Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

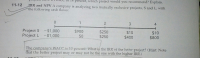

Transcribed Image Text:IRR and NPV A company is analyzing two mutually exclusive projects, S and L, with

*the following cash flows:

1

2

3

4

Project S -$1,000

$900

$250

$250

$10

$400

$10

Project L

-$1,000

$0

$800

The company's WACC is 10 percent. What is the IRR of the better project? (Hint: Note

that the better project may or may not be the one with the higher IRR.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 9. Consider the following two mutually exclusive projects: Project A Project B -$15,000 -$25,000 $5,000 $12,000 $8,000 n 10 $0 $X $X 3 PW (15%) ? $9,600 The firm's MARR is known to be 15%. Compute the PW (15%) for Project A. 10. In question 9, compute the unknown cash flow X in years 2 and 3 for Project B. 11. In question 9, which project would you select?arrow_forwardPlease show workingarrow_forwardConsider the following two projects: Cash flows Project A Project B C0�0 −$ 240 −$ 240 C1�1 100 123 C2�2 100 123 C3�3 100 123 C4�4 100 a. If the opportunity cost of capital is 8%, which of these two projects would you accept (A, B, or both)? b. Suppose that you can choose only one of these two projects. Which would you choose? The discount rate is still 8%. c. Which one would you choose if the cost of capital is 16%? d. What is the payback period of each project? e. Is the project with the shortest payback period also the one with the highest NPV? f. What are the internal rates of return on the two projects? g. Does the IRR rule in this case give the same answer as NPV? h. If the opportunity cost of capital is 8%, what is the profitability index for each project? i. Is the project with the highest profitability index also the one with the highest NPV? j. Which measure should you use to choose between the projects?arrow_forward

- A company is analyzing two mutually exclusive projects, S and L, with the following cash flows: 1 2 3 4 Project S -$1,000 $870.95 $260 $5 $10 Project L -$1,000 $5 $260 $400 $803.94 The company's WACC is 8.0%. What is the IRR of the better project? (Hint: The better project may or may not be the one with the higher IRR.) Round your answer to two decimal places. %arrow_forwardplease be soecific w answer pls complete the boxarrow_forwardA company is analyzing two mutually exclusive projects, S and L, with the following cash flows: 0 1 2 3 4 Project S -$1,000 $875.58 $260 $10 $15 Project L -$1,000 $0 $250 $380 $843.71 The company's WACC is 10.0%. What is the IRR of the better project? (Hint: The better project may or may not be the one with the higher IRR.) Round your answer to two decimal places.arrow_forward

- A company is analyzing two mutually exclusive projects, S and L, with the following cash flows: Project S Project L 0 % 1 2 3 4 $879.45 $250 $10 -$1,000 -$1,000 $0 $15 $420 $260 $734.66 The company's WACC is 9.5%. What is the IRR of the better project? (Hint: The better project may or may not be the one with the higher IRR.) Round your answer to two decimal places.arrow_forwardA company is analyzing two mutually exclusive projects, S and L, with the following cash flows: 0 % 1 2 3 4 Project S -$1,000 $872.78 $250 $15 $15 $783.02 Project L -$1,000 $5 $240 $420 The company's WACC is 9.5%. What is the IRR of the better project? (Hint: The better project may or may not be the one with the higher IRR.) Round your answer to two decimal places.arrow_forwardA company is analyzing two mutually exclusive projects, S and L, with the following cash flows: 0 1 2 3 4 Project S -$1,000 $884.00 $250 $15 $15 Project L -$1,000 $0 $250 $400 $805.87 The company's WACC is 9.0%. What is the IRR of the better project? (Hint: The better project may or may not be the one with the higher IRR.) Round your answer to two decimal places. ___%arrow_forward

- A company is analyzing two mutually exclusive projects, S and L, with the following cash flows: 0 1 2 3 4 Project S -$1,000 $894.60 $240 $15 $15 Project L -$1,000 $0 $250 $380 $836.66 The company's WACC is 8.0%. What is the IRR of the better project? (Hint: The better project may or may not be the one with the higher IRR.) Round your answer to two decimal places. %arrow_forward3. You are analyzing the following two mutually exclusive projects and have developed the following Which information. Please calculate the IRRS for the two projects and the crossover rate. project should you accept if the cost of capital is 5%, and which project should you accept if the cost of capital is 10%? Year 0 1 3 Project A Cash Flow -$84,500 $29,000 $40,000 $27,000 IRR A: IRR B: Crossover Rate: If WACC-5%, accept If WACC=10%, accept Project B Cash Flow -$76,900 $25,000 $35,000 $26,000 Jarrow_forward"Consider the following two mutually-exclusive altematives: Project Alternatives n Project A1 Cash Flows Project A2 Cash Flows 0-514,000 1+$4,000 - $17,000 $21,000 2- 54,000 3-$12,000 If MARR=15% and assuming indefinite required service and repeatability, use the incremental NPV and IRR analyses in parts (a) and (b) of the problem, respectively, to choose the project in part (c). Please note that project alternatives A7 and A2 have different lives, namely three years for A1 and one year for A2. The alternatives should be compared over the same period, so project A2 will have to be repeated twice." axThe Net Present Value of the incremental investment is: YbrThe rternal Rate of Retun of the incremental investment is: (oWe shoulo choose project alternative: Note: Please enrer your onswvers to two decimal places. If using the interest factor method, apply the value of the factor os presented in the table or spreocsheet (with all four decimal places).arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education