FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

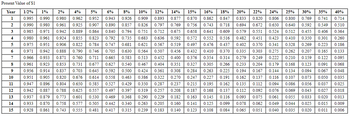

Transcribed Image Text:Present Value of $1

Year 1/2%

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

4%

1% 2%

0.995 0.990 0.980 0.962

0.985 0.971 0.942

5% 6% 8% 10% 12% 14% 15% 16% 18% 20% 22% 24% 25% 30% 35% 40%

0.952 0.943 0.926 0.909 0.893 0.877 0.870 0.862 0.847 0.833 0.820 0.806 0.800 0.769 0.741 0.714

0.990 0.980 0.961 0.925 0.907 0.890 0.857 0.826 0.797 0.769 0.756 0.743 0.718 0.694 0.672 0.650 0.640 0.592 0.549 0.510

0.889 0.864 0.840 0.794 0.751 0.712 0.675 0.658 0.641 0.609 0.579 0.551 0.524 0.512 0.455 0.406 0.364

0.980 0.961 0.924 0.855 0.823 0.792 0.735 0.683 0.636 0.592 0.572 0.552 0.516 0.482 0.451 0.423 0.410 0.350 0.301 0.260

0.975 0.951 0.906 0.822 0.784 0.747 0.681 0.621 0.567 0.519 0.497 0.476 0.437 0.402 0.370 0.341 0.328 0.269 0.223 0.186

0.971 0.942 0.888 0.790 0.746 0.705 0.630 0.564 0.507 0.456 0.432 0.410 0.370 0.335 0.303 0.275 0.262 0.207 0.165 0.133

0.966 0.933 0.871 0.760 0.711 0.665 0.583 0.513 0.452 0.400 0.376 0.354 0.314 0.279 0.249 0.222 0.210 0.159 0.122 0.095

0.961 0.923 0.853 0.731 0.677 0.627 0.540 0.467 0.404 0.351 0.327 0.305 0.266 0.233 0.204 0.179 0.168 0.123 0.091 0.068

0.914 0.837 0.703 0.645 0.592 0.500 0.424 0.361 0.308 0.284 0.263 0.225 0.194 0.167 0.144 0.134 0.094 0.067 0.048

0.951 0.905 0.820 0.676 0.614 0.558 0.463 0.386 0.322 0.270 0.247 0.227 0.191 0.162 0.137 0.116 0.107 0.073 0.050 0.035

0.947 0.896 0.804 0.650 0.585 0.527 0.429 0.350 0.287 0.237 0.215 0.195 0.162 0.135 0.112 0.094 0.086 0.056 0.037 0.025

0.942 0.887 0.788 0.625 0.557 0.497 0.397 0.319 0.257 0.208 0.187 0.168 0.137 0.112 0.092 0.076 0.069 0.043 0.027 0.018

0.937 0.879 0.773 0.601 0.530 0.469 0.368 0.290 0.229 0.182 0.163 0.145 0.116 0.093 0.075 0.061 0.055 0.033 0.020 0.013

0.933 0.870 0.758 0.577 0.505 0.442 0.340 0.263 0.205 0.160 0.141 0.125 0.099 0.078 0.062 0.049 0.044 0.025 0.015 0.009

0.928 0.861 0.743 0.555 0.481 0.417 0.315 0.239 0.183 0.140 0.123 0.108 0.084 0.065 0.051 0.040 0.035 0.020 0.011 0.006

0.956

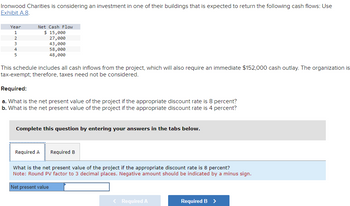

Transcribed Image Text:Ironwood Charities is considering an investment in one of their buildings that is expected to return the following cash flows: Use

Exhibit A.8.

Year

1

4Nm & in

2

3

4

5

Net Cash Flow

$ 15,000

27,000

43,000

58,000

48,000

This schedule includes all cash inflows from the project, which will also require an immediate $152,000 cash outlay. The organization is

tax-exempt; therefore, taxes need not be considered.

Required:

a. What is the net present value of the project if the appropriate discount rate is 8 percent?

b. What is the net present value of the project if the appropriate discount rate is 4 percent?

Complete this question by entering your answers in the tabs below.

Required A

Required B

What is the net present value of the project if the appropriate discount rate is 8 percent?

Note: Round PV factor to 3 decimal places. Negative amount should be indicated by a minus sign.

