FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

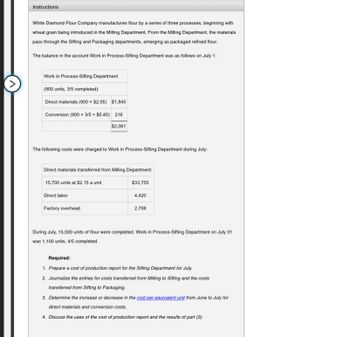

Transcribed Image Text:Instructions

White Diamond Flour Company manufactures flour by a series of three processes, beginning with

wheat grain being introduced in the Milling Department. From the Milling Department, the materials

pass through the Sifting and Packaging departments, emerging as packaged refined flour.

The balance in the account Work in Process-Sifting Department was as follows on July 1:

Work in Process-Sifting Department

(900 units, 3/5 completed):

Direct materials (900 x $2.05) $1,845

Conversion (900 x 3/5 * $0.40) 216

$2,061

The following costs were charged to Work in Process-Sifting Department during July:

Direct materials transferred from Milling Department:

15,700 units at $2.15 a unit

$33,755

Direct labor

4,420

Factory overhead

2,708

During July, 15,500 units of flour were completed. Work in Process-Sifting Department on July 31

was 1,100 units, 4/5 completed.

Required:

1. Prepare a cost of production report for the Sifting Department for July.

2. Journalize the entries for costs transferred from Milling to Sifting and the costs

transferred from Sifting to Packaging.

3. Determine the increase or decrease in the cost per equivalent unit from June to July for

direct materials and conversion costs.

4. Discuss the uses of the cost of production report and the results of part (3).

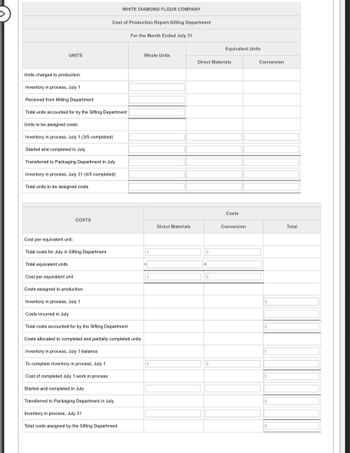

Transcribed Image Text:UNITS

Units charged to production:

Inventory in process, July 11

WHITE DIAMOND FLOUR COMPANY

COSTS

Cost

Received from Milling Department

Total units accounted for by the Sifting Department

Units to be assigned costs:

Inventory in process, July 1 (3/5 completed)

Started and completed in July

Transferred to Packaging Department in July

Inventory in process, July 31 (4/5 completed)

Total units to be assigned costs

Production Report-Sifting Department

For the Month Ended July 31

Cost per equivalent unit:

Total costs for July in Sifting Department

Total equivalent units

Cost per equivalent unit

Costs assigned to production:

Inventory in process, July 11

Costs incurred in July

Total costs accounted for by the Sifting Department

Costs allocated to completed and partially completed units:

Inventory in process, July 1-balance

To complete inventory in process, July 1

Cost of completed July 1 work in process

Started and completed in July

Transferred to Packaging Department in July

Inventory in process, July 311

Total costs assigned by the Sifting Department

Whole Units

$

+

$

$

Direct Materials

Direct Materials

$

+

$

Equivalent Units

$

Costs

Conversion

Conversion

$

$

$

$

Total

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Honeybutter Pty Ltd manufactures a product that goes through two departments prior to completion—the Mixing Department followed by the Packaging Department. The following information is available about work in the first department, the Mixing Department, during June. Percent completed Units Materials Conversion Work in process, beginning 70,000 70% 40% Units started during June 460,000 Completed and transferred out 450,000 Work in process, ending 75% 25% Work in process, beginning $36,550 $13,500 Cost added during June $391,850 $287,300 Required: Assume that the company uses the weighted-average method. (a) Determine the physical units of the ending inventory in June for the Mixing Department (b) Determine the equivalent units for June for the Mixing Department (c) Compute the costs per equivalent unit…arrow_forwardWhite Diamond Flour Company manufactures flour by a series of three processes, beginning with wheat grain being introduced in the Milling Department. From the Milling Department, the materials pass through the Sifting and Packaging departments, emerging as packaged refined flour. The balance in the account Work in Process—Sifting Department was as follows on July 1:Work in Process—Sifting Department (900 units, 3/5 completed) on July 1Cost Source Dollar AmountDirect Materials (900 x $3.15) $2,835Conversion (900 x 3/5 x $0.30) 162Total Materials and Conversion 2,997The following costs were charged to Work in Process—Sifting Department during July:Work in Process—Sifting DepartmentCost Source Dollar AmountDirect materials transferred from Milling Department: 15,700 units at $2.30 a unit $36,110Direct Labor 5,420Factory Overhead 2,384During July, 15,500 units of flour were completed. Work in Process—Sifting Department on July 31 was 1,100 units, 4/5 completed.Instructionsa. Prepare a cost…arrow_forwardCost of Production Report: Average Cost Method Sunrise Coffee Company roasts and packs coffee beans. The process begins in the Roasting Department. From the Roasting Department, the coffee beans are transferred to the Packing Department. The following is a partial work in process account of the Roasting Department at December 31: ACCOUNT Work in Process—Roasting Department ACCOUNT NO. Date Item Debit Credit Balance Debit Credit Dec. 1 Bal., 10,500 units, 75% completed 21,000 31 Direct materials, 210,400 units 246,800 267,800 31 Direct labor 135,700 403,500 31 Factory overhead 168,630 572,130 31 Goods transferred, 208,900 units ? ? 31 Bal., ? units, 25% completed ? Required: Prepare a cost of production report, using the average cost method, and identify the missing amounts for Work in Process—Roasting Department. If required, round your cost per equivalent unit answer to the nearest cent. Sunrise…arrow_forward

- Equivalent Units and Related Costs; Cost of Production Report; Entries Dover Chemical Company manufactures specialty chemicals by a series of three processes, all materials being introduced in the Distilling Department. From the Distilling Department, the materials pass through the Reaction and Filling departments, emerging as finished chemicals. The balance in the account Work in Process—Filling was as follows on January 1: Work in Process—Filling Department (3,100 units, 60% completed): Direct materials (3,100 x $18.1) $56,110 Conversion (3,100 x 60% x $11.7) 21,762 $77,872 The following costs were charged to Work in Process—Filling during January: Direct materials transferred from Reaction Department: 40,000 units at $17.8 a unit $712,000 Direct labor 250,310 Factory overhead 240,490 During January, 39,700 units of specialty chemicals were completed. Work in Process—Filling Department on January 31 was 3,400 units, 90% completed. Required:…arrow_forwardBholaarrow_forwardEquivalent Units of Production The following information concerns production in the Baking Department for March. All direct materials are placed in process at the beginning of production. ACCOUNT Work in Process-Baking Department ACCOUNT NO. Balance Date Item Debit Credit Debit Credit March 1 Bal., 8,400 units, 3/5 completed 26,880 31 Direct materials, 151,200 units 241,920 268,800 31 Direct labor 68.110 336,910 31 Factory overhead 38,318 375,228 31 Goods finished, 153,300 units 362,502 12,726 31 Bal. ? units, 3/5 completed 12,726 a. Determine the number of units in work in process inventory at March 31. units b. Determine the equivalent units of production for direct materials and conversion costs in March. If an amount box does not require an entry, leave it blank. Baking Department Equivalent Units of Production for Direct Materials and Conversion Costs Costs For March Direct Materials Conversion Equivalent Equivalent Whole Units Units Units Inventory in process, March 1 Started and…arrow_forward

