FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

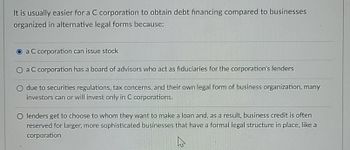

Transcribed Image Text:It is usually easier for a C corporation to obtain debt financing compared to businesses

organized in alternative legal forms because:

a C corporation can issue stock

O a C corporation has a board of advisors who act as fiduciaries for the corporation's lenders

O due to securities regulations, tax concerns, and their own legal form of business organization, many

investors can or will invest only in C corporations.

O lenders get to choose to whom they want to make a loan and, as a result, business credit is often

reserved for larger, more sophisticated businesses that have a formal legal structure in place, like a

corporation

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Which of the following statements is true about different types of firms? O Corporations do not have limited liability O Owners of a corporation are liable for any obligations it enters into O Partnerships are the most common type of business firms in the world O A limited liability company is like a corporation because its owners are not personally liable for the firm's debtsarrow_forwardSelect all that are true with respect the similarities or differences between debt and equity. Group of answer choices Debt represents an ownership interest in the firm, equity does not. Equity represents an ownership interest in the firm, debt does not. Generally speaking, dividends are tax deductible, interest is not. (US tax laws) Generally speaking, interest is tax deductible, dividends are not. (US tax laws) Debtholders have priority over equity holders in receiving "payments".arrow_forwardTrue or false: The corporation, and not the owners, are viewed as owning the resources and as owing the debts of the business. O True O Falsearrow_forward

- Match the following terms to their correct definitionarrow_forward3. John is president and sole shareholder of Photo, Inc. Photo, Inc. wishes to borrow money, but to do so, the bank requires John to orally guarantee to repay the loan if Photo, Inc. cannot. Examine the validity of John’s oral guarantee.arrow_forward1 The most important exemption from the prospectus requirement are the "Accredited Investors" provisions in the Securities Act. Who are defined as Accredited Investors? Multiple Choice Banks and investment dealers. Individuals and their spouses owning net financial assets exceeding $1 million; and individuals who, either alone or with a spouse, have net assets of at least $5 million. Banks, investment dealers and governments. All of these are accredited investors. Governments.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education