FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

M15.

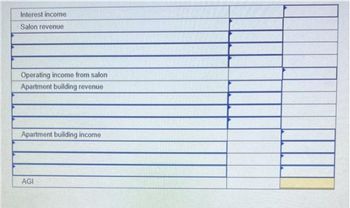

Transcribed Image Text:Interest income

Salon revenue

Operating income from salon

Apartment building revenue

Apartment building income

AGI

![Required information

[The following information applies to the questions displayed below]

Rocco operates a beauty salon as a sole proprietorship. Rocco also owns and rents an apartment building. In 2022, Rocco

had the following income and expenses. You may assume that Rocco will owe $2,502 in self-employment tax on his salon

income, with $1,251 representing the employer portion of the self-employment tax. You may also assume that his divorce

from Svetlana was finalized in 2016.

Interest income

Salon sales and revenue

Salaries paid to beauticians

Beauty salon supplies

Alimony paid to his ex-wife, Svetlana

Rental revenue from apartment building

Depreciation on apartment building

Real estate taxes paid on apartment building

Real estate taxes paid on personal residence

Contributions to charity

o. Determine Rocco's AGL

Note: Amounts to be deducted should be indicated by a minus sign.

$11,255

86,360

45,250

23,400

6,000

31,220

12,900

11,100

6,241

4,237](https://content.bartleby.com/qna-images/question/ef3e1da9-efa9-41bf-8766-d612578816c8/d6c19b09-08ef-46e3-a68c-d03f59a89d82/eu5nvif_thumbnail.jpeg)

Transcribed Image Text:Required information

[The following information applies to the questions displayed below]

Rocco operates a beauty salon as a sole proprietorship. Rocco also owns and rents an apartment building. In 2022, Rocco

had the following income and expenses. You may assume that Rocco will owe $2,502 in self-employment tax on his salon

income, with $1,251 representing the employer portion of the self-employment tax. You may also assume that his divorce

from Svetlana was finalized in 2016.

Interest income

Salon sales and revenue

Salaries paid to beauticians

Beauty salon supplies

Alimony paid to his ex-wife, Svetlana

Rental revenue from apartment building

Depreciation on apartment building

Real estate taxes paid on apartment building

Real estate taxes paid on personal residence

Contributions to charity

o. Determine Rocco's AGL

Note: Amounts to be deducted should be indicated by a minus sign.

$11,255

86,360

45,250

23,400

6,000

31,220

12,900

11,100

6,241

4,237

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education