Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

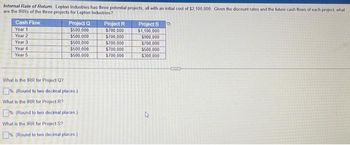

Transcribed Image Text:Internal Rate of Return. Lepton Industries has three potential projects, all with an initial cost of $2,100,000. Given the discount rates and the future cash flows of each project, what

are the IRRs of the three projects for Lepton Industries?

Cash Flow

Year 1

Year 2

Year 3

Year 4

Year 5

Project Q

$500,000

$500,000

$500,000

$500,000

$500,000

What is the IRR for Project Q?

% (Round to two decimal places.)

What is the IRR for Project R?

% (Round to two decimal places.)

What is the IRR for Project S?

% (Round to two decimal places.)

Project R

$700,000

$700,000

$700,000

$700,000

$700,000

Project S

$1,100,000

$900,000

$700,000

$500,000

$300,000

GTD

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Cash Payback Period, Net Present Value Method, and Analysis Elite Apparel Inc. is considering two investment projects. The estimated net cash flows from each project are as follows: Year Plant Expansion Retail Store Expansion 1 $150,000 $125,000 2 122,000 147,000 3 106,000 101,000 4 96,000 70,000 5 29,000 60,000 Total $503,000 $503,000 Each project requires an investment of $272,000. A rate of 15% has been selected for the net present value analysis. Present Value of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 0.890 0.826 0.797 0.756 0.694 3 0.840 0.751 0.712 0.658 0.579 4 0.792 0.683 0.636 0.572 0.482 5 0.747 0.621 0.567 0.497 0.402 6 0.705 0.564 0.507 0.432 0.335 7 0.665 0.513 0.452 0.376 0.279 8 0.627 0.467 0.404 0.327 0.233 9 0.592 0.424 0.361 0.284 0.194 10 0.558 0.386 0.322 0.247 0.162 Required: 1a. Compute the cash payback period for each project. 1a. Compute the cash…arrow_forwardCash Payback Period, Net Present Value Method, and Analysis Elite Apparel Inc. is considering two investment projects. The estimated net cash flows from each project are as follows: Year Plant Expansion Retail Store Expansion 1 $171,000 $143,000 2 140,000 168,000 3 121,000 115,000 4 109,000 81,000 5 34,000 68,000 Total $575,000 $575,000 Each project requires an investment of $311,000. A rate of 12% has been selected for the net present value analysis. Present Value of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 0.890 0.826 0.797 0.756 0.694 0.840 0.751 0.712 0.658 0.579 0.792 0.683 0.636 0.572 0.482 0.747 0.621 0.567 0.497 0.402 6 0.705 0.564 0.507 0.432 0.335 7 0.665 0.513 0.452 0.376 0.279 8. 0.627 0.467 0.404 0.327 0.233 0.592 0.424 0.361 0.284 0.194 10 0.558 0.386 0.322 0.247 0.162 Required: la. Compute the cash payback period for each project. 2. 3.arrow_forwardCash Payback Period, Net Present Value Method, and Analysis Elite Apparel Inc. is considering two investment projects. The estimated net cash flows from each project are as follows: Year Plant Expansion Retail Store Expansion 1 $176,000 $147,000 2 144,000 173,000 124,000 118,000 4 112,000 83,000 36,000 71,000 Total $592,000 $592,000 Each project requires an investment of $320,000. A rate of 12% has been selected for the net present value analysis. Present Value of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 0.890 0.826 0.797 0.756 0.694 0.840 0.751 0.712 0.658 0.579 4 0.792 0.683 0.636 0.572 0.482 5 0.747 0.621 0.567 0.497 0.402 6 0.705 0.564 0.507 0.432 0.335 7 0.665 0.513 0.452 0.376 0.279 8 0.627 0.467 0.404 0.327 0.233 0.592 0.424 0.361 0.284 0.194 10 0.558 0.386 0.322 0.247 0.162 Required: la. Compute the cash payback period for each project. Cash Payback Period Plant Expansion Retail Store Expansion 1b. Compute the net present value. Use the…arrow_forward

