Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Don't give answer in image

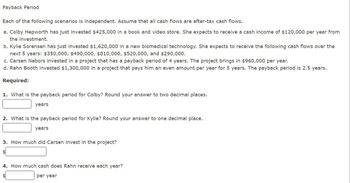

Transcribed Image Text:Payback Period.

Each of the following scenarios is independent. Assume that all cash flows are after-tax cash flows.

a. Colby Hepworth has just invested $425,000 in a book and video store. She expects to receive a cash income of $120,000 per year from

the investment.

b. Kylie Sorensen has just invested $1,620,000 in a new biomedical technology. She expects to receive the following cash flows over the

next 5 years: $350,000, $490,000, $810,000, $520,000, and $290,000.

c. Carsen Nabors invested in a project that has a payback period of 4 years. The project brings in $960,000 per year.

d. Rahn Booth invested $1,300,000 in a project that pays him an even amount per year for 5 years. The payback period is 2.5 years.

Required:

1. What is the payback period for Colby? Round your answer to two decimal places.

years

2. What is the payback period for Kylie? Round your answer to one decimal place.

years

3. How much did Carsen invest in the project?

4. How much cash does Rahn receive each year?

per year

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- hrl.3 answer must be in proper format or i will give down votearrow_forwardIt says they answers are wrong from your example.arrow_forwardYou own a car with somewhat high fuel consumption. It is 10 years old and can be sold now for $3,000 cash. Assume its market value (MV) in two years will be $500. The annual maintenance expenses are expected to be $400 into the foreseeable future, and the car averages only 2 miles per gallon of fuel. Gasoline costs $5.00 per gallon, and the car will be used for about 200 miles per year. If you sell the old car, you can buy a newer model for $10,000. It will be under a maintenance warranty for two years, so this expense is negligible. The newer car will average 10 miles per gallon of fuel and will have an MV of $7,000 in two years. Use a two-year study period to determine which alternative is preferred. The MARR is 15% per year. State your assumptions.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education