- Lui Coffee Company roasts and packs coffee beans. The process begins by placing coffee beans into the Roasting Department. From the Roasting Department, coffee beans are then transferred to the Packing Department. The following is a partial work in process account of the Roasting Department at March 31: ACCOUNT Work in Process—Roasting Department ACCOUNT NO. Date Item Debit Credit BalanceDebit BalanceCredit March 1 Bal., 25,000 units, 10% completed 21,250 31 Direct materials, 600,000 units 450,000 471,250 31 Direct labor 244,600 715,850 31 Factory overhead 415,820 1,131,670 31 Goods transferred, 605,000 units ? 31 Bal., ? units, 45% completed ? Required:1. Prepare a cost of production report, and identify the missing amounts for Work in Process—Roasting Department. If an amount is zero, enter "0". When computing cost per equivalent units, round to the nearest cent. Units Whole Units Equivalent UnitsDirect…arrow_forwardEquivalent Units of Production The following information concerns production in the Baking Department for August. All direct materials are placed in process at the beginning of production. ACCOUNT Work in Process-Baking Department Date Item August 1 Bal., 8,100 units, 3/5 completed 31 Direct materials, 145,800 units 31 Direct labor 31 Factory overhead 31 Goods finished, 147,600 units 31 Bal., ? units, 4/5 completed Debit Credit 291,600 85,120 47,882 ACCOUNT NO. 420,426 Balance Balance Debit Credit 12,960 304,560 389,680 437,562 17,136 17,136 a. Determine the number of units in work in process inventory at August 31. unitsarrow_forwardEquivalent Units of Production The following information concerns production in the Baking Department for March. All direct materials are placed in process at the beginning of production. ACCOUNT Work in Process—Baking Department ACCOUNT NO. Date Item Debit Credit Balance Debit Credit March 1 Bal., 6,000 units, 4/5 completed 24,000 31 Direct materials, 108,000 units 216,000 240,000 31 Direct labor 61,860 301,860 31 Factory overhead 34,800 336,660 31 Goods finished, 109,500 units 325,230 11,430 31 Bal. ? units, 3/5 completed 11,430 a. Determine the number of units in work in process inventory at March 31.fill in the blank e90ad102cfba051_1 units b. Determine the equivalent units of production for direct materials and conversion costs in March. If an amount is zero, enter in "0". Baking Department Equivalent Units of Production for Direct Materials and Conversion Costs For March…arrow_forward

- The following information concerns production in the Baking Department for March. All direct materials are placed in process at the beginning of production. ACCOUNT Work in Process-Baking Department ACCOUNT NO. Balance Date Item Debit Credit Debit Credit Mar. 1 Bal., 5,100 units, 1/3 completed 11,645 31 Direct materials, 91,800 units 183,600 195,245 31 Direct labor 53,940 249,185 31 Factory overhead 30,336 279,521 31 Goods finished, 93,000 units 269,615 9,906 31 Bal. ? units, 3/5 completed 9,906 a. Based on the above data, determine each cost listed below. Round "cost per equivalent unit" answers to the nearest cent. 1. Direct materials cost per equivalent unit 2. Conversion cost per equivalent unit 3. Cost of the beginning work in process completed during March 4. Cost of units started and completed during March 5. Cost of the ending work in process b. Assuming that the direct materials cost is the same for February and March, did the conversion cost per equivalent unit increase,…arrow_forwardThe following information concerns production in the Baking Department for March. All direct materials are placed in process at the beginning of production. ACCOUNT Work in Process-Baking Department ACCOUNT NO. Date Item Balance Debit Credit Debit Credit Mar. 1 Bal., 5,100 units, 4/5 completed 11,322 31 Direct materials, 91,800 units 156,060 167,382 31 Direct labor 41,230 208,612 31 Factory overhead 23,198 231,810 31 Goods finished, 93,000 units 222,996 8,814 31 Bal. ? units, 4/5 completed 8,814 a. Based on the above data, determine each cost listed below. Round "cost per equivalent unit" answers to the nearest cent. 1. Direct materials cost per equivalent unit 2. Conversion cost per equivalent unit 3. Cost of the beginning work in process completed during March 4. Cost of units started and completed during March 5. Cost of the ending work in process b. Assuming that the direct materials cost is the same for February and March, did the conversion cost per equivalent unit increase,…arrow_forwardEquivalent Units and Related Costs; Cost of Production Report; Entries Dover Chemical Company manufactures specialty chemicals by a series of three processes, all materials being introduced in the Distilling Department. From the Distilling Department, the materials pass through the Reaction and Filling departments, emerging as finished chemicals. The balance in the account Work in Process—Filling was as follows on January 1: Work in Process—Filling Department (3,500 units, 40% completed): Direct materials (3,500 x $10.70) $37,450 Conversion (3,500 x 40% x $6.90) 9,660 $47,110 The following costs were charged to Work in Process—Filling during January: Direct materials transferred from Reaction Department: 45,200 units at $10.50 a unit $474,600 Direct labor 160,800 Factory overhead 154,488 During January, 44,800 units of specialty chemicals were completed. Work in Process—Filling Department on January 31 was 3,900 units, 10% completed. Required:…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education