- Cash Payback Period, Net Present Value Method, and Analysis Elite Apparel Inc. is considering two investment projects. The estimated net cash flows from each project are as follows: Year Plant Expansion Retail Store Expansion 1 $163,000 $136,000 2 133,000 160,000 3 115,000 110,000 4 104,000 77,000 5 33,000 65,000 Total $548,000 $548,000 Each project requires an investment of $296,000. A rate of 6% has been selected for the net present value analysis. Present Value of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 0.890 0.826 0.797 0.756 0.694 3 0.840 0.751 0.712 0.658 0.579 4 0.792 0.683 0.636 0.572 0.482 5 0.747 0.621 0.567 0.497 0.402 6 0.705 0.564 0.507 0.432 0.335 7 0.665 0.513 0.452 0.376 0.279 8 0.627 0.467 0.404…arrow_forwardValuation Problem Calculate NPV and IRR for the following investment. Initial investment = $1,000,000 machine, the project term is 6 years, ncf yr 1 = 387,160 ncf yr 2 = 459,460 ncf yr 3 = 465,322 ncf yr 4 = 481,725 ncf yr 5 = 506,617 ncf yr 6 = 269.200 and the discount rate is 12%.arrow_forwardSolve this without excel using excelarrow_forward

- (Ignore income taxes in this problem.) Your Company has a telephone system that is in poor condition. The system must be either overhauled or replaced with a new system. The following data have been gathered concerning these two alternatives: Present System Proposed New System Purchase cost when new $100,000 $110,000 Accumulated depreciation 90,000 Overhaul cost needed now 80,000 Working capital required 50,000 Annual cash operating costs 30,000 20,000 Salvage value now of old system 10,000 Salvage value in 8 years 2,000 15,000 Your Company uses a 12% discount rate and the total cost approach to capital budgeting analysis. Both alternatives are expected to have a useful life of eight years. What is the net present value of the new system alternative? Enter your answer without dollar signs. If the NPV is negative enter with a minus sign in front.arrow_forwardWhat is the NPV, payback period, and internal rate of return for Project A. With the initial cost of 1250000.000arrow_forwardConsider a project with the following information: Year 1 2 3 4 5 6 Initial outlay= $950,000 Compute the NPV if the company's discount rate is 10%. 1) $268,244 2) $201,650 3) $213,050 $129 After-tax cash flows $300,000 $400,000 $400,000 $200,000 $150,000 $150,000arrow_forward

- Mutually exclusive projects and NPV you have been assigned the task of evaluating two mutually exclusive projects with the following projected cash flows. year. Project A (cash flow) Project B 0 $(102,000) $(102,000) 1 31,000 0 2 31,000 0 3 31,000 0 4 31,000 0 5 31,000 240,000 if the appropriate discount rate on these is 11 percent, which would be chosen and why? the NPV of project A is $arrow_forwardPecos Corporation is considering several investment proposals, as shown below: Investment required Present value of future net Investment Proposal OD, B, C, A O B, D, C, A OB, D, A, C O A, C, B, D A B $ 80,000 $ 100,000 C $ 60,000 D $ 75,000 cash flows $ 96,000 $ 150,000 $ 84,000 $ 120,000 If the project profitability index is used, the ranking of the projects from most to least profitable would be:arrow_forwardNPV and EVA A project cost $3.2 million up front and will generate cash flows in perpetuity of $270,000. The firm's cost of capital is 8%. a. Calculate the project's NPV. b. Calculate the annual EVA in a typical year. c. Calculate the overall project EVA. a. The project's NPV is $. (Round to the nearest dollar.) ibra culat ource Enter your answer in the answer box and then click Check Answer. Check Ans udy Clear All 2 parts remaining Lation Tools> pe here to searcharrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education