FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

It is talking about Hong Kong Tax, Special Business, Profit Tax Computation of Financial instituition, please explain what is DIPN 21 and its related two concepts, "Initiation" and "funding" with example, and explain the two drafts below.

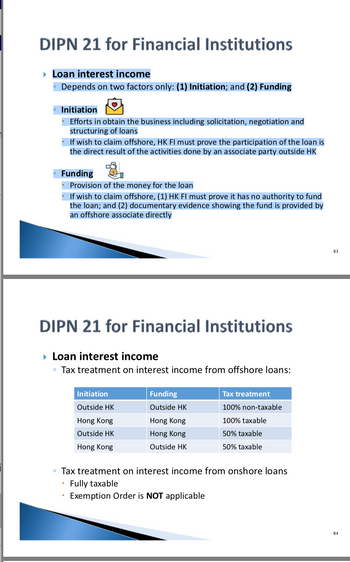

Transcribed Image Text:DIPN 21 for Financial Institutions

▸ Loan interest income

Depends on two factors only: (1) Initiation; and (2) Funding

Initiation

Efforts in obtain the business including solicitation, negotiation and

structuring of loans

⚫ If wish to claim offshore, HK FI must prove the participation of the loan is

the direct result of the activities done by an associate party outside HK

Funding

Provision of the money for the loan

If wish to claim offshore, (1) HK FI must prove it has no authority to fund

the loan; and (2) documentary evidence showing the fund is provided by

an offshore associate directly

DIPN 21 for Financial Institutions

▸ Loan interest income

。 Tax treatment on interest income from offshore loans:

Initiation

Outside HK

Funding

Outside HK

Hong Kong

Hong Kong

Tax treatment

100% non-taxable

100% taxable

Outside HK

Hong Kong

50% taxable

Hong Kong

Outside HK

50% taxable

。 Tax treatment on interest income from onshore loans

Fully taxable

Exemption Order is NOT applicable

83

84

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- The taxes most relevant for personal financial planning are: A. Income tax B. Sales tax C. Estate tax D. Consumer taxarrow_forwardCalculation of Foreign Tax Credit (here is the answer for A&F. You need to complete Basket B&D and Basket Earrow_forwardThere are two basis of accounting: cash basis and accrual basis. Personal finance often focuses on the cash basis, whereas corporate accounting focuses on the accrual basis, as prescribed by U.S. Generally Accepted Accounting Principles (GAAP). Furthermore, tax filers focus on the modified accrual basis. If you were about to select the basis of accounting for your organization, which basis would you select, and why?arrow_forward

- What are seven organizational policies and procedures that would relate to the preparation of tax documentation for individual taxpayers in Australia?arrow_forwardWhat would be the appropriate account title for funds collected by a sales tax custodial fund? A. Sales tax revenue B. Other financing sources C. Additions-tax collections for other governments D. Sales taxes receivablearrow_forwardIt is talking about Hong Kong Tax, Special Business, Profit Tax Comuptaion of Financila instituition, please explain the DIPN 21 "Initiation" and "funding".arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education