Net present value

< Required A

Required B >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- World Trans. is considering two mutually exclusive projects. Both require an initial investment of $9,200 at t = 0. Project X has an expected life of 2 years with after-tax cash inflows of $7,000 and $7,800 at the end of Years 1 and 2, respectively. In addition, Project X can be repeated at the end of Year 2 with no changes in its cash flows. Project Y has an expected life of 4 years with after-tax cash inflows of $5,000 at the end of each of the next 4 years. Each project has a WACC of 8%. Using the replacement chain approach, what is the NPV of the most profitable project? Do not round the intermediate calculations and round the final answer to the nearest whole number. Group of answer choices $5,971 $5,528 $6,855 $7,371 $7,592arrow_forwardA company is considering two mutually exclusive projects. Both require aninitial cash outlay of Rs.20000 each, and have a life of five years. Thecompany’s required rate of return is 10% and pays tax at a 35% rate. Theprojects with be depreciated on a straight – line basis. The before taxes cashflows expected to be generated by the projects are as follows. Before-tax cashflows (Rs.) Project1 2 3 4 5 A 8000 8000 8000 8000 8000B 12000 6000 400010000 10000 calcualte for each project: The NPV and the internal rate ofreturn. Which project should be accepted and why.arrow_forwardFor each situation, compute the required amount using the provided tables. Click here to view the Future Value of $1 Table. Click here to view the Present Value of $1 Table Required Requirement 1, Uniondale Technologies Inc.'s operations are generating excess cash that will be invested in a special fund. During 2023, Uniondale Technologies invests $12,300,000 in the fund for a planned advertising campaign for a new product to be released eleven years later, in 2034. If Uniondale Technologies's investments can earn 8 percent each year, how much cash will the company have for the advertising campaign in 2034? (Round to the nearest dollar.) How much will the company have for the advertising campaign in 20347 Requirement 2. Uniondale Technologies Inc. will need $17 million to advertise a new product in 2034. How much must Uniondale Technologies invest in 2023 to have the cash available for the advertising campaign? Uniondale Technologies's investments can earn 8 percent annually. (Round to…arrow_forward

- Mulroney Corp. is considering two mutually exclusive projects. Both require an initial investment of $11,300 at t = 0. Project X has an expected life of 2 years with after-tax cash inflows of $6,600 and $7,600 at the end of Years 1 and 2, respectively. In addition, Project X can be repeated at the end of Year 2 with no changes in its cash flows. Project Y has an expected life of 4 years with after-tax cash inflows of $4,200 at the end of each of the next 4 years. Each project has a WACC of 8%. Using the replacement chain approach, what is the NPV of the most profitable project? Do not round the intermediate calculations and round the final answer to the nearest whole number. a. $3,448 b. $3,302 c. $2,611 d. $2,953 e. $2,464arrow_forwardRoosevelt Communication is trying to estimate the Year 1 operating cash flow for a proposed project. The assets required for the project were fully depreciated at the time of purchase. The financial staff has collected the following information: Sales revenues $13.3 million Operating Costs 8.4 million Interest Expense 1.3 million Roosevelt has also determined that this project would cannabalize one of its other projecrs by $1.6 million of cash flow (before taxes) per year. The firm has a 25 percent tax rate, and its WACC is 8 percent. Calculate the project's operating cash flow for Year 1. Answers: a. $ -25,000 b. $2,475,000 c. $1,500,000 d. $2,700,000 e. $3,675,000arrow_forwardAn income-producing property is priced at $600,000 and is expected to generate the following after-tax.cash flows: Year 1: $42,000; Year 2: $44,000; Year 3: $45,000; Year 4: $50,000; and Year 5: $650,000. Calculate the NPV if the required rate of return is 15%. (If the calculated NPV is negative, report it as negative)arrow_forward

- Mulroney Corp. is considering two mutually exclusive projects. Both require an initial investment of $11,500 at t = 0. Project X has an expected life of 2 years with after-tax cash inflows of $6,900 and $7,700 at the end of Years 1 and 2, respectively. In addition, Project X can be repeated at the end of Year 2 with no changes in its cash flows. Project Y has an expected life of 4 years with after-tax cash inflows of $4,400 at the end of each of the next 4 years. Each project has a WACC of 8%. Using the replacement chain approach, what is the NPV of the most profitable project? Do not round the intermediate calculations and round the final answer to the nearest whole number. a. $3,399 b. $3,925 c. $3,073 d. $2,768 e. $3,620arrow_forwardDuo Corporation is evaluating a project with the following cash flows. The company uses a discount rate of 12 percent and a reinvestment rate of 9 percent on all of its projects. Year 0 Cash Flow -$ 16,100 1 2 12345 7,200 8,400 3 8,000 4 5 ces 6,800 -4,200 Calculate the MIRR of the project using all three methods with these interest rates. Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. Discounting approach Reinvestment approach Combination approach % % %arrow_forwardVinubhaiarrow_forward

- Shelton Tax Services is considering investing in new software for their corporate tax business. The investment will require an outlay of $350,000 initially, and is expected to generate the following after-tax cash flows: Year 1, $60,000; Year 2, $80,000; Year 3, $105,000; Year 4, $120,000; Year 5, $145,000. Shelton uses a discount rate of 10%. What is the net present value of the proposed investment? Should this investment be accepted or rejected? Must show your computation steps. Use the appropriate tables in Appendix A to obtain the relevant present value factor and round up your final answer to the nearest dollar.arrow_forwardXYZ, Co. is considering the purchase of a new building that will allow them to expand their market. They plan to pay for the investment with a bank loan. The interest payments on the loan will be $140,000 per year. How will this be treated in the cash flows for capital budgeting?arrow_forwardPleasearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education