FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

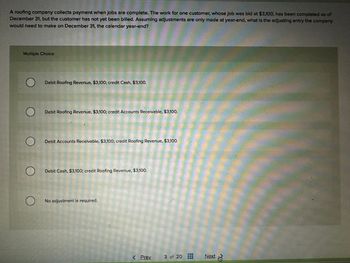

Transcribed Image Text:A roofing company collects payment when jobs are complete. The work for one customer, whose job was bid at $3,100, has been completed as of

December 31, but the customer has not yet been billed. Assuming adjustments are only made at year-end, what is the adjusting entry the company

would need to make on December 31, the calendar year-end?

Multiple Choice

O

O

O

O

O

Debit Roofing Revenue, $3,100; credit Cash, $3,100.

Debit Roofing Revenue, $3,100; credit Accounts Receivable, $3,100.

Debit Accounts Receivable, $3,100; credit Roofing Revenue, $3,100.

Debit Cash, $3,100; credit Roofing Revenue, $3,100.

No adjustment is required.

< Prey.

3 of 20

Next

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Brushstroke Art Studio, Inc., provides quality instruction to aspiring artists. The business adjusts its accounts monthly, but performs closing entries annually on December 31. This is the studio’s unadjusted trial balance dated December 31, current year. Other Data1. Supplies on hand at December 31, current year, total $1,000. 2. The studio pays rent quarterly (every three months). The last payment was made November 1, current year. The next payment will be made early in February, next year. 3. Studio equipment is being depreciated over 120 months (10 years). 4. On October 1, current year, the studio borrowed $24,000 by signing a 12-month, 12 percent note payable. The entire amount, plus interest, is due on September 30, next year. 5. At December 31, current year, $3,000 of previously unearned client fees had been earned. 6. Accrued, but unrecorded and uncollected client fees earned total $690 at December 31, current year. 7. Accrued, but unrecorded and unpaid salary expense totals…arrow_forwardAccording to your studying of the Conceptual Framework, Discuss the following: 1. Selane Eatery operates a catering service specializing in business luncheons for large companies. Selane requires customers to place their orders 2 weeks in advance of the scheduled events. Selane bills its customers on the tenth day of the month following the date of service and requires that payment be made within 30 days of the billing date. Conceptually, when should Selane recognize revenue related to its catering service? 2. Mogilny Company paid $135,000 for a machine. The Accumulated Depreciation account has a balance of $46,500 at the present time. The company could sell the machine today for $150,000. The company president believes that the company has a “right to this gain.” What does the president mean by this statement? Do you agree? 3. Three expense recognition methods (associating cause and effect, systematic and rational allocation, and immediate recognition) were discussed in the chapter…arrow_forwardAt the end of April, Hernandez Company had a balance of $35,070 in the vacation benefits payable account. During May, employees earned an additional $2,730 in vacation benefits, but some employees used vacation days that amounted to $1,920 of the vacation benefits. The $1,920 was charged to Wages Expense when it was paid in May. What adjusting entry would Hernandez Company make at the end of May to bring the vacation benefits payable account up to date? If an amount box does not require an entry, leave it blank. Account Debit Credit Vacation Benefits Expense Vacation Benefits Payable Feedback Additional Vacation benefits earned less benefits paid; balance should be debited to Vacation Benefits Expense and credited to Vacation Benefits Payable.arrow_forward

- Ken Hensley Enterprises, Inc., is a small recording studio in St. Louis. Rock bands use the studio to mix high-quality demo recordings distributed to talent agents. New clients are required to pay in advance for studio services. Bands with established credit are billed for studio services at the end of each month. Adjusting entries are performed on a monthly basis. Below is an unadjusted trial balance dated December 31 of the current year. (Bear in mind that adjusting entries have already been made for the first 11 months, but not for December.) KEN HENSLEY ENTERPRISES, INC.UNADJUSTED TRIAL BALANCEDECEMBER 31, CURRENT YEAR Cash $ 51,804 Accounts receivable 97,680 Studio supplies 9,120 Unexpired insurance 600 Prepaid studio rent 4,800 Recording equipment 108,000 Accumulated depreciation: recording equipment $ 63,000 Notes payable 19,200 Interest payable 1,008 Income taxes…arrow_forwardA roofing company collects fees when jobs are complete. The work for one customer, whose job was bid at $3,000, has been completed as of December 31, but the customer has not yet been billed. An adjusting entry for this transaction is made at year-end, what accounting principle/concept requires this adjusting entry? matching proper internal controls required billing full and fair disclosure No adjustment is required.arrow_forwardYour Personal Chef, Inc. prepares healthy gourmet dinners for clients on a subscription basis. Clients pay $75 per week for 3 delivered dinners. During 2019, Your Personal Chef, Inc. received advance payments of $18,000. At December 31, 2019, two-thirds of the advance payments had been earned. Make the entry for the advance payments received during the year. Make the necessary adjusting entry at December 31, 2019. What is the balance in the Unearned Revenue Account after the adjusting entry is made?arrow_forward

- At Bramble Company, employees are entitled to one day’s vacation for each month worked. In January, 70 employees worked the full month. Record the vacation pay liability for January, assuming the average daily pay for each employee is $120. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answer to 0 decimal place, eg. 2500.) Date Account Titles and Explanation Debit Credit Jan. 31arrow_forwardI’m not quite sure if i understand question 1 a. and 1b. Can you please help or explain?arrow_forwardOffice Depot has an invoice for $3,814 dated May 8, with terms of 3/10, 2/15, n/30. The invoice also has a 1% penalty per month for payment after 30 days. a. What amount is due if paid on May 12? b. What amount is due if paid on May 22? c. What amount is due if paid on June 7? d. What amount is due if paid on June 13?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education