Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

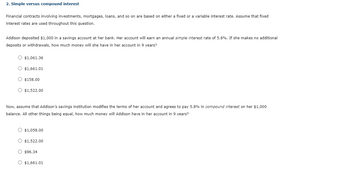

Transcribed Image Text:2. Simple versus compound interest

Financial contracts involving investments, mortgages, loans, and so on are based on either a fixed or a variable interest rate. Assume that fixed

interest rates are used throughout this question.

Addison deposited $1,000 in a savings account at her bank. Her account will earn an annual simple interest rate of 5.8%. If she makes no additional

deposits or withdrawals, how much money will she have in her account in 9 years?

O $1,061.36

O $1,661.01

O $158.00

O $1,522.00

Now, assume that Addison's savings institution modifies the terms of her account and agrees to pay 5.8% in compound interest on her $1,000

balance. All other things being equal, how much money will Addison have in her account in 9 years?

O $1,058.00

O $1,522.00

O $96.34

O $1,661.01

Transcribed Image Text:Suppose Addison had deposited another $1,000 into a savings account at a second bank at the same time. The second bank also pays a nominal (or

stated) interest rate of 5.8% but with quarterly compounding. Keeping everything else constant, how much money will Addison have in her account at

this bank in 9 years?

O $158.00

O $1,059.27

O $103.03

O $1,679.09

Expert Solution

arrow_forward

Step 1

Simple interest is simple in nature that means no interest on interest is there but in compounded interest there is interest on the interest also.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- It asks how much Monica balance from Account 1 will be over 5.7 years. Round to two decimal places.arrow_forward2. Simple versus compound interest Financial contracts involving investments, mortgages, loans, and so on are based on either a fixed or a variable interest rate. Assume that fixed interest rates are used throughout this question. Heather deposited $1,700 at her local credit union in a savings account at the rate of 9.8% paid as simple interest. She will earn interest once a year for the next 13 years. If she were to make no additional deposits or withdrawals, how much money would the credit union owe Heather in 13 years? O $3,865.80 O $5,731.65 O $1,882.93 O $266.60 Now, assume that Heather's credit union pays a compound interest rate of 9.8% compounded annually. All other things being equal, how much will Heather have in her account after 13 years? O $5,731.65 O $561.70 $1,866.60 O $3,865.80arrow_forwardCiana wants to take out a $7,500 loan with a 5.3% APR. She can afford to pay $128 per month for loan payments. 22. What should be the length of her loan? Round to the nearest tenth of a year.a. 5.5 yearsb. 5.6 yearsc. 5.7 yearsd. 5.8 years 23. How would an increase of $20 to her monthly payment affect the length of her loan?a. 0.9 years moreb. 0.9 years lessc. 0.8 years lessd. 0.8 years morearrow_forward

- Alexei finances her purchase of a $900 television. Her one-year loan has a fixed annual interest rate of 2.5%. Which equation correctly calculates Alexei's monthly payment? 12.0.025 М — -12-1 900 1-(1+ ) 0.025 900-0.025 M -12.1 12 12 1- (1+ 0.025 900.0.025 M = -12-1 0.025 12 1-(1+ 12 12.0.025 M -12.1 900 1- 12 1+ 0.025arrow_forwardNOTE: DONT USE EXCEL 2. Ms. Pan Aram has set the goal of accumulating Php 4,000,000 for her son's college fund, which will be needed 18 years in the future. Her investment agent advises her that she can deposit today to Bank X that earns 8% annual interest. a. Option A: How much she needs to deposit today in the bank? b. Option B: If she will be depositing an equal payment of Php 107,000 per year for 18 years at 8% annual interest, how much is the future value? c. Which is the better option Ms. Pan should decide? Why?arrow_forward10. Kristine has $5,000 in an account today that pays 3% interest rate. Two years from now she withdraws $1,000 from that account to buy a laptop. How much will she have in this account in 6 years if she does not make any other deposits or withdrawals? Assume annual compounding. a. $4,844.75 b. $7,095.77 c. $4,776.21 d. $7,164.31 e. $4,970.26 11. Your grandaunt wants to buy an (ordinary) annuity that will pay her cost of living of $70,000 per year for 20 years. If the quoted interest rate today is 5% and the annuity compounds monthly, how much does this annuity cost? a. $872,354.72 b. $865,404.52 c. $883,897.66 d. $863,824.15 12. After graduation, you get a great job. You budget $1,000 per month towards housing. You'd like to buy a house. Assume that the interest rate = 4% for a 30-year mortgage. a. How much can you borrow? i. $209,461.24 ii. $207,504.40 iii. $694,049.40 iv. $24,999.98 b. Eight years into the mortgage, your company decides to relocate you to Hawaii. How much must you…arrow_forward

- Engr. Marquez wants to get from her bank account P29,120.84, 12 years from now. How much should she invests for three consecutive years (annually) starting this year if the interest rate is 0.23? "Use 4 decimal placesarrow_forwardMatty deposits $1,300.00 into a Savings Account at their bank. The annual compound interest rate 2%. How much interest did they earn after after 10 years? Enter answer in format: $ 00.00 Question 2 Suzy deposits $2,400.00 into a Savings Account at their bank. The annual compound interest rate 2.5%. How much interest did she earn after after 15 years? Enter answer in format: $ 00.00arrow_forwardTime to accumulate a given sum Personal Finance Problem Manuel Rios wishes to determine how long it will take an initial deposit of $7,000 to double. a. If Manuel earns 8% annual interest on the deposit, how long will it take for him to double his money? b. How long will it take if he earns only 5% annual interest? c. How long will it take if he can earn 10% annual interest? d. Reviewing your findings in parts a, b, and c, indicate what relationship exists between the interest rate and the amount of time it will take Manuel to double his money. a. If Manuel earns 8% annual interest, the amount of time to double his money is years. (Round to two decimal places.) Carrow_forward

- An acquaintance asks Kara to borrow money today to help her repair her car. The person will be able to repay Kara $500 in one year, and Kara is fully expects she will be repaid on time (risk free). If Kara requires a 5.0% return, what (largest) amount should she lend to her acquaintance?$525.00$495.00$475.00$476.19$471.43arrow_forwardNn.160. Subject :- Financearrow_forwardHelparrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education