FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

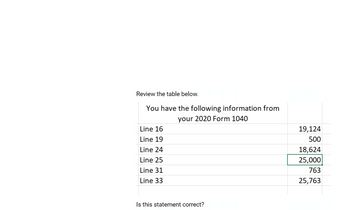

Is this statement correct based on the form 1040 above?

a. The calculation for the balance due can be found on a 1040 worksheet and not on the form 1040 itself.

b. The child tax credit increases the taxpayer's refund by $500

Edit - this is the only imformation the test provides for this qiestion

Transcribed Image Text:Review the table below.

You have the following information from

your 2020 Form 1040

Line 16

Line 19

Line 24

Line 25

Line 31

Line 33

Is this statement correct?

19,124

500

18,624

25,000

763

25,763

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Which amounts on the payroll register reduce Federal withholding tax but are not deducted for FICA tax computations (You may select more than one answer. Charitable contrubutions retirement plan (401k, contributions non qualified pre tax insurance garnishmentsarrow_forwardA tax preparer may be subject to a $540 preparer penalty under IRC 56695(g) Select one: O a For failure to comply with due diligence requirements limited to a maximum of $540 O b. For each failure to comply with the due diligence requirements OC. For failure to file Form 8879 O d For including a Schedule A when filing a return using the standard deduction O e. None of these Jeff is a single taxpayer who sold his home when he was transferred from NY to Denver by his employer. He purchased the home on January 10, 2013 He was sent by his Cempany for temporary assignment to Detroit on February 1, 2016, that lasted for longer and was gone for 16 months in 2016 and 2017, during which time he rented out his home. He moved back into the home on June 3, 2017 He sold the home on March 15, 2020. Jeff can claim an exclusion of gain on the sale up to Select one EO a $500.000 O b. $300,000 O C $250,000 Od soarrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- True or False.arrow_forwardPlease advise on the answers for After Tax (C) the first two answers are wrong. It is not -26100 and -22960. Please advise.arrow_forwardRequired information Problem 8-77 (LO 8-5) (Algo) [The following information applies to the questions displayed below.] This year Lloyd, a single taxpayer, estimates that his tax liability will be $12,250. Last year, his total tax liability was $16,500. He estimates that his tax withholding from his employer will be $9,225. Problem 8-77 Part b (Algo) b. Assuming Lloyd does not make any additional payments, what is the amount of his underpayment penalty? Assume the federal short-term rate is 5 percent. Note: Do not round intermediate calculations. Round your final answers to 2 decimal places. Dates April 15th June 15th September 15th January 15th Total Actual Withholding Required Withholding Over (Under) Withheld Penalty Per Quarter $ 0.00arrow_forward

- 24. As a newly hired IRS trainee, you have been asked to calculate the amount of tax refund or tax owed for the taxpayer (in $). (Enter a positive value for the amount.) Name TaxLiability TaxCredits OtherTaxes Payments Refund/Owe(Select one) Amount Trent $5,798 $1,331 $875 $6,700 $arrow_forwardSM2arrow_forwardRequired: Use the following information to complete Rhonda Hill's federal income tax return. If any information is missing, use reasonable assumption to fill in the gaps. Prepare this return for the year ending December 31, 2021 You may use any tax software program to complete the return, or you can do them manually by downloading fillable forms from the IRS website (www.irs.gov). The forms, schedules, and instructions can be found at the IRS website (www.irs.gov). The instructions can be helpful in completing the forms. Facts: 1. Rhonda Hill (unmarried) is employed as an office manager at the main office of Carter & Associates CPA firm. Rhonda lives in a home she purchased 20 years ago. Rhonda's older cousin Mabel Wright lives with Rhonda in her home. Mabel is retired and receives $2,400 of Social Security payments each year. Mabel is able to save this money because Rhonda provides all of Mabel's support. Rhonda also provided the following information. Rhonda does not want to…arrow_forward

- Which of the following statements regarding a Coverdell Education Savings Account (CESA) is incorrect? Multiple Choice In order to be tax-free, distributions must be used exclusively to pay the qualified education expenses of the beneficiary. Any person can contribute to a CESA, even if he or she is not related to the beneficiary. Contributions to a CESA are not tax-deductible. A person can contribute to only one CESA during each tax year.arrow_forwardPlease complete all requirement with Explanation and don not give solution in image formatarrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education