Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

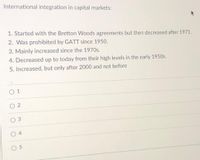

Transcribed Image Text:International integration in capital markets:

1. Started with the Bretton Woods agreements but then decreased after 1971.

2. Was prohibited by GATT since 1950.

3. Mainly increased since the 1970s.

4. Decreased up to today from their high levels in the early 1950s.

5. Increased, but only after 2000 and not before

O 1

4

5.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Due to the immense failure of banking institutions in response to the global financial crisis haswitnessed an increase of development on risk management. However Islamic banking is much less affected by the destruction for a variety of reasons probably because it is still a very small part of the global system and has yet to develop enough connectivity to catch the cold. Thecurrent wave of financial liberalization and globalization naturally stimulates the question of risk management in Islamic banking. a. As outlined above, critically discuss the issues and challenges of risk management faced by Islamic banking.arrow_forwarda) Explain why Bank of England's intervention during the September 1992 was described as "too little, too late". Explain why this directly led to 1992 British exchange rate fiasco?arrow_forward6) Suppose that the European central bank increased money supply right after you bought the European financial assets. How that change might aff ect the expected return you will get at the end of the period as an American investor? (Use graphs)arrow_forward

- Provide Answerarrow_forwardTrue/false : International Financial Management: 1. Forward contracts are often valued at £1 million or more, and are not normally used by consumers or small firms. (a) True (b) False 2. Governments may influences the equilibrium exchange rate by affecting macro variables such as inflation, interest rates, and income levels. (a) True (b) False 3. A forward contract is an agreement to buy or sell an asset in the future at prices agreed upon today. (a)True (b) Falsearrow_forwardPrepare a two page executive briefing on the question of whether capital generated in the industrialized countries is finding its way to and from emerging markets. Is there some critical distinction between “less developed” and “emerging”?arrow_forward

- (please all options information and correct answer)arrow_forwardWhich factor below is causing many of the world's top financial institutions to consider moving their global operations out of London and shift them to other financial capitals within the Eurozone? economic uncertainty high interest rates Brexit high-risk venturesarrow_forwardDiscuss how the following hinder or become barriers to international diversification of portfolios of investment. Segmented markets Lack of liquidity Exchange rate controls Less developed capital marketsarrow_forward

- Variation in the price of non-agricultural commodities is determined over time by demand-supply dynamics. The last two decades have seen a significant increase in international trade and business volume due to globalization and liberalization sweeping across the world. This increase has led to rapid and unpredictable variations in financial assets prices, interest rates and exchange rates, and subsequently, to exposing Multi-National Corporations to financial risk. As a result, financial markets have experienced rapid variations in interest and exchange rates and stock market prices, thus exposing the corporate world to a state of growing financial risk. We can hedge the risk of price variations in stocks, bonds, commodities, currencies, interest rates, market indices etc. Given this context, please conduct the necessary research and answer the following questions. Discuss two (2) similarities and two (2) differences between a futures contract and a forward contract. When would the use…arrow_forwardLong-Term Capital Management (LTCM) implemented a convergence trading strategy involving corporate bonds and U.S. Treasuries. Expecting the spread between corporate bond yields and Treasury yields to narrow over time, LTCM took large leveraged positions, going long (buying) corporate bonds and short (selling) Treasuries. However, the 1998 Russian debt crisis triggered a flight to quality, causing corporate bond prices to fall and Treasury prices to rise, leading to a divergence of the spreads and massive losses for LTCM's trades. On July 1, 1998, LTCM initiated a convergence trade by going long $100 million notional of Baa-rated 10-year corporate bonds with a yield of 7.5% and coupon rate of 7%, and shorting $100 million notional of 10-year U.S. Treasury bonds with a yield of 5.5% and coupon rate of 5%. a. Explain LTCM's rationale for going long corporate bonds and short Treasuries in their convergence trade. What were the underlying assumptions behind this strategy? b. Calculate…arrow_forwardThe rise of globalization is due to the many companies that have become multinational corporations for various reasons—for example, to access better technology, to enter new markets, to obtain more raw materials, to find funding resources, to minimize production costs, or to diversify business risk. This multimarket presence exposes companies to different kinds of risk as well—for example, political risk and exchange rate risk. Several factors affect the exchange rate of a currency with another currency. Which of the following statements are true about the factors that have an impact on exchange rates? Check all that apply. If a government intends to prevent its currency’s value from falling relative to other currencies, it will purchase its currency from sellers in the market. If the demand for a currency increases, the currency’s value will increase relative to other currencies. When a government limits imports and restricts foreign exchange transactions, its currency’s value tends…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education