FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

What is the warranty expense?

A. 1,640,000

B. 1,080,000

C. 800,000

D. 360,000

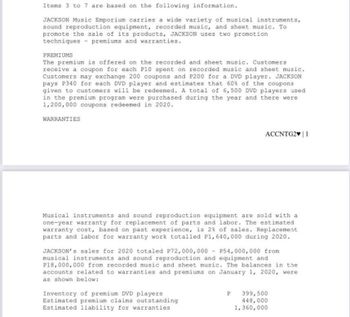

Transcribed Image Text:Items 3 to 7 are based on the following information.

JACKSON Music Emporium carries a wide variety of musical instruments,

sound reproduction equipment, recorded music, and sheet music. To

promote the sale of its products, JACKSON uses two promotion

techniques premiums and warranties.

PREMIUMS

The premium is offered on the recorded and sheet music. Customers

receive a coupon for each P10 spent on recorded music and sheet music.

Customers may exchange 200 coupons and P200 for a DVD player. JACKSON

pays P340 for each DVD player and estimates that 60% of the coupons

given to customers will be redeemed. A total of 6,500 DVD players used

in the premium program were purchased during the year and there were

1,200,000 coupons redeemed in 2020.

WARRANTIES

ACCNTG2♥ | 1

Musical instruments and sound reproduction equipment are sold with a

one-year warranty for replacement of parts and labor. The estimated

warranty cost, based on past experience, is 2% of sales. Replacement

parts and labor for warranty work totalled P1, 640,000 during 2020.

JACKSON's sales for 2020 totaled P72,000,000 P54,000,000 from

musical instruments and sound reproduction and equipment and

P18,000,000 from recorded music and sheet music. The balances in the

accounts related to warranties and premiums on January 1, 2020, were

as shown below:

Inventory of premium DVD players

Estimated premium claims outstanding

Estimated liability for warranties

P 399,500

448,000

1,360,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- QUESTION 5 Katharine Bartle will receive an annuity of $4,090.00 every month for 23 years. How much is this cash flow worth to them today if the payments begin today? Assume a discount rate of 5.00%. Oa. $55,398.13 b. $2,119,880.47 c. $672,837.73 Od. $170,156.69arrow_forwardUse the NPV method to determine whether Root Products should invest in the following projects: • Project A: Costs $275,000 and offers eight annual net cash inflows of $53,000. Root Products requires an annual return of 12% on investments of this nature. Project B: Costs $380,000 and offers 9 annual net cash inflows of $74,000. Root Products demands an annual return of 10% on investments of this nature. E(Click the icon to view Present Value of $1 table.) E (Click the icon to view Present Value of Ordinary Annuity of $1 table.) Read the requirements. Requirement 1. What is the NPV of each project? Assume neither project has a residual value. Round to two decimal places. (Enter any factor amounts to three decimal places, X.XXX. Use parentheses or a minus sign for a negative net present value.) Caclulate the NPV (net present value) of each project. Begin by calculating the NPV of Project A. Project A: Net Cash Annuity PV Factor Present Years Inflow (i=12%, n=8) Value 1-8 Present value of…arrow_forward9arrow_forward

- Use the table below to answer the following questions: Period 4 567 8 9 10 11 Present Value of an Annuity of 1 4% Future Value of an Annuity of 1 5% 5% 8% 10% 4% 8% 10% 3.6299 3.5460 3.3121 3.1699 4.2465 4.3101 4.5061 4.6410 4.4518 4.3295 3.9927 3.7908 5.4163 5.5256 5.8666 6.1051 5.2421 5.0757 4.6229 4.3553 6.6330 6.8019 7.3359 7.7156 6.0021 5.7864 5.2064 4.8684 7.8983 8.1420 8.9228 9.4872 5.7466 5.3349 9.2142 9.5491 10.6366 11.4359 7.4353 7.1078 6.2469 5.7590 10.5828 11.0266 12.4876 13.5795 8.1109 7.7217 6.7101 6.1446 12.0061 12.5779 14.4866 15.9374 8.7605 8.3064 7.1390 6.4951 13.4864 14.2068 16.6455 18.5312 6.7327 6.4632 Bobby receives alimony payments every 6 months and the next payment is tomorrow. Median homes go for $950,000 and he wants to save $190,000 in 4 years. How much money should Bobby put away into an investment each time he receives alimony payments if he can get a 8% return a year? $35,593 O $31,624 O $23,131 O $46,262arrow_forwardAlice Longtree has decided to invest $430 quarterly for 4 years in an ordinary annuity at 8%. As her financial adviser, calculate for Alice the total cash value of the annuity at the end of year 4. (Please use the following provided Table.) (Do not round intermediate calculations. Round your answer to the nearest cent.) Future valuearrow_forwardST Unit 8 Quest (11U) + pQLSf8ziezOsWz6j9T7OGVQSHI-6ls9bQrlQevfkKxle-RtQ3Rlg/formResponse Question 6: How much was the amount of the original loan? Regular Payment Rate of Compound Interest per Year Compounding Period semi-annual $1575 every 6 months 5.4% $8445.09 $17076.01 a. b. $14 444.94 $24 143.61 a b C. d. Time 6 yearsarrow_forward

- Umarrow_forward14. What is the present value of $250,000 received in 250 days at 12% p.a. simple interest? Select one: a. $250,000.00 b. $231,012.66 c. $201,905.00 d. $213,012.66arrow_forwardQuestion: A debenture of $100 each is issued at $90 per debenture. How much is the discount? A. $0 B. full C . $10 D. $90arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education