The following are several figures reported for Allister and Barone as of December 31, 2021:

| Allister | Barone | |||

| Inventory | $ | 580,000 | $ | 380,000 |

| Sales | 1,160,000 | 960,000 | ||

| Investment income | not given | |||

| Cost of goods sold | 580,000 | 480,000 | ||

| Operating expenses | 270,000 | 340,000 | ||

Allister acquired 90 percent of Barone in January 2020. In allocating the newly acquired subsidiary's fair value at the acquisition date, Allister noted that Barone had developed a customer list worth $72,000 that was unrecorded on its accounting records and had a six-year remaining life. Any remaining excess fair value over Barone's book value was attributed to

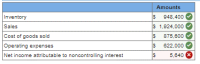

Determine balances for the following items that would appear on Allister's consolidated financial statements for 2021:

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

- The following are several figures reported for Allister and Barone as of December 31, 2021 Allister Barone $ 600,000 $ 400,000 1,200,000 1,000,000 not given 600,000 280,000 Inventory Sales Investment income Cost of goods sold Operating expenses 500,000 350,000 Allister acquired 90 percent of Barone in January 2020. In allocating the newly acquired subsidiary's fair value at the acquisition date Allister noted that Barone had developed a customer list worth $76,000 that was unrecorded on its accounting records and had a five- year remaining life. Any remaining excess fair value over Barone's book value was attributed to goodwill. During 2021, Barone sells inventory costing $140,000 to Allister for $200,000. Of this amount, 15 percent remains unsold in Allister's warehouse at year-end Determine balances for the following items that would appear on Allister's consolidated financial statements for 2021 4 Inventory Sales Cost of goods sold Operating expenses Net income attributable to…arrow_forwardThe following are several figures reported for Allister and Barone as of December 31, 2021: Allister Barone $ 500,000 $ 300,000 1,000,000 not given 500,000 230,000 Inventory Sales 800,000 Investment income Cost of goods sold Operating expenses 400,000 300,000 Allister acquired 90 percent of Barone in January 2020. In allocating the newly acquired subsidiary's fair value at the acquisition date, Allister noted that Barone had developed a customer list worth $78,000 that was unrecorded on its accounting records and had a four-year remaining life. Any remaining excess fair value over Barone's book value was attributed to goodwill. During 2021, Barone sells inventory costing $130,000 to Allister for $180,00o. Of this amount, 10 percent remains unsold in Allister's warehouse at year-end. Determine balances for the following items that would appear on Allister's consolidated financial statements for 2021: Amounts Inventory Sales Cost of goods sold Operating expenses Net income attributable…arrow_forwardPizza Factory Company owns 100% controlling interest in its long held subsidiary; The Sugar Company and they use the Equity Method. Pizza Factor sells inventory to Sugar Company for a 25% Gross Profit. During 2019 and 2020, intercompany sales amounted to: Intercompany Sales: 2019 840,000 2020 930,000 At the end of 2019, Sugar Company had one-fifth of the goods purchased that year from Pizza Factory in its ending inventory. At the end of 2020, Sugar Company's 2020 ending inventory contained one-fourth of that year’s purchases from Pizza Factory. There were no intercompany sales prior to 2019. Prepare in general journal form all entries necessary on the consolidated statements…arrow_forward

- Fried Inc. purchased 90% ownership of Chicken Corp. in 2020, at underlying book value. On that date, the fair value of non-controlling interest was equal to 10% of the book value of Chicken Corp. Fried Inc. purchased inventory from Chicken Corp. for P270,000 on September 1, 2021, and resold the 70% of the inventory to unrelated parties on December 5, 2021 for P300,000. Chicken Corp. produced the inventory sold to Fried Inc. for 201,000. The entities had no other transactions during 2021. What amount of consolidated net income will be assigned to Fried Inc. in 2021?* a. P 111,000 b. P 60,300 c. P 154,470 d. P 159,300 Thank you for answering!arrow_forwardOn January 1, 2017, Harrison, Inc., acquired 90 percent of Starr Company in exchange for$1,125,000 fair-value consideration. The total fair value of Starr Company was assessed at $1,200,000. Harrison computed annual excess fair-value amortization of $8,000 based on the difference between Starr’s total fair value and its underlying book value. The subsidiary reported net income of $70,000 in 2017 and $90,000 in 2018 with dividend declarations of $30,000 each year. Apart from its investment in Starr, Harrison had net income of $220,000 in 2017 and $260,000 in 2018. What is the balance of the non controlling interest in Starr at December 31, 2018?arrow_forwardHouse Corporation has been operating profitably since its creation in 1960. At the beginning of 2016, House acquired a 70 percent ownership in Wilson Company. At the acquisition date, House prepared the following fair-value allocation schedule: Consideration transferred for 70% interest in Wilson $ 707,000 Fair value of the 30% noncontrolling interest 303,000 Wilson business fair value $ 1,010,000 Wilson book value 790,000 Excess fair value over book value $ 220,000 Assignments to adjust Wilson’s assets to fair value: To buildings (20-year remaining life) $ 60,000 To equipment (4-year remaining life) (20,000 ) To franchises (10-year remaining life) 40,000 80,000 To goodwill (indefinite life) $ 140,000 House regularly buys inventory from Wilson at a markup of 25 percent more than cost. House's purchases during 2016 and 2017 and related ending inventory…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education