FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

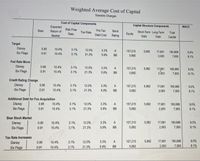

Transcribed Image Text:Weighted Average Cost of Capital

Scenario Changes

Cost of Capital Components

Capital Structure Components

Expected

Return of

WACC

Risk Free

Pre-Tax

Debt Cost

Beta

Bond

Short-Term Long-Term

Tax Rate

Total

Rate

Equity

Market

Rating

Debt

Debt

Capital

Target

Disney

Six Flags

0.95

10.4%

3.1%

12.0%

3.3%

A

157,215

5,992

17,681

180,888

9.0%

0.91

10.4%

3.1%

21.3%

5.9%

BB

5,892

2,063

7,955

8.1%

Fed Rate Move

Disney

Six Flags

0.95

10.4%

3.1%

12.0%

3.3%

A

157,215

5,992

17,681

180,888

9.0%

0.91

10.4%

3.1%

21.3%

5.9%

BB

5,892

2163

7,955

8.1%

Credit Rating Change

Disney

Six Flags

0.95

10.4%

3.1%

12.0%

3.3%

A

157,215

5,992

17,681

180,888

9.0%

0.91

10.4%

3.1%

21.3%

5.9%

BB

5,892

2,063

7,955

8.1%

Additional Debt for Fox Acquisition

Disney

Six Flags

0.95

10.4%

3.1%

12.0%

3.3%

A

157,215

5,992

17,681

180,888

9.0%

0.91

10.4%

3.1%

21.3%

5.9%

BB

5,892

2,063

7,955

8.1%

Bear Stock Market

A

157,215

5,992

17,681

180,888

9.0%

Disney

Six Flags

0.95

10.4%

3.1%

12.0%

3.3%

0.91

10.4%

3.1%

21.3%

5.9%

BB

5,892

2,063

7,955

8.1%

Tax Rate Increases

Disney

0.95

10.4%

3.1%

12.0%

3.3%

A

157,215

5,992

17,681

180,888

9.0%

Six Flags

10.4%

21.3%

5.9%

BB

5,892

2,063

7,955

8.1%

0.91

3.1%

Transcribed Image Text:3. How may Disney's WACC be impacted by stated changes

in its operating environment. Consider the following scenar-

ios:

1. an increase in the Federal Reserve reference rate;

2. a two notch downgrade in Disney's credit rating;

3. adding debt to Disney's capital structure for an acquisition;

4. a downturn in the US equity market; and,

5. an increase in Disney's marginal income tax rate?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Provide Answerarrow_forwardWhich of the following will increase the WACC for a tax-paying company? Decrease the proportion of equity financing Decrease the proportion of debt financing Decrease the market value of the equity Increase the market value of the debtarrow_forwardWhich of the following would reduce a firm's WACC after tax? a. A firm invests in an average-risk project using equity, rather than debt financing. b. A supermarket chain decides to establish hardware stores which increases its systematic risk. c. A firm issues shares and uses the proceeds to pay off a bank loan. d. A firm issues bonds and uses the proceeds to repurchase stock. e. A firm significantly improves its operating cost control to boost profits.arrow_forward

- am. 167.arrow_forwardWhat is a financial market? What is the role of a financial market? 3-2 What would happen to the standard of living in the United States if people lost faith in our financial markets? Why? 3-3 How does a cost-efficient capital market help to reduce the prices of goods and services? 3-4 The SEC attempts to protect investors who are purchasing newly issued securities by requiring issuers to provide relevant financial information to prospective investors. The SEC does not provide an opinion about the real value of the securities. Hence, an unwise investor might pay too much for some stocks and consequently lose heavily. Do you think the SEC should, as a part of every new stock or bond offering, render an opinion to investors on the proper value of the securities being offered? Explain.arrow_forwardWhich of the following can be the effect of leverage on the WACC if corporate taxes are considered? Increased leverage will decrease the WACC. An increase in leverage will be offset by a decrease in equity financing, thus leaving WACC unchanged. Increased leverage will increase the WACC. Changes in leverage will affect the WACC only if the interest rate on debt changes.arrow_forward

- Is offering clients big discounts to shift future revenue into the current quarter a violation of US GAAP rules for revenue recognition?arrow_forwardWhich of the following can be classified under Business Finance? Select one: a. Australian government reducing individual tax thresholds b. George's decision to purchase 20 000 units of Afterpay for himself c. Qantas' capital raising following COVID lockdowns d. Jerome Powell and the Fed applying quantitative easing to buy government bonds to support businessesarrow_forwardWhen an acquirer assesses a potential target, the price the acquirer is willing to pay should be based on the value of: The target firm’s total corporate value (debt and equity) The target firm’s equity The target firm’s debt Consider the following scenario: Ziffy Corp. is considering an acquisition of Keedsler Motors Co., and estimates that acquiring Keedsler will result in incremental after-tax net cash flows in years 1–3 of $14.00 million, $21.00 million, and $25.20 million, respectively. After the first three years, the incremental cash flows contributed by the Keedsler acquisition are expected to grow at a constant rate of 6% per year. Ziffy’s current beta is 1.60, but its post-merger beta is expected to be 2.08. The risk-free rate is 5%, and the market risk premium is 7.10%. Based on this information, complete the following table by selecting the appropriate values (Note: Do not round intermediate calculations, but round your answers to two decimal places): Value…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education