up, enter the amount of the change as a positive number.arrow_forward

- During 2018, Raines Umbrella Corporation had sales of $749,000. Cost of goods sold, administrative and selling expenses, and depreciation expenses were $576,000, $101,000, and $131,000, respectively. In addition, the company had an interest expense of $99,000 and a tax rate of 40 percent. (Ignore any tax loss carryback or carryforward provisions.) Assume Raines Umbrella Corporation paid out $16,000 in cash dividends. If spending on net fixed assets and net working capital was zero, and if no new stock was issued during the year, what is the firm's net new long-term debt?arrow_forwardLok Co. reports net sales of $5,856,480 for Year 2 and $8,679,690 for Year 3. End-of-year balances for total assets are Year 1, $1,686,000; Year 2, $1,800,000; and Year 3, $1,982,000. (a) Compute Lok’s total asset turnover for Year 2 and Year 3. (b) Lok’s competitor has a turnover of 3.0. Is Lok performing better or worse than its competitor on the basis of total asset turnover?arrow_forwardDexter Industries purchased packaging equipment on January 8 for $116,600. The equipment was expected to have a useful life of three years, or 20,000 operating hours, and a residual value of $6,600. The equipment was used for 8,700 hours during Year 1, 7,380 hours in Year 2, and 3,920 hours in Year 3. Determine the amount of depreciation expense for the three years ended December 31 by (a) the double-declining-balance method. Also determine the total depreciation expense for the year by this method. (Note: For the Declining Balance, round the multiplier to five decimal places. Then round the answer for the year to the nearest whole dollar.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education