Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Nn.160.

Subject :- Finance

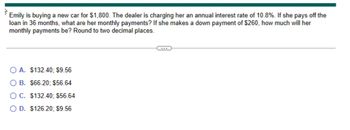

Transcribed Image Text:Emily is buying a new car for $1,800. The dealer is charging her an annual interest rate of 10.8%. If she pays off the

loan in 36 months, what are her monthly payments? If she makes a down payment of $260, how much will her

monthly payments be? Round to two decimal places.

O A. $132.40; $9.56

B. $66.20; $56.64

OC. $132.40; $56.64

O D. $126.20; $9.56

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- QUESTION 4 Which of the following fund types does not report the payment of bond principal as an expenditure? a. Special revenue fund b. Enterprise fund c. Debt service fund d. General fundarrow_forwardQ12. The following are commonly used plug items, except a. cash and marketable securities b. equity c. short-term debt d. long-term debt e. all of the choicesarrow_forward7. which of the following is considered as Non deposit borrowing D retained earning O issuing commercial papers O federal fund sold O repoarrow_forward

- 23. Which of the following would be included as a cash disbursement on a cash budget? A. Fixed asset purchases B. Depreciation C. Borrowings from a bank D. Both A & C 12arrow_forwardIf the difference between current assets and current liabilities is 88.7, bill payable 166.5, creditors 30, prepaid expenses 10, then what is the total current assets? Select one: O a. All the given choices are not correct Ob. 206.50 Oc. 118.70 Od. 285.20 O e. 295.20arrow_forwardA3) Finance what is a pillar of finance?arrow_forward

- acc2arrow_forwardIf the difference between current assets and current liabilities is 94.2, bill payable 169.9, creditors 30, prepaid expenses 10, then what is the total current assets? Select one: O a. 294.10 O b. 304.10 O c. 209.90 O d. All the given choices are not correct O e. 124.20arrow_forwardDescribe the scope of Public Finance.arrow_forward

- The long term liabilities are --------------- Project fundSelect one:a. Debt serviceb. permanentc. Capitald. Specialarrow_forwardD6) What is Behavioral Finance and how does it relate to effective asset allocation? expand your answerarrow_forward5 [HD # GT 5. Which ratio determines the amount of a company's assets that are funded by borrowing? Add a caption... Bonchiarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education