FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Help to clarify the

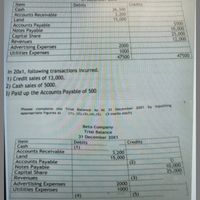

Transcribed Image Text:Debits

Item

Cash

Accounts Receivable

Land

Accounts Payable

Notes Payable

Capital Share

Revenues

Credits

26,300

3,200

15,000

$500

10,000

25,000

12,000

2000

Advertising Expenses

Utilities Expenses

1000

47500

47500

In 20x1, following transactions incurred.

1) Credit sales of 13,000.

2) Cash sales of 5000.

3) Paid up the Accounts Payable of 500

appropriate figures at

(1), (2),(3), (4),(5). (i marks eachi

Beta Company

Trial Balance

31 December 20X1

Debits

(1)

Item

Cash

Credits

Accounts Receivable

Land

Accounts Payable

Notes Payable

Capital Share

Revenues

3,200

15,000

(2)

10,000

25,000

Advertising Expenses

Utilities Expenses

(3)

2000

1000

(5)

(4)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- background info: Green checkmark means that entry is correct, red is wrong. There is only supposed to be a total of 19 entries. look at 1 picture with the complete journal and adjust to fit the allowance method to go into the second table with green and red corrections. The first entry....you are removing the account so you have to remove the allowance and related receivable (2 parts) The second entry...you want to record the cash received, the removal of the allowance and related receivable (3 parts) The third entry...recording a credit sales (2 parts) The fourth entry...setting up receivable and the allowance (2 parts) The fifth entry...record collection of a previously recorded credit sale (2 parts) The sixth entry...record collection of a previously recorded credit sale (2 parts) The seventh entry...adjusting the allowance by reducing the allowance and reducing 5 customer receivable accounts (6 parts) 1. Finalize the journal entries shown on the Fan-Tastic Sports Gear Inc. panel…arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardPaid interest expense on Note recorded previously (above). Select the account(s) that would be debited and credited when recording the above transaction. If a second debit or credit does not apply, select "None" as a match. Debit Debit Credit Credit Interest Expense Interest Payable Interest Payable Casharrow_forward

- (b) To record estimated liability. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Period 1 Account Titles and Explanation Period 2 Account Titles and Explanation Save for Later Debit Debit Credit Credit Attempts: 0 of 1 used Submit Answerarrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardRahularrow_forward

- Complete the table for the last three payments. (Do not round until the final answer. Then round to the nearest cent as needed.) Payment Number Amount Paid Interest Paid Principal Repaid Outstanding Principal Balance 30 31 32 $0 Total Paid = $ (Do not round until the final answer. Then round to the nearest cent as needed.) Interest Paid = S (Do not round until the final answer. Then round to the nearest cent as needed.)arrow_forward8. ABC Cleaning Company paid off the $280 they owe to XYZ Corp, check #104. • Which accounts are affected? Is it an increase or decrease to the account? Where will the debit and credit be reported? Okay Youarrow_forward3. Zach had surgery, which was his third claim of the year. He had a bill of $5000. Considering the prior visits, what is Zach's portion of this bill, and what is the responsibility of the insurance carrier? 4. How much is Zach responsible for so far this year considering his first three visits